Source: Earnest Analytics

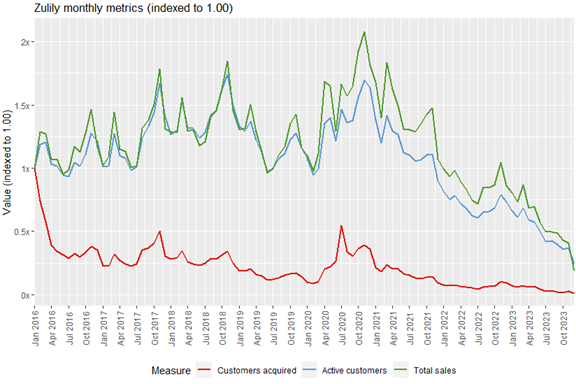

In December 2023, the e-commerce platform Zulily came to an unfortunate end. Founded in 2009, the company initially thrived as a private sale site targeting young mothers. The company grew rapidly, achieving $143 million in sales and positive cash flow by 2011, driven by its flash sale business model. Despite early success, including a $2.6 billion valuation at IPO in 2013, Zulily faced significant challenges such as customer complaints, retention issues, and a shift towards holding inventory, leading to working capital problems. As can be seen in the figure above from Earnest Analytics, a data analytics firm, revenue and active customers, which had been relatively flat before the pandemic, began to fall sharply after COVID’s onset. This culminated in over 800 layoffs in 2023 after being acquired by private equity firm Regent in May 2023. Fierce competition, rising cost of customer acquisition, and a post-COVID slump in demand made it increasingly difficult for Zulily to profitably retain its existing customer base, grow adoption from prospects, and hold on to key supplier relationships. Competition was particularly fierce from established giants like Amazon, and emerging fashion platforms such as Shein and Temu.

Traditional financial metrics are often volatile, backward-looking, and most importantly, overlook important dynamics in a company’s most important asset: its customers, potentially missing early indicators of trouble. In the case of Zulily, once such early indicator would have been customer acquisitions – as can be seen above, acquisitions had been falling sharply well before the post-COVID slump. While there was a temporary respite due to COVID, the freefall continued thereafter.

This example highlights the growing relevance of Customer-Based Corporate Valuation (CBCV). CBCV analyzes a company’s value by focusing on key customer behaviors, recognizing that every revenue dollar originates from a customer. A more holistic and accurate evaluation approach, it focuses on understanding and quantifying the value of a company’s customer base by predicting essential customer behaviors – acquisition, retention, transaction frequency, and spend per transaction – to derive more precise revenue predictions, cash flows, and as a result, overall company valuation.

It is easier than ever to model customer behavior at consumer businesses like Zulily through CBCV. Investors can use this data to more accurately assess the long-term prospects of its potential investments and existing portfolio companies. This customer-focused lens allows for an in-depth view of the customer base, its growth potential, competitive advantages, and associated risks. This enables investors to make more informed decisions and negotiate better terms. For instance, when Blue Apron went public in 2017, we at Theta (a predictive customer value analytics company) used CBCV to identify significant issues with customer churn that were not apparent from the financial disclosures alone. As a result, we were one of the first to advise against investing in the IPO, which hindsight proved to be a prudent decision.

CBCV is also invaluable for internal customer value management. It helps companies measure the impact of various initiatives such as marketing campaigns, product launches, or pricing strategies on the overall company valuation. This approach fosters a common language between marketing and finance departments, promoting strategic alignment, a historically challenging task.

The fall of Zulily underscores the necessity for both operators and investors to adopt a more analytical, customer-oriented approach to understanding company and customer health and valuation. CBCV is a vital tool when performing these assessments (and how they come together to influence fair valuation), offering deeper insights into a company’s true value by focusing on the most critical asset for any business: its customers.

Apparel & Footwear

Tailored Brands in CEO transition

There’s going to be a change in leadership at Tailored Brands. The parent company of Men’s Wearhouse, Jos. A. Bank and other menswear brands has named co-CEO Peter Sachse as sole chief executive officer, effective Feb. 4. At that time, co-CEO Bob Hull will move into a new role of executive chairman of the board. Tailored Brands board members Hull and Peter Sachse were named as interim co-CEOs in March 2021 following the departure of Dinesh Lathi, who left after seeing the retailer through bankruptcy. The two were named permanent co-CEOs one year later, in March 2022. “Under Bob’s and Peter’s leadership over the past several years, Tailored Brands has achieved a comprehensive strategic, operational and financial transformation,” Tailored Brands stated. Sachse previously spent 34 years in various roles at Macy’s, Inc., including serving as chief stores officer, chief marketing officer and chairman and CEO of macys.com. In other changes, Paul Soldatos will move from a non-executive chairman role to become lead director of the board. Sean Mahoney will continue as an active director.

Rothy’s names new CEO, president as co-founders step down from the roles

Rothy’s now has an all-female-led senior management team. The sustainable footwear and handbag brand appointed board member and seasoned retail executive Jenny Ming as CEO. She succeeds company co-founder Stephen Hawthornthwaite, who is transitioning to the role of board chair. Ming is best known for her tenure at Gap Inc., which she joined in 1986 and where she held several executive positions, including serving on the founding team of Old Navy, where she was president from 1993 to 2006. Ming went on to serve as president and CEO of Charlotte Russe from 2009 to 2019. She is on the boards of Levi Strauss & Co. and Kaiser Foundation Health Plan & Hospitals, and has served as independent director on Rothy’s Board since June of 2022. In other changes, Rothy’s CFO and COO Dayna Quanbeck will take on the expanded role as president, succeeding company co-founder Roth Martin. Martin is taking on the role of chief creative and innovation officer.

Lululemon raises Q4 revenue outlook

Lululemon has updated its fourth quarter guidance. The athletic apparel retailer expects revenue to range from $3.17 billion to $3.19 billion, a 14% to 15% increase from Q4 of 2022. The company previously issued revenue guidance of $3.14 billion to $3.17 billion. The company also raised its gross margin outlook. Lululemon now expects its gross margin to range from 58.6% to 58.7% for the fourth quarter of fiscal 2023. Lululemon’s previous outlook for this metric was 58.3% to 58.6%. Earnings per share will range from $4.96 to $5.00, up from $4.85 to $4.93. Lululemon’s Q4 guidance for selling, general, and administrative expenses and its effective tax rate remain unchanged. During Q3, the company’s net revenue rose 19% to $2.2 billion, up 12% in North America and up 49% internationally. “We are pleased with our performance during the holiday season, as guests continue to respond well to our innovative and versatile product offerings,” Chief Financial Officer Meghan Frank said in a statement. “Our sales trend remains balanced across channels, categories, and geographies, enabling us to raise our guidance for the fourth quarter and close out another strong year.”

Chico’s CEO out as brands join Sycamore holding company

Chico’s FAS CEO Molly Langenstein is leaving the company, according to a source close to KnitWell Group. New owner Sycamore Partners, a private equity firm, has moved Chico’s brands into KnitWell, a holding company formed last year. KnitWell also includes Ann Taylor, Loft and Talbots and provides services to plus-size specialty retailer Lane Bryant. Last week, as Sycamore announced that its deal to take over Chico’s had closed, Langenstein said that the private equity firm and apparel conglomerate “share a commitment to providing solutions, building communities, and creating memorable experiences to bring women confidence and joy.” Langenstein, who once led Chico’s two largest brands — Chico’s and White House Black Market — was promoted to lead the entire conglomerate four years ago, amid sliding sales. Now, employees have been told that Langenstein is leaving, the KnitWell source said. Previously, analysts had noted that she has been key to Chico’s success and that the Sycamore acquisition likely went forward thanks to her support.

Athletic & Sporting Goods

Platinum Equity Acquires Augusta Sportswear Brands and Founder Sport Group

Platinum Equity has unveiled its latest strategic move: the acquisitions of Augusta Sportswear Brands (ASB) and Founder Sport Group (FSG). Both ASB and FSG are recognized as leading suppliers of team uniforms, off-field performance wear, and fan apparel for youth and recreational sports markets. The undisclosed financial terms of these private transactions are part of a significant plan aimed at bolstering the efficiency and customer experience within the youth sports apparel industry. The merger of ASB and FSG brings together an expansive portfolio of brands.

Pure Hockey Expands Footprint with Acquisition of Behind the Mask

Pure Hockey, a premier destination for hockey equipment, apparel, and accessories, is excited to announce its latest expansion through the acquisition of Behind the Mask. This strategic move marks Pure Hockey’s first entry into the Arizona market and underscores the company’s commitment to serving the needs of hockey players across the United States. As a recognized leader in the hockey retail industry, Pure Hockey’s acquisition of Behind the Mask represents a significant step in the company’s continued growth trajectory. With this acquisition, Pure Hockey now operates an impressive network of 77 retail locations across 25 states nationwide, further solidifying its position as the go-to destination for hockey players, coaches, and fans.

Cosmetics & Pharmacy

Puig Acquires Dr. Barbara Sturm

Spanish beauty and fashion company Puig has acquired a majority stake in Dr. Barbara Sturm. Terms of the deal were not disclosed. The German molecular cosmetics brand was founded in 2014 by Dr. Barbara Sturm, who is to retain a minority stake in the company. She will also stay as chief product development officer and brand ambassador. WWD in September 2023 reported Dr. Barbara Sturm was mulling deal options, and that its annual sales were said to be around 70 million euros. Puig’s Dr. Barbara Sturm deal comes at a time when the European beauty scene is morphing rapidly. Kering is taking its beauty in-house and Richemont is building a Laboratoire de Haute Parfumerie. It’s a sign of the times, as luxury-makers recognize beauty’s staying power despite the ongoing tough geopolitical and macroeconomic climate. They have been lured by its growth, resilience, desirability and margins, especially that of the luxury category, which is the fastest-growing subsegment in beauty.

L’Occitane Group, Biologique Recherche and Orveon Name New CEOs

L’Occitane Group, Biologique Recherche and Orveon have all named new chief executive officers this week. L’Occitane Group has appointed Laurent Marteau to the position. Currently the beauty group’s managing director, he will also take up the CEO job, as a combined role, effective April 1. Marteau succeeds André J. Hoffmann, who was acting as CEO and chose to step down from the position. He is to remain a L’Occitane Group executive director and member of the board, focusing on strategic, policy and leadership issues. Another European brand, Biologique Recherche, will have a new CEO, following 15 years of co-CEO and co-ownership shared by Pierre-Louis Delapalme and Rupert Schmid. During that time, the duo multiplied the professional skin care company’s sales by more than 20 times, according to a statement. Jean-Guillaume Trottier will join Biologique Recherche in early January, then become its CEO at the start of May. There has also been a CEO appointment Stateside. Orveon, the Advent International-owned parent company of BareMinerals, Buxom and Laura Mercier, has named Neela Montgomery to the role, effective Jan. 18. The executive, who hails from CVS Health and has also held roles at Crate & Barrel Holdings, Otto Group and Tesco plc, succeeds Pascal Houdayer, who left Orveon late last year.

L’Oréal Boosts Water Sustainability with Gjosa Acquisition

With a focus on water sustainability and high tech innovation, L’Oréal has acquired the outstanding shares of Switzerland-based water fractioning specialist Gjosa, and unveiled its sustainable professional hair drying tool, AirLight Pro. The company first invested in Gjosa in 2021, and, in 2018, co-developed a sustainable hair rinse system. The company’s water fragmentation technology, featured in the L’Oréal Professionnal Water Saver by Gjosa, reportedly allows hair salons to reduce water consumption at the backbar by up to 69%. The plan is to continue this roll-out to over 200,000 salons worldwide in the coming years, addressing the increasingly water-stressed global environment.

This Works snapped up by Inspirit Capital

Parent company Canopy Growth Corporation has sold the British sleep and skin care brand for a quarter of the value it bought it for in 2019. This Works has been acquired by investment firm Inspirit Capital in a deal valued at up to £9.3m. This Works was founded in 2003 and is best known for its sleep-promoting pillow sprays. Will Stamp, Partner at Inspirit Capital, said the brand is well positioned to capitalise on the ongoing growth in sleep and wellness. “Given the strong brand equity and their track record of product innovation,” he said. Canopy Growth acquired This Works for £43m in May 2019. The company has decided to sell the business so it can focus on its North American cannabis operations in a bid to achieve “market leadership”. Canopy Growth CEO David Klein said: “This sale represents a further step to enable this through the transformation of Canopy Growth into a simplified, asset-light, cannabis-focused business.”

CVS closing dozens of pharmacies inside Target by April

CVS Health Corp. plans to close dozens of its locations in Target Corp. discount stores as the drugstore chain grapples with rising costs in its pharmacy business. A number of CVS’s 1,800 pharmacies in Target stores will be closed between February and April, a CVS spokesperson said, without specifying the exact count. The closures are part of a plan to “realign our national retail footprint and reduce store and pharmacy density,” the spokesperson said. The biggest US drugstore chain, CVS has been cutting costs and warned investors back in August that rising expenses in its pharmacy and insurance businesses will take a toll on profit over the next two years.

Discounters & Department Stores

Walmart to expand drone delivery to 1.8M more Texas homes

Walmart is expanding its on-demand drone delivery services to 1.8 million more homes in Texas’ Dallas-Fort Worth area, the retailer announced Tuesday. The expansion includes stores across more than 30 towns and municipalities in the Dallas-Fort Worth metroplex, allowing Walmart to offer drone delivery to up to 75% of the area’s population. Customers will receive their orders via drone delivery providers Zipline and Wing, a subsidiary of Google parent company Alphabet. “This expansion will bring the ultimate convenience of drone delivery to communities across the DFW area,” said Prathibha Rajashekhar, Walmart U.S. senior vice president of innovation and automation, in the announcement. “Customers will have access to a broad assortment of items from Walmart available for delivery to their home in just minutes.”

Dollar General appoints new store operations leader

Dollar General’s Executive Vice President of Store Operations, Steve Sunderland, plans to leave the company, effective Jan. 19, according to a Friday announcement. The retailer’s current executive vice president of growth and emerging markets, Steve Deckard, will transition into the “expanded role” of executive vice president of store operations and development. Dollar General has undergone numerous leadership changes in recent months, including firing its CEO back in October less than a year after appointing him.

Walmart and Wholescale Establish Official Ratings & Reviews Partnership

Wholescale has announced its partnership with Walmart Inc. to syndicate authentic ratings & reviews to the world’s largest retailer. The official partnership comes amidst record growth for Wholescale in 2023. Wholescale’s proprietary technology prioritizes authentic reviews for shoppers, while offering advanced solutions for suppliers. The syndication partnership demonstrates Walmart’s commitment to enriching customers’ shopping experiences and offering cutting-edge technologies and platform-choice to suppliers. “Suppliers and sellers can now serve shoppers and Walmart merchants in the most efficient manner,” said David Rapps, President of Wholescale. “Suppliers spend exorbitant fees on incentivized and sampled reviews that shoppers tend to distrust, so Wholescale and Walmart naturally aligned to execute this partnership. Suppliers and sellers are excited about how seamlessly Wholescale’s authentic reviews platform integrates into Walmart’s ecosystem. I applaud the Walmart and Wholescale teams for their excellent collaboration and execution.”

Emerging Consumer Companies

Perfect Day raises $90 million in pre-series E financing round

Perfect Day, a company that produces animal-free dairy proteins, has raised $90 million in a pre-series E financing round. The funding round was led by internal investors. Co-founders Ryan Pandya and Perumal Gandhi will step down from their operational management roles to focus on future opportunities. Perfect Day, formerly known as Muufri, was founded in 2014 and launched its first dairy-free ice cream product in 2019. The company uses fermentation in microflora to produce dairy proteins instead of relying on cows. TM Narayan, the president of Perfect Day, will take over as interim CEO. Aftab Mathur and Patrick Zhang, newly hired co-chairmans of the board, will support Narayan in his transition. The company’s previous funding rounds include $350 million in a series D round in September 2021, $160 million in a series C round in June 2020, and $140 million in a series C round in December 2019.

WTHN raises $5 million to expand acupuncture wellness clinics

WTHN, a modern wellness clinic specializing in acupuncture and Traditional Chinese Medicine (TCM), has raised $5 million in a Series A funding round led by L Catterton. The clinic combines hands-on therapies with herbal remedies for holistic wellness and pain management. With the new funding, WTHN plans to expand beyond its two studios in New York City. L Catterton, the leading consumer-focused private equity firm, has recently made investments in the wellness industry. They acquired wellness supplement maker Thorne HealthTech and also support personalized longevity company Tally Health. WTHN aims to provide accessible and modern acupuncture services to a wider audience. Acupuncture is a form of alternative medicine that involves inserting thin needles into specific points on the body to stimulate healing. Traditional Chinese Medicine, on the other hand, encompasses a range of practices including herbal medicine, acupuncture, and dietary therapy. The $5 million funding will help WTHN in its expansion plans and allow more people to experience the benefits of acupuncture and Traditional Chinese Medicine.

Blank Street Coffee grows with subscription program, attracting budget-conscious consumers

Blank Street Coffee, a rapidly growing coffee chain with 74 locations across New York City, Boston, Washington, D.C., and London, is betting on subscriptions to attract more customers and boost revenue. The chain’s new subscription program, called Blank Street Regulars, charges $8.99 or $17.99 weekly for 14 drinks and has already attracted about 5,000 paying members, with another 4,000 on the waiting list. The program is expected to eventually account for 30% to 40% of the chain’s customer base. Blank Street Coffee’s low prices have helped it attract customers, especially as the cost of coffee beans has increased. The chain’s subscription program aims to offer even more savings to customers. The company, which has raised approximately $100 million in funding, has faced criticism for its rapid growth and venture funding. However, its lower overhead costs, smaller square footage, and semi-automated espresso machines allow it to charge cheaper prices for its coffee. Blank Street Coffee plans to expand its subscription program and is considering adding family and group plans in the future.

Food & Beverage

Fenwick Food Group Acquires Alabama-Based Wickles Pickles

Fenwick Food Group, a division of Fenwick Brands Inc. — a consumer packaged goods investment firm located in the Southeast — has acquired Wickles Pickles, an iconic and beloved Alabama brand. Fenwick Food Group is an operating platform for food businesses and includes Alabama-based Moore’s Marinades & Sauces and newly acquired Wickles Pickles. Wickles was founded by brothers Will and Trey Sims, and Andy Anderson back in 1998. With a unique flavor profile and robust product offering, Wickles has captured significant market share and consumer loyalty within the billion-dollar pickle category. The opportunity was timely, with the Wickles brand hitting an inflection point where investment and additional resourcing was needed for scale. As growth minded investors already operating in mainstream retail outlets with Moore’s Marinades and Sauces, Fenwick’s decision to purchase the Wickles Pickles brand makes the partnership synergistic. Financial details of the transaction are not being released.

Altamont Capital Partners has acquired Mini Melts USA, a maker of frozen novelty products. Altamont is partnering with Dan Kilcoyne, the CEO and founder of Mini Melts, on this transaction. Mini Melts is a maker and distributor of beaded ice cream, a frozen dessert that consists of tiny, bead-like ice cream pellets that are created by flash-freezing a 14% butterfat blend of a liquid ice cream mix using liquid nitrogen. According to the company, Mini Melts is one of the fastest-growing ice cream novelties nationwide with sales growing 35% annually with total sales that are estimated to exceed $100 million within the next 18 months. According to IRI Worldwide, Mini Melts is currently the second fastest growing frozen handheld treat in the convenience store channel and was selected as one of Bain & Company’s 2023 Insurgent Brands.

AUA Private Equity Partners Announces Acquisition of Weaver Holdings

AUA Private Equity Partners, LLC (“AUA Private Equity”) is pleased to announce the acquisition of Weaver Holdings, LLC (“Weaver Popcorn Manufacturing” or the “Company”), a fourth-generation family-owned manufacturer of popcorn and snacking products. Financial terms of the transaction were not disclosed. Weaver Popcorn Manufacturing is the largest independent manufacturer of popcorn products in the United States. The Company is recognized for its scale, quality, and innovation by its blue-chip retail and branded customers. Alongside its investment in Weaver Popcorn Manufacturing, AUA Private Equity will bring the firm’s significant experience in professionalizing and improving family-owned food manufacturing businesses to help expand on the Weaver Family’s well-invested assets and passionate employee base.

Voyage Foods Nets New $22M Investment

Food technology company Voyage Foods ended 2023 with a hefty new investment. The Oakland, California-based company brought in nearly $22 million in a round that included new capital from previous investors Valor Equity Partners, Horizons Ventures, UBS O’Connor and Level One Fund. According to a Securities and Exchange Commission form D filed on December 29 the $21.9 million is part of a $30 million round Voyage is hoping to secure. Since launching in 2020, the company has raised over $41 million over two previous rounds including $36 million in May 2022.

Grocery & Restaurants

Next Level Burger acquires Veggie Grill

Portland, Ore.-based Next Level Burger, along with vegan investment fund and new NLB shareholder VegInvest, announced Thursday the acquisition of California-based vegetarian restaurant chain Veggie Grill. Together, the post-acquisition value of the company is $80 million, with 27 locations nationally, making Next Level Burger/Veggie Grill one of the largest plant-based restaurant chains nationally. “We’re not just writing a new chapter for Veggie Grill – we’re starting a new book,” Next Level Burger cofounder and CEO Matt de Gruyter said in a statement. “Veggie Grill by Next Level will mean all sorts of changes: organic produce, non-GMO ingredients and ensuring living wages for our many team members across the country. Everything guests know and love about Veggie Grill is about to be taken to the Next Level, but know that the fan favorites aren’t going anywhere.”

Albertsons reports strong Q3 returns as Kroger merger looms

With a decision due any day by the Federal Trade Commission on the $24.6 billion Kroger, Albertsons merger, Albertsons reported strong net sales and revenue figures in its Q3 report on Tuesday. Albertsons reported $18.6 billion in net sales and revenue for the 12-week period ended Dec. 2, 2023, up 2% from the $18.2 billion reported for the same quarter in 2022, the company said. Net income was up $361 million, or $0.62 per share, for the quarter, Albertsons reported. Adjusted net income was $462 million, or $0.79 per share, while the adjusted EBITDA was $1.1 billion. Albertsons said the revenue boost was driven by growth in its digital and pharmacy operations. Identical sales – a metric typically based on repeat performance at stores in operation for more than a year – grew 2.9% for the quarter, and digital sales were up a whopping 21% for the quarter.

Kroger, Albertsons merger faces lawsuit from Washington State AG

Kroger and Albertsons continue to get heat from states regarding the companies’ pending $24.6 billion merger. The Washington State attorney general is now expected to file a lawsuit to block the deal, reports Bloomberg News. The news comes after Axios reported that the Federal Trade Commission (FTC) was not expected to make a decision on the Kroger, Albertsons merger until February. In regards to the Washington State lawsuit, Kroger emailed the following statement to Supermarket News: “If the merger is blocked, the non-union retailers like Walmart and Amazon will become even more powerful and unaccountable – and that’s bad for everyone. Any decision to attempt to enjoin the transaction now would be premature as we are engaged in productive discussions with the FTC and state Attorneys General about how this merger will bring lower prices to more of America’s consumers who are still reeling from high grocery prices.” Back in October, California was readying its own lawsuit against the merger deal with the following concerns: higher prices for consumers, lower payments to California farmers, the possibility of food and pharmacy deserts, and the impact on grocery workers. However, there has been no further news on whether a lawsuit was filed.

Home & Road

Helen of Troy Home & Outdoor Segment Posts Fiscal Q3 Growth

Helen of Troy Limited reported that fiscal third-quarter net sales at its Home & Outdoor segment, which includes OXO, Hydro Flask and Osprey, increased 3.1 percent, to $235.9 million for the three-month period ended November 30, compared to $228.9 million on the prior-year corresponding period. The increase was said to be driven by organic growth of $4.5 million, or 2.0 percent, primarily from higher home category sales in the club, online and brick & mortar channels, consumer demand and expanded distribution, insulated beverageware growth in the online channel, driven by expanded distribution and replenishment of the new travel tumbler, higher travel related sales in the outdoor category, and higher sales in the closeout channel. The above factors were partially offset by reduced sales to Bed, Bath & Beyond due to its bankruptcy, a decline in brick & mortar sales in the insulated beverageware category and lower home category sales in the closeout channel.

Legacy Companies Acquires Kalorik Kitchen Electrics, Housewares Lines

The Legacy Companies, developer and marketer of several brands of household kitchen products and food service equipment, has acquired the kitchen countertop appliance and non-electric kitchenware and utensil lines of Team International Group of America, Inc., which did business under the Kalorik brand. Terms of the asset purchase transaction were not disclosed. The Kalorik brand is a strong complement to the existing umbrella of Legacy brands, bringing high-quality innovation and style at affordable prices, said Neal Asbury, president and CEO of The Legacy Companies. The Legacy Companies develops and markets small appliances and housewares under such brands as West Bend, Omega, Avanti, Chef’sChoice, Excalibur, Vinturi, Zeroll and Yonanas. The company supplies food service appliances and equipment under such brands as Admiral Craft, BevLes, Blakeslee, General, Legion and Maxx Cold.

Jewelry & Luxury

LVMH Names Frédéric Arnault New CEO of Watches

LVMH has named a new CEO of its watch division. Frédéric Arnault, CEO of TAG Heuer and son of LVMH CEO Bernard Arnault, will take on the role, overseeing Hublot, TAG Heuer, and Zenith. He joined TAG Heuer in 2016, taking on the CEO role in 2020, and has helped transform the brand over the last six years. He will report to Stephane Bianchi, CEO of LVMH’s watches and jewelry division. “His unique and disruptive vision for the watchmaking industry fed to a spectacular transformation for TAG Heuer, which recovered its credentials in record time as the luxury watch brand driven by high performance,” said Bianchi. “I am extremely pleased to have Frédéric join me within the LVMH watches and jewelry division to oversee our three watch maisons and eager to see what his unique insights and vision will bring to fuel additional and sustainable growth for them.”

Burberry’s share price drops 10% as luxury brand warns about trading over Christmas

Burberry, the London-based luxury goods fashion house, warned Friday that profits this year would be lower than anticipated as wealthy shoppers, particularly in the Americas, tightened their belts during the crucial Christmas trading period. In a statement, the company said its recent trading had been hit by a continued “slowdown in luxury demand” after rises in the cost of living and interest rates around the world. “We experienced a further deceleration in our key December trading period and we now expect our full year results to be below our previous guidance,” said Jonathan Akeroyd, the company’s chief executive. The company said retail revenues for the three months to Dec. 30 slid by 7% to 706 million pounds ($900 million), and that its like-for-like sales, which strips out new additions or closures, declined by 4% over the same period. It warned that it expects unfavorable currency exchange rates to knock revenues by 120 million pounds and profits by around 60 million.

Office & Leisure

The Rubik’s Cube turns 50: How a 3-by-3 grid captured hearts and market share

It took a month of twisting and turning for the first person to solve a Rubik’s Cube. That person was Erno Rubik, now 79, the iconic puzzle toy’s creator. A source of pride, envy and frustration, the Rubik’s Cube turns 50 this year and, under the ownership of Spin Master, it shows no signs of retirement. Since its inception in 1974, the Rubik’s Cube has spread throughout the pop culture landscape, appearing in movies and TV shows, music videos, comics, video games and museums. The iconic 3-by-3 grid has graced T-shirts, been turned into keychains, inspired architecture and sparked an entire subgenre of art. Toronto-based Spin Master, known for brands such as Hatchimals, Tech Deck and Kinetic Sand, acquired the Rubik’s Cube brand in 2021, five years after snapping up the iconic Etch-a-Sketch. Adding tried-and-true evergreen products to its portfolio allows Spin Master to take risks with new brands, knowing it has a set of products that will always have a space on retail shelves. At present, the cube has 42% market share in the brain teaser category, according to Susz. And sales are still growing.

Barnes & Noble hopes to open 50 shops in 2024 amid strong sales and ‘significant growth’

Barnes & Noble saw strong sales over Christmas and a good year overall, CEO James Daunt told the American trade magazine Publishers Weekly (PW), as the chain prepares for a year of growth in 2024. Daunt attributed the chain’s success in part to the supply chain holding up, especially over the festive season. He also said sales were driven by books including Rebecca Yarros’ Iron Flame (Piatkus/ Red Tower Books) and Fourth Wing (Piatkus/ Red Tower Books), Prince Harry’s Spare (Bantam/ Random House), James McBridge’s Heaven and Earth (Riverhead Books/ W&N) and David Grann’s The Wager (Simon & Schuster/ Simon & Schuster UK). The chain also saw improvements in the performance of its cafe business and newsstands. However, gift sales were lower this year, as some of the space allocated to them is now reserved for books. The CEO also told the publication that toy and game sales “trod water” during 2023. As the company enters a period of “significant growth” in 2024, the Barnes & Noble CEO aims to open 50 new stores, while also investing in IT and distribution. Daunt told PW that he has a positive outlook on the publishing calendar for the year ahead, highlighting upcoming titles by Maas and suggesting that political books might be in the spotlight because of the US presidential election.

Tetris Taps IMG for Consumer Products Program

As the Tetris brand gears up for its 40th anniversary this year, The Tetris Company has appointed IMG as its merchandise licensing representative in the U.S., Canada and EMEA, including key territories such as the U.K., France, Germany, Middle East, North Africa and India. The agreement expands on IMG and The Tetris Company’s existing licensing partnership in Asia and Brazil. The new multiyear partnership will see IMG develop a wide range of licensed products across key categories, including toys, games and collectibles, apparel and accessories, home and décor, food and beverages, sporting goods and outdoor gear, beauty and personal care, pet toys and accessories, travel, stationery and consumer electronic accessories. As the Tetris Company’s merchandise licensing representative in Asia since 2018, IMG has grown the brand’s lifestyle portfolio through notable collaborations with global brands, including FILA and Uniqlo. “With IMG’s track record as one of the world’s top licensing agencies, we’re excited to expand our partnership with them in the U.S., Canada and EMEA,” says Maya Rogers, chief executive officer, Tetris. “This year is the Tetris brand’s 40th anniversary, so we can’t wait to see what opportunities the team at IMG will secure for us.”

Technology & Internet

Why a US bitcoin ETF is a game-changer for crypto

The U.S. Securities and Exchange Commission (SEC) on Wednesday approved exchange-traded funds (ETFs) that track the price of bitcoin in a game-changer for the cryptocurrency industry which has been trying for more than a decade to launch such a product. Multiple asset managers have applied for bitcoin ETFs since 2013, but the SEC rejected them on the grounds they would be vulnerable to market manipulation. In August, however, a court found the SEC was wrong to reject Grayscale Investments’ bitcoin ETF application, forcing the agency to rethink its stance. On Wednesday, SEC approved applications from ARK Investments, BlackRock (BLK.N) and Fidelity, among others. Here is how the products work and why the approval is seen as a big deal.

iRobot shares dip on report Amazon won’t offer EU concessions

Shares of iRobot closed down 19% on Wednesday, after a report said Amazon will not offer concessions to Europe’s antitrust watchdog in a bid to clear its planned $1.7 billion acquisition of the Roomba maker. Politico reported the companies have until the end of the day Wednesday to offer to make changes to Amazon’s business in the EU market, citing two people familiar with the matter. Last November, the European Commission warned the planned acquisition raises competition concerns, saying it found Amazon may have the ability to prevent or degrade iRobot rivals’ access to its online site by delisting or reducing the visibility of their products in search results and other areas. The European Commission opened an in-depth probe into the purchase last July and is expected to rule on the deal by Feb. 14.

Finance & Economy

Consumer spending rises in December to end solid holiday season

Retailers chalked up solid gains in the final month to wrap up the holiday season, according to the CNBC/NRF Retail Monitor for December. However, the data also shows the true state of consumer spending is now clouded by a new factor: deflation. The Retail Monitor, which excludes autos and gas, rose 0.4% in December, down from a gain of 0.8% in November, when the holiday shopping season traditionally kicks off. It’s just below the long-run average of 0.6%.

Inflation increases more than expected in December

Consumer prices increased more than expected in December as investors continue to look for signs the Federal Reserve can begin to cut interest rates. The December Consumer Price Index (CPI) showed prices ticked up slightly at 0.3% over last month, an increase from the 0.2% seen in November. Prices rose 3.4% over the prior year, an increase from the 3.1% increase seen the month prior. When removing the volatile food and energy categories, “core” inflation fell to an annual rate of 3.9% from 4.0% the month prior. Economists surveyed by Bloomberg had expected core inflation of 3.8%. On a monthly basis, core inflation was 0.3%, up unchanged from the month prior.