When the beginning of the COVID-19 pandemic in March 2020 resulted in government-mandated shutdowns, consumer spending for things other than essential grocery items fell off a cliff. Because of the lack of spending, coupled with federal stimulus payments and uncertainty surrounding the pandemic, and despite growing unemployment, personal savings rates increased dramatically. The author of a recent bulletin published by the Federal Reserve Bank of Kansas City, using data from the Bureau of Economic Analysis, provided the following chart:

While the savings rate peaked in April at close to 33%, the rate has come down each month since but is still above 2019 levels, which is attributed to both precautionary and government transfer-induced (stimulus payment) savings.

Economists point out that the savings rate tends to rise in a recession, and past increases in the savings rate have not always correlated to future consumption increases. But we are living in extraordinary economic times. The stock market has rebounded to pre-pandemic levels, and in most areas of the country the housing market is on fire, implying that the rate of homeownership is climbing. Per the Consumer Expenditure Survey, homeowners spend 1.6 times more than renters on average per year on all sorts of goods and services.

With the continued relaxation of governmental restrictions, the beginning of the rollout of COVID-19 vaccines and perhaps due to larger balances in their savings accounts, consumers have begun showing signs of loosening their purse strings. Last week, the NRF reported that 2020 holiday sales increased 8.3%, over twice the rate of annual increase in each of the last five years. There are other signs of possible pent-up spending in the new year as well.

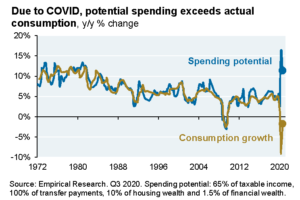

The chart below, from a recent J.P.Morgan research report, tracks annual changes in consumer spending potential versus actual consumption since 1972. The potential and actual spending changes track relatively closely in most years, and the 2008-2009 recession is the only time until this year when either were less than zero.

What is striking is the unprecedented gap between potential spending growth of ~11% and an actual consumption decline of ~<2%> in the third quarter of 2020. The gap was actually higher earlier in 2020, so it has already started to narrow. With the recent NRF news on holiday spending, it will be interesting to see how quickly the two metrics converge again.

After close to a year of recessionary behavior as we lived through the height of the pandemic, there are signs that we have turned a corner towards improving consumer confidence, pointing to 2021 as a year of growth in spending. Today, the U.S. is in the early days of the rollout of the COVID-19 vaccine, and there is hope that the majority of the population will have been immunized by summer. This fact alone bodes well for a rise in consumer confidence. Once Americans can again take to the roads and skies to travel, shop and congregate without limitation, it is hard to imagine that spending won’t also return.

Headlines of the Week

Staples offers to buy Office Depot for $2.1 billion

Staples is once again proposing to buy rival Office Depot in a $2.1 billion deal, five years after the US government squashed their prior merger agreement. The $40-per-share offer price for Office Depot’s parent company, ODP Corp., is a roughly 60% premium over its average closing price for the last 90 trading days. The all-cash transaction, according to Staples, is a “compelling value proposition” and is a “superior to the intrinsic, standalone value” of Office Depot. Staples went private in 2017, selling itself to Sycamore Partners, a firm focused on keeping distressed retailers afloat. Monday’s proposal is about a third of the purchase price of the original 2015 purchase agreement of $6.3 billion. This marks the third time in about 25 years that the companies have tried to merge, including once in 1997.

Petco raises $864 million in IPO that values company at nearly $4 billion

Petco Health and Wellness Company’s return to the public market came in above forecasts. Petco, which is owned by the Canada Pension Plan Investment Board (CPP Investments) and private equity firm CVC Capital Partners, raised $864 million by selling 48 million shares in its initial public offering at $18. The company had planned to sell the shares at a target range of $14 to $17 per share. The IPO values the pet supplies and services retailer at nearly $4 billion, Petco started trading on the Nasdaq on Thursday under the symbol “WOOF.” The company first went public in 1994, but then went private in 2000 when it was acquired by TPG and Leonard Green in a $600 million deal. Petco went public again in 2002, but TPG and Leonard Green took it private again in 2006 in a $1.7 billion deal. They sold it to CVC and CPPIB for $4.6 billion in 2016.

Apparel & Footwear

Marks & Spencer buys Jaeger fashion brand from administrators

Marks & Spencer has bought the Jaeger fashion brand from administrators, in a deal that excludes the retailers 63 remaining stores. M&S expects to complete the purchase of Jaeger’s stock and other assets by the end of the month, it said in a statement on Monday. The price it paid for the brand is understood to be in the low millions of pounds. The FTSE 250 retailer had been considered a frontrunner to snap up Jaeger after its owner, Edinburgh Woollen Mill Group, fell into administration in November along with other chains including Peacocks. The group, which was controlled by entrepreneur Philip Day, fell into severe financial difficulty after the Covid-19 pandemic forced it to close its doors.

Christopher & Banks files for bankruptcy, could close all stores

Christopher & Banks filed for Chapter 11 bankruptcy Thursday after protracted demand declines among its customer base in 2020 and defaults on major financial obligations earlier this month. The women’s apparel seller said in a press release that it plans to close “a significant portion, if not all, of its brick-and-mortar stores.” It has hired Hilco Merchant Resources to run liquidation sales at all 449 stores, according to court documents. While it prepares to exit brick-and-mortar, Christopher & Banks plans to sell its e-commerce unit in Chapter 11. The company is in “active discussion with potential buyers,” it said in the release. With store sales making up 75% of Christopher & Banks’ sales, the COVID-19 pandemic was a fatal blow to the apparel seller’s business. CEO Keri Jones said in court papers that its Chapter 11 filing was “primarily the result” of the pandemic’s impact.

Edinburgh Woollen Mill issues sales contracts to potential buyer

There could be hope to save hundreds of high street jobs after Edinburgh Woollen Mill’s administrators FRP Advisory issued sales contracts to a potential buyer, according to The Sunday Times. Philip Day’s retail empire has reportedly accepted a rescue deal, although a source cited by The Sunday Times said the deal was likely to save only a small number of EWM’s 400 stores. At the time of administration, the group permanently closed 56 Edinburgh Woollen Mill stores along with eight Ponden Home shops, axing 866 jobs and putting a further 1821 jobs under threat. Edinburgh Woollen Mill previously held Peacocks, Jaeger, Austin Reed and Bonmarché in its stable of high street brands before the impact of coronavirus resulted in national and localised lockdowns. EWM is believed to owe creditors, including suppliers and landlords, around £192 million, according to a report from administrator FRP Advisory.

Chunky bootmaker Dr. Martens to sell shares to public

The maker of Dr. Martens boots, the chunky-soled footwear once championed by rebellious young people but now favored by celebrities like Rihanna, plans to sell shares to the public as the existing owners seek to profit from growth of the iconic brand. Dr. Martens Ltd. said Monday that current investors plan to sell at least 25% of their stake in an initial public offering on the London Stock Exchange. Permira Funds, a London-based private equity investor, bought Dr. Martens for 300 million pounds (currently worth $400 million) in 2014. Dr. Martens Chief Executive Kenny Wilson said the IPO underscored the brand’s “global growth potential” after revenue increased by 39% over the past two financial years to an annual 672.2 million pounds ($900 million). The company is expanding online sales to complement revenue from 130 shops in 60 countries.

Athletic & Sporting Goods

Nike Sues More Than 1,000 Websites and Other Parties Over Alleged Counterfeiting

Nike is suing 589 websites, the owners of 676 social media accounts and more than 100 unidentified companies and individuals for allegedly selling counterfeit versions of its Nike and Converse shoes online. Nike wrote in a lawsuit filed in the U.S. District Court for the Southern District of Manhattan that its trademarks “are among the most widely recognized trademarks in the United States and around the world, as well as among the most popular with consumers. The fame and popularity of plaintiffs’ marks adds enormous value to the authentic … Nike products and Converse products.” Nike alleged that the defendants represent at least 42 networks of counterfeiters that sell bootleg versions of the company’s wares.

Li Ning, the gymnast-entrepreneur who lit the Olympic flame during China’s 2008 Games, has bought control of one of Britain’s oldest shoe producers, extending the global shopping spree by Chinese companies for famous international brands. Viva China Holdings, the sports talent agency founded by Li, has agreed to pay £51 million (US$69.7 million) for 51 per cent of LionRock Capital Partners QiLe Limited, the private equity firm which will own the Clarks brand, according to a filing to the Hong Kong stock exchange. The investment would give Viva China control of Clarks when LionRock completes its £100 million investment to recapitalise Clarks. Li is the non-executive chairman of LionRock.

Cosmetics & Pharmacy

Juliette Has a Gun sells minority stake to Cathay Capital

Juliette Has a Gun, the French selective perfumery brand founded in 2006 by Romano Ricci, great-grandson of legendary Parisian couturier Nina Ricci, has sold a minority stake to investment fund Cathay Capital. The objective was to tap the support of a shareholder to accelerate the brand’s international expansion, especially in China. For the last 15 years, Juliette Has a Gun has brought to the market its modern take on selective perfumery. With fragrance lines like ‘Not a perfume’, featuring scents, shower gels and home fragrances, the brand is currently distributed in 42 countries via over 4,000 retailers. Juliette Has a Gun also operates a flagship store in Paris, chiefly for brand image purposes, since France only accounts for a very thin slice of Juliette Has a Gun’s revenue (5% in 2017). Thanks to Cathay Capital, the brand now wants to accelerate the rate of its global expansion, especially in China, where the fragrance market is forecast to be worth CHY12 billion in 2023 (€1.5 billion), and the high-end perfume segment is predicted to increase by 18% this year.

Hero Cosmetics Lands Minority Investment from Aria Growth Partners

Aria Growth Partners made its first inaugural investment, taking a minority stake in Hero Cosmetics, known for its range of hydrocolloid acne patches. Hero was founded in 2017 by Ju Rhyu with Dwight Lee and Andrew Lee. The business has focused on selling skincare products online on its own site, as well as at Amazon and Target, Ulta Beauty, CVS, Anthropologie, and Urban Outfitters. Aria Growth Partners was founded by partner Trevor Nelson, formerly of Alliance Consumer Growth, and principal Jackie Dunklau, formerly of Cavu Ventures. The group plans to invest in founder-led businesses across consumer product categories, including beauty and personal care, as well as food and beverage and household products. The investment will be used for product development and to build out a leadership team. Hero’s sales grew 300 percent in 2020 and is projected to do more than $80 million in retail sales in 2021.

Walgreens Boots Alliance takes majority stake in iA

The recently rebranded iA has a powerful pharmacy ally in its new majority investor. Walgreens Boots Alliance on Tuesday announced its majority investment in the Johnson City, N.Y.-based pharmacy automation provider, which it said would support iA’s expansion and further development of pharmacy automation solutions that will benefit the entire industry. “The role of pharmacists as an integral part of the healthcare system and patients’ care teams has never been more critical,” said Stefano Pessina, executive vice chairman and CEO, Walgreens Boots Alliance. “The iA mission to further modernize and automate the prescription fulfillment process aligns with our priority to create the pharmacy of the future, reducing operational costs and enabling pharmacists to spend more time providing valuable healthcare services to patients such as vaccinations, diagnostic testing and medication management.”

Discounters & Department Stores

Macy’s opens second Market by Macy’s strip center location

Macy’s will open its second Market by Macy’s location, a smaller format (about 20,000 square feet) in an off-mall strip center that is part of a real estate strategy unveiled last February. The store in the WestBend lifestyle shopping center is in the Dallas-Fort Worth area, as is the first, in Southlake, Texas. The company said it “maximized learnings” from that one, which opened almost a year ago, “to create a scalable store format.” These stores are merchandised with “an edit of brands and items available at full-line Macy’s stores” tagged with “a range of accessible prices,” according to an emailed press release.

Nordstrom tops list of most connected retailers: survey

Nordstrom, Target and Home Depot topped a list of the most connected retailers, and they will continue to succeed after the pandemic, according to a report from CI&T. The survey assessed retailers on overall experience, search, shop, cart, buy, fulfillment and returns. Of the 530 shoppers surveyed, 85% of respondents thought good customer service mattered when choosing a retailer, and 87% said it was “getting a good price.” Having a quality product is also the third most mentioned shopping aspect that makes customers want to return.

Walmart to test refrigerated boxes that store grocery orders outside homes

Walmart plans to begin testing unattended, temperature-controlled boxes designed to hold groceries outside delivery customers’ residences in its hometown of Bentonville, Arkansas, this spring, the retailer announced in a blog post Tuesday. The secure receptacles, developed by HomeValet, are equipped with three separate zones intended to keep frozen, refrigerated and pantry items at optimal temperatures. The boxes electronically unlock when a delivery provider arrives with an order. Although store pickup has been a focus for the retailer regarding e-commerce, Walmart is developing new services and innovations to meet growing demand for home delivery. The company is also testing in-home delivery.

Target’s same-store sales up 17% over the holidays as it holds on to some of its pandemic gains

Target said Wednesday comparable sales rose 17.2% in November and December, as customers bought matching pajamas and gingerbread house kits to celebrate a cozy holiday at home during the pandemic. While online sales remained robust, shoppers also visited Target’s stores and spent more money per purchase than they did last holiday season. Combined transactions in Target stores and on its website rose 4.3% and average tickets grew by 12.3% year over year, the company said. Target shares, which have a market value of about $100 billion, were recently trading down about 1% on Wednesday morning. Earlier, shares were higher, and touched an all-time high of $199.96. The stock has gained nearly 60% over the past year.

Emerging Consumer Companies

Open Farm raises $65 million from General Atlantic

Open Farm, a Toronto-based premium pet food brand, has raised $65MM+ in its latest round of funding, led by growth equity firm General Atlantic. The investment marks General Atlantic’s first investment in the pet industry. Earlier investors include Encore Consumer Capital. The funding will be used to accelerate Open Farm’s mission to Do Some Good for animals and the planet, introduce the brand to millions of new pet parents, and support continued innovation to transform the way pets are fed through high-quality nutrition. Founded in 2014, Open Farm can be found in 5,500 neighborhood pet stores across North America and at OpenFarmPet.com.

Gainful, a New York-based personalized nutrition brand, raised a $7.5 million Series A. The round was led by BrandProject and Courtside Ventures, with participation from AF Ventures, Round13 Capital, and Barrel Ventures. The company offers tailored subscriptions to protein powders, hydration products and supplements, with the goal of making professional level sports nutrition available to the consumer. It focuses on three types of supplements – protein, hydration, and pre-workout. The company was part of Y Combinator’s winter 2018 batch.

CookUnity raises $15.5 million

CookUnity, the Brooklyn-based company that introduced the first chef-to-consumer meal subscription platform, closed a $15.5 million Series A investment round. The round was led by Fuel Venture Capital, with participation from new and existing investors including seed round lead IDC Ventures. The funding brings the company’s total capital raised since the platform’s 2018 inception to $23 million. It will enable CookUnity to expand across North America and expand its marketing initiatives. CookUnity will also open two new state-of-the-art kitchens in Los Angeles and Texas in addition to the original kitchen in Brooklyn, to support the national expansion. CookUnity Chef and Chef/Owner of Mŏkbar, Esther Choi, is one of over thirty chefs who create fully prepared restaurant-quality meals for consumers to enjoy at home daily.

Grocery & Restaurants

Utz Brands to acquire Vitner’s snack brand

Utz Brands, Inc. has entered into a definitive agreement to acquire certain assets related to the Vitner’s snack brand from Snak-King Corp. for a total purchase price of $25 million. The transaction includes the intellectual property, including the Vitner’s trademark, and direct-store delivery distribution assets related to Vitner’s branded products. Established in 1926, Vitner’s is a brand of potato chips, popcorn, corn chips, pork rinds and cheese snacks distributed throughout the Chicago area. Most of Vitner’s products are manufactured by Snak King, but Utz plans to transition manufacturing of most of the products to its own facilities following completion of the transaction. Vitner’s generated net sales of $25 million in the 12 months ended Sept. 27, 2020. The purchase price represents a multiple of approximately 5.9x the brand’s pro forma adjusted EBITDA.

Coca-Cola sells Zico coconut water brand back to founder

A growth equity fund is resuscitating the Zico coconut water brand months after the Coca-Cola Co. revealed plans to discontinue it. PowerPlant Ventures, co-founded and co-led by Zico founder Mark Rampolla, has acquired the business from Coca-Cola for an undisclosed sum. Founded in 2004, Zico was one of the three original coconut water brands, along with ONE and Vita Coco. Shortly after PepsiCo, Inc. invested in ONE, Coca-Cola in 2009 joined a group of entrepreneurs, distributors and celebrities in acquiring a 20% minority stake in Zico. In 2012, Coca-Cola bought a majority stake in the brand and began distributing the company’s products along with its signature beverages in the United States and Canada. A year later, Coca-Cola purchased the outstanding ownership stake in Zico. This past October, Coca-Cola announced plans to retire Zico, along with several other beverage brands, as part of an ongoing portfolio refresh.

Doggie desserts: Ben & Jerry’s enters the pet food business

Think your dog deserves dessert? So does Ben & Jerry’s. The venerable Vermont ice cream company has said it is introducing a line of frozen dog treats, its first foray into the lucrative pet food market. Doggie Desserts, sold in 4-ounce cups, go on sale in U.S. groceries and pet stores later this month. The treats come in two flavors: pumpkin with cookies and peanut butter with pretzels. They’re made from the same ingredients Ben & Jerry’s uses in its non-dairy human desserts. Ben & Jerry’s is the latest food company to pivot to pets, sensing opportunity as more Americans acquire furry friends. The number of U.S. households with pets rose 6.5% to 84.9 million between 2015 and 2020, according to the American Pet Products Association, a trade group.

Home & Road

Natuzzi to sell IMPE foam subsidiary

Italian leather upholstery and home furnishings major Natuzzi has reached an agreement to sell its IMPE SpA foam manufacturing subsidiary to The Vita Group for €6.1 million. The sale is expected to close in the first quarter. The Vita Group is a leading European provider of flexible polyurethane foam and Talalay latex and flooring products. Its three divisions serve customers across a range of industries including bed-in-a-box mattresses and bedding, furniture, hygiene and medical, mobility, construction and flooring. IMPE, based in Naples, manufactures polyurethane foam for the furniture and bedding industry in Italy. It has 32 employees and production capabilities of 20,000 tons of foam per year. Moving forward, the operation will be called Vita Italy. “The agreement is part of the Company’s strategy to review its value chain and reshape the Group’s manufacturing configuration,” said Natuzzi Chairman and CEO Pasquale Natuzzi. “With this agreement, we have posed the basis for a business cooperation with an international group, such as Vita, whose contribution will be beneficial to our operations.”

USTR: Vietnam’s currency practices unreasonable, harm U.S. commerce

The U.S. Trade Representative has determined that Vietnam’s actions, policies and practices have unfairly contributed to the undervaluation of its currency and that those actions artificially enhance its exports, restrict imports, and burden or restrict U.S. commerce. While USTR did not recommend specific steps to take, the report concluded that Vietnam’s currency valuation-related practices, “including excessive (foreign exchange) market interventions and other related actions” …”are actionable under section 301 of the Trade Act.” USTR’s findings, which emerged from its investigation begun in October, come after the U.S. Treasury labeled Vietnam a currency manipulator last month. The USTR report said that the State Bank of Vietnam sets a tight band within which licensed credit institutions can trade Vietnamese dong and U.S. dollars in Vietnam and “engages in the accumulation or decumulation of (foreign exchange) reserves to maintain the VND/USD exchange rate within +/-3 percent of the central exchange rate that it sets,” and that the investigation found no basis for concluding that the exchange rate is set solely for the purpose of ensuring the maintenance of adequate foreign exchange reserves. Second, citing the U.S. Treasury and International Monetary Fund, USTR determined the dong has been undervalued in recent years, and Vietnam has tightly managed the dong relative to the U.S. dollar at an undervalued rate “consistently in periods of both appreciation and depreciation pressure.”

December furniture sales see increase, but overall sales in 2020 fall

Falling slightly below November levels, furniture sales continued its year-over-year climb in December 2020, up for the month for the fifth month in a row, closing out the year with strong sales, although the sector’s sales for the entire year were down. And despite bringing in a total of $10.11 billion in December, according advance estimates from the Department of Commerce’s monthly report on retail sales, furniture and home furnishings store sales totals for the month were down 0.6% from November 2020’s adjusted $10.17 billion total, which was originally set at $10.3 billion in last month’s report, but up 3.1% from December 2020. Similarly, for the three month period of October-December, totals were up 3.5% year-over-year and down 0.9% when compared with July-September of this year. The slight dip in furniture and home furnishings sales month to month could be attributed to consumer holiday shopping trends. Research has indicated that many people opted not to shop traditional retail holidays this year out of concern over coronavirus safety in crowded stores, and many retailers obliged those concerns by elongating holiday sales into the months before and after those holidays, meaning Christmas and end-of-year shopping may have taken place during November or may even be taking place now in January.

Jewelry & Luxury

Signet Jewelers Reports Strong Comp Jump This Holiday

Signet Jewelers reported better-than-expected preliminary sales results for the 2020 holiday season, with comps rising a healthy 5.6%. Overall holiday sales totaled $1.8 billion, flat with last year. The company defined the holiday season as the nine weeks ending Jan. 2, 2021. The sales growth was, not surprisingly, powered by strong e-commerce gains. Online sales jumped 60.8% over last year—while brick-and-mortar stores comps fell 4.1%. Signet also noted that sales at mall locations were “slightly negative,” but off-mall sales were up.

Pandora Has Closed 25% of Stores Due to COVID-19

Pandora has had to temporarily close about 25% of its physical stores since the beginning of the year because of the ongoing spread of COVID-19, the company announced on Monday. That’s up from the 10% of its physical stores that were closed during the fourth quarter of 2020. The closures, and general worldwide increase in COVID-19, are creating “elevated uncertainty about 2021 financial performance,” the company said in a statement.

When the Billionaire Bling Kids Get to Run Tiffany and Prada

Bernard Arnault has finally taken control of Tiffany & Co. With the acquisition being LVMH Moet Hennessy Louis Vuitton SE’s biggest deal to date, and an expensive trophy asset despite the last-minute price cut, there’s little wonder that the company’s chief executive officer is sending experienced staffers from his flagship brand Louis Vuitton to oversee it. More interesting is the appointment of his 28-year-old son Alexandre to a senior role at Tiffany. It is the latest example of how Arnault, the 71-year-old LVMH founder and France’s richest man, is situating his children into the world’s biggest luxury group, readying them for eventual succession.

How Luxury Brands Plan To Reconnect With Local Consumers In Post-Covid 2021

Many luxury brands will have been relieved to leave Covid-ravaged 2020 behind. After all, the personal luxury goods sector shrunk for the first time since 2009 with sales back to their 2014 levels. But this depressing statistic masks a happier prospect for 2021, and the following few years. The star performance of Hermès, LVMH and Kering’s share prices last autumn supports views that once Covid is properly contained, the world will go for a frenzy of instant gratification, pleasure and consumption, similar to the catch-up effect that World War I and the Spanish flu triggered during the roaring 1920s. With the environmental situation and other issues likely to get worse this decade, such a boom might well be short-lived, but it’s likely to happen all the same.

Office & Leisure

GameStop in board overhaul in deal with activist investor

The video game retailer announced an agreement with activist investor RC Ventures LLC that includes the immediate appointment of three new directors. RC Ventures, one of GameStop’s largest shareholders, is managed by Ryan Cohen, the co-founder and former CEO of Chewy Inc. The new directors include Cohen and two former Chewy colleagues, Alan Attal and Jim Grube. Cohen, who sold Chewy for $3.35 billion to PetSmart in 2017, has been pushing for GameStop to focus on online gaming and trim its store portfolio. Separately, GameStop said same-store sales for the nine-week holiday sales period ended Jan. 2 rose 4.8% from the year-ago period. Net sales for the period fell 3.1% to $1.77 billion as strong demand for gaming consoles was offset by store closures. Online sales skyrocketed 309% to represent about 34% of total sales.

Blackford Capital invests in Massachusetts-based water sports manufacturer

Private equity firm Blackford Capital has invested in Aqua-Leisure Industries Inc., a maker of leisure products for water sports and recreation based in Avon, Mass. The 50-year-old company produces swim goggles, pool floats, learn-to-swim and other products that are sold at retailers under a variety of brand names. In announcing the deal, Grand Rapids-based Blackford Capital said the company has maintained growth throughout the COVID-19 pandemic and that it plans to “help Aqua-Leisure seize these opportunities to gain market share and capitalize on key industry trends, including unprecedented consumer demand through e-commerce and online sales channels.”

Technology & Internet

Poshmark IPO: POSH starts trading on Nasdaq

Shares of online clothing reseller Poshmark ended the day up more than 141% in the company’s market debut Thursday. The stock began trading at $97.50 per share. On Wednesday, Poshmark priced its IPO at $42 a share, giving it an initial valuation of more than $3 billion. It was valued at nearly $600 million in its last round, a series D in November 2017. Poshmark, founded in 2011, is an internet marketplace for second-hand clothing shoes and accessories. Like eBay and Etsy, Poshmark connects buyers with sellers, who often list items from their own closet. Poshmark makes money by taking a cut of every transaction. Poshmark filed to go public in December. In its IPO prospectus, Poshmark said it has benefited from a flood of demand generated by the coronavirus, as stuck-at-home shoppers continue to turn to online retailers for essential and non-essential goods. The marketplace has served as a source of additional income for Poshmark’s 4.5 million sellers, the company said. The company now counts 6.2 million active buyers and 31.7 million active users, the majority of which are female and either millennials or Gen Z.

Google closes its Fitbit acquisition

Alphabet-owned Google announced Thursday it has finally completed the acquisition of Fitbit, which was first announced in November 2019. The deal had been subject to a months-long probe into whether it could further push Google’s market position in the online advertising business if it uses Fitbit data to help personalize ads. But, while Google said the deal is closed, Reuters said the U.S. Department of Justice’s probe into the merger is still ongoing. Enforcement agencies typically have strict time windows to block mergers before they’re completed, but can still bring an enforcement action at any point. Fitbit may help boost Google’s presence in the wearable market. While Google doesn’t build its own smartwatches or fitness trackers, it provides the software that’s used by other companies to build smartwatches.

Finance & Economy

U.S. retail sales fall again in December

U.S. retail sales declined further in December as renewed measures to slow the spread of COVID-19 undercut spending at restaurants and reduced traffic to shopping malls, the latest sign the economy lost considerable speed at the end of 2020. Excluding automobiles, gasoline, building materials and food services, retail sales tumbled 1.9% last month after a downwardly revised 1.1% decline in November. These so-called core retail sales correspond most closely with the consumer spending component of gross domestic product. They were previously estimated to have decreased by 0.5% in November. The report followed in the wake of news last week that the economy shed jobs in December for the first time in eight months. Further job losses are likely in January as new applications for unemployment benefits surged in the first week of the month. The data are in line with economists’ expectations for a sharp slowdown in economic growth in the fourth quarter.

US unemployment claims jump to 965,000 as virus takes toll

The number of people seeking unemployment aid soared last week to 965,000, the most since late August and a sign that the resurgent virus has likely escalated layoffs. The latest figures for jobless claims, issued by the Labor Department, remain at levels never seen until the virus struck. Before the pandemic, weekly applications typically numbered around 225,000. They spiked to nearly 7 million last spring, after nationwide shutdowns took effect. Applications declined over the summer but have been stuck above 700,000 since September. The high pace of layoffs coincides with an economy that has faltered as consumers have avoided traveling, shopping and eating out in the face of soaring viral caseloads.