We are now almost 75% through the month of January – if you are participating in Dry January and have made it this far without a slip up, good work. In Dry January, participants try to abstain from alcohol for the month of January. Many who partake do so to kick off the new year with a healthier start and/or to save money. Originally popularized in 2013 in London, Dry January has become a commonly known phenomenon in both the U.K. and U.S. (so too has Dry January’s less restrictive cousin, “Damp January”). However, a recent study reports that, surprisingly, participation in Dry January this year is actually down because of strength in the same trends that made Dry January popular in the first place. Trends that have benefits and pitfalls for not only participants, but also the alcoholic beverage industry.

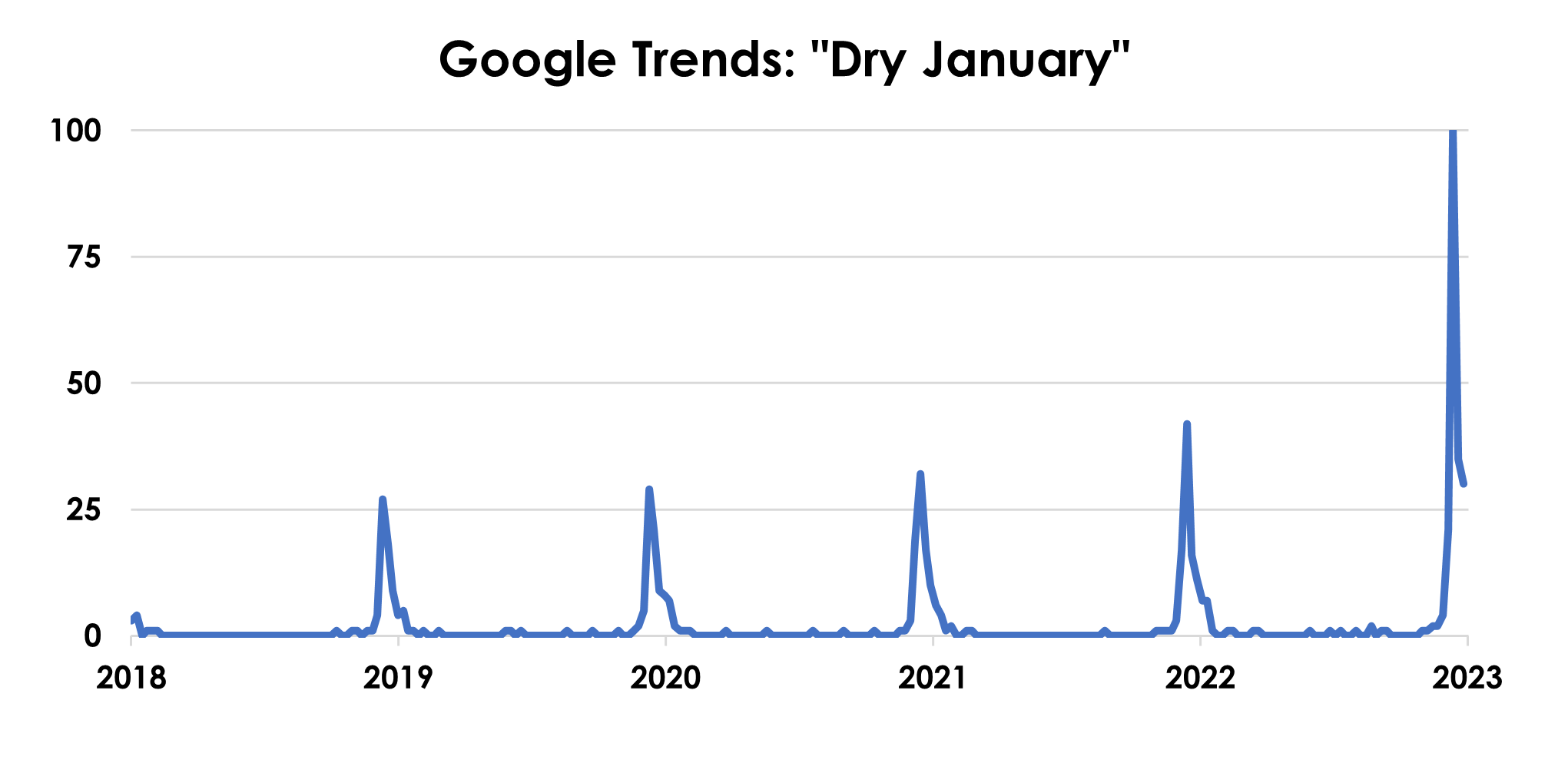

Dry January seems to have captured more attention and mentions than ever before. A recent study from Morning Consult estimates that 25% of U.S. adults are now aware of the trend, up four percentage points from last year. However, that may be understating the leap that it has made this year. Google Trends reports that search interest for Dry January this year is more than twice as high as it was in January of 2022.

However, the same Morning Consult study found that participation in Dry January this year is actually down four percentage points to 15% this year. The reason for the dip, the study suggests, is that with the rise of the “sober curious” movement, there are fewer drinkers to participate. According to Morning Consult, only 62% of millennials say they drink alcohol, down from 69% a year ago. This suggests that many millennials aren’t participating in Dry January because they are already drinking very little or not at all.

“Sober curious” is the recent trend among some drinkers toward moderating, if not eliminating, their alcohol consumption. Sober curious drinking, which is gaining popularity across all age groups but most quickly among millennials and Gen Z, has many positives, including improved physical and mental health, better sleep hygiene, and weight loss. In this regard, sober curious drinking fits in the same health-and-wellness megatrend that has recently propelled growth in categories such as organic foods, plant-based proteins, and home fitness.

Beverage companies have taken notice of these trends, and so while Dry January might seem like an anti-consumption “holiday,” product launches and sales of nonalcoholic beverages are booming. An August 2022 report from Nielsen found that sales of nonalcoholic beer, wine, and spirits were up versus last year 20%, 23%, and 88%, respectively. While still a drop in the bucket of the overall alcoholic beverage industry, non-alcoholic beverages have steadily grown each of the last five years. A bevy of direct-to-consumer, ecommerce no- and low-alcohol spirits have headlined this growth in the last couple of years, including Seedlip (which sold a majority stake to spirits giant Diageo in 2019) Ritual Zero Proof, Clean Co., and Monday Spirits to name just a few. These join the more established category of nonalcoholic beer, which has also seen a number of product launches in recent years, including Heineken 0.0, Budweiser Zero, Sam Adams Just the Haze, and Athletic Brewing.

These trends aren’t upending the alcoholic beverage industry just yet, and, as we discussed in the Big Story last year, one of the biggest trends in the space is higher-alcohol ready to drink cocktails. Still, if millennials’ and Gen Z’s interest in low- to no-alcohol lifestyles endure, the industry might have more to worry about than Dry January.

Headlines of the Week

Holiday sales fall short of expectations, set stage for tougher 2023 for retailers

Holiday sales came in below industry expectations, as shoppers felt pinched by inflation and rising interest rates, according to data from the National Retail Federation. Sales during November and December grew 5.3% year over year to $936.3 billion, below the major trade group’s prediction for growth of between 6% and 8% over the year prior. In early November, NRF had projected spending of between $942.6 billion and $960.4 billion. For retailers, the shopping season’s results reflect the challenges ahead. As Americans continue to pay higher prices for groceries, housing and more month after month, they are racking up credit card balances, spending down savings and having fewer dollars for discretionary spending.

Party City files for bankruptcy with plans to shed debt

Party City Holdco on Tuesday filed for voluntary Chapter 11 bankruptcy protection. The company said in court documents that it negotiated a deal with a bondholder group to obtain a $150 million debtor-in-possession loan, part of an “expedited restructuring” that would significantly reduce debt and improve its capital structure and liquidity. A hearing is set in the U.S. Bankruptcy Court for the Southern District of Texas to consider emergency motions that will allow the company to continue normal operations. In its Chapter 11 petition, the company says it has liabilities and assets of $1 billion to $10 billion and 10,001 to 25,000 creditors. Party City has over 800 company-owned and franchised stores. But its franchised stores, Anagram balloon business and subsidiaries outside the U.S. are not part of the Chapter 11 proceedings. Party City describes itself as “the largest vertically integrated designer, manufacturer, distributor, and retailer of party goods in North America.” In addition to its Party City stores, it also operates Halloween City seasonal pop-up stores.

Apparel & Footwear

Shein in talks on fundraising that would reduce valuation by £30bn

Shein is in discussions to raise up to £3 billion in fundraising that would reduce its valuation from £81 billion to £51 billion. The fast fashion retailer is seeking to close a new fundraising round from existing investors including Abu Dhabi sovereign wealth fund Mubadala, venture capital group Sequoia China and private equity group General Atlantic. The investors took part in the previous fundraising round which took place last April, valuing the business at £81 million. Since the Chinese retailer secured its billion pound valuation, there has been a decline in venture capital funding and a largely closed market for IPOs, which has led to a lack of funding for many private tech companies in the past year. Despite the lack of funding, Shein expects to launch an IPO as early as this year in the US, which is its largest market, the Financial Times reported. The retailer said it is considering a move to sell merchandise from third-party brands in addition to its own brand.

Dr Martens’ shares plunge after US bottleneck hits profits

British bootmaker Dr Martens has cut its profit forecast for the second time in three months, pinning the blame on a bottleneck at a new distribution centre in Los Angeles and sending its shares down 25 per cent. The company said it had recently identified “significant operational issues” at the site in Los Angeles, which it opened last July and is at the heart of its operations in the US, the group’s largest market. Disruption at the centre will reduce the group’s full-year profits by as much as £25mn. The bottleneck compounded the challenge Dr Martens faced last quarter in the US, leaving it unable to meet rising demand in December after warmer weather had hit sales in October and November.

The Robert Talbott brand story is legendary in the men’s market. In 1950, entrepreneur Robert Talbott and his talented wife Audrey (a part-time fashion model) moved west to seek a better life and pursue their vision for men’s fashion. Small batch designs for neckwear and dress shirts were crafted with exacting integrity – originally by Audrey’s own hands. Fortunately for Robert Talbott fans, the brand has been acquired by Newtimes Brands, whose CEO Alex Angelchik grew up with the beloved label and understands consumer sentiment towards it. The relaunch seeks to stay true to Talbott’s west coast heritage with a distinctly California attitude. The first tightly edited collection includes shirts, pants, and knits in luxurious casual designs crafted in Italy and Portugal.

Online retailer Boohoo sales drop 11% in Christmas period

British online fashion retailer Boohoo said revenue fell 11% in its key Christmas trading period, hurt by delivery disruption and tough comparatives, as it broadly stuck to annual guidance. For its financial year which ends on Feb. 28, Boohoo, which sells clothing, shoes and accessories aimed at 16 to 40-year olds, said adjusted core earnings would be in line with market expectations. Its forecast for a 12% decline in annual revenue was slightly behind the downgraded guidance for a 10% drop it gave in September. The sales fall during the Christmas period, the four months to the end of December, was partly due to longer delivery times, said Boohoo, and its UK market, where sales were also down 11%, was against a tough comparative period, as last year, COVID-19 meant shoppers favoured online orders. The weaker trading, which echoed a sales fall at online-only peer ASOS, is in contrast to a stronger performance from more traditional retailers such as Next, Marks & Spencer and JD Sports, which posted sales growth despite Britain being in the midst of a cost-of-living crisis.

Athletic & Sporting Goods

TaylorMade makes ‘material investment’ in PopStroke, Tiger Woods’ golf-entertainment business

Tiger Woods’ second career as a golf entrepreneur got a boost on Tuesday from one of his primary equipment sponsors when TaylorMade Golf made a “material investment” in PopStroke, Woods’ golf-entertainment business. PopStroke venues mix upscale putting courses with restaurant, bar and other gaming experiences. Currently, there are six locations (five in Florida and one in Texas) with two more under construction in Arizona. PopStroke was founded in 2018 by Woods and Greg Bartoli, a former Wall Street executive who was managing director of the Interest Rate Trading Group at JPMorgan. Bartoli is also the founder and CEO of J.E.M. Partners, a Florida-based real-estate investment company specializing in outdoor family entertainment and amusement parks.

Trilantic-Backed Taymax Acquires Saber Fitness

Taymax Group Holdings LP, a Planet Fitness franchisee backed by Trilantic North America, has acquired Saber Fitness, an operator of Planet Fitness clubs with 27 locations and future development rights throughout California. Founded in 2013, Saber’s Planet Fitness locations span the greater Los Angeles, Inland Empire, San Jose and East Bay regions of California with a staff of 425 employees. The acquisition works as an extension of Taymax’s existing operations in the greater Sacramento area and also looks to establish the company’s presence in new territories. With Saber, Taymax now employs over 2,800 team members.

76ers, Devils owners buy into Ripken, Cooperstown youth baseball

Cal Ripken and Cooperstown are connected again. Ripken’s eponymous tournaments for youth baseball players have merged with Cooperstown All Star Village under a new agreement with the owners of the Philadelphia 76ers and New Jersey Devils. Josh Harris and David Blitzer have become majority investors in the deal announced that merged two of the leading youth baseball brands that combined to host more 15,000 teams and 250,000 participants last year. The Ripken Experience operates in Maryland, South Carolina and Tennessee and plans to open a location in 2023 in Kentucky. The All Star Village, based in Oneonta, New York, hosts more than 10,000 players ages 10 to 12 each summer.

Cosmetics & Pharmacy

AS Beauty Enters Skin Care with Bliss Acquisition

AS Beauty has acquired Bliss—its first entry into skin care—in a move that signals the company’s intention to diversify its growing portfolio, which also consists of Laura Geller Beauty, Julep Beauty, Mally Beauty and Cover FX. Details of the transaction have not been publicly disclosed. The Bliss World brand has seen strong reception and traction in drug and mass retailers with more than 30,000 retail points of distribution at Target, Walmart, CVS and Walgreens.

Thirteen Lune’s New Funding to Drive Inclusive Omnichannel & Brick-and-Mortar Expansion

Beauty e-commerce retailer Thirteen Lune has raised a seed plus investment round of $8 million from The BrainTrust Fund. This capital, along with an initial seed round led by Fearless Fund, represents $12.5 million in total funds raised. Thirteen Lune expects to reach profitability in 2023, and has had more than 2,000% growth in 2022—driven by the launch of its first private label brand, Relevant: Your Skin Seen, the expansion of its in-store partnership with JCPenney Beauty, and the addition of brands to its platform. Thirteen Lune is dedicated to brands created by Black and Brown founders for people of all colors and was co-founded by Nyakio Grieco and CEO Patrick Herning in 2020.

Sephora Confirms U.K. Store Comeback

Sephora has confirmed that it will open the doors to a London flagship store this spring. Sephora notoriously exited the U.K. in May 2005 after opening just six stores. In 2021, Sephora acquired U.K.-based e-beauty retailer FeelUnique for $147 million, paving the way for a return to the U.K., and then switched domains from FeelUnique to Sephora.co.uk in October 2022. The new flagship store will occupy a circa 6,000 sq. ft. store housing a range of products from make-up to fragrance, skincare, haircare, and wellness and over 140 brands including Drunk Elephant, Summer Fridays to Fenty as well as a line-up of names exclusive to Sephora U.K. such as Makeup by Mario.

Discounters & Department Stores

Macy’s CEO: ‘We are in the final stretch’ of closing stores

Coming fresh off the announcement that the company is shuttering four full-line store locations, Macy’s CEO Jeff Gennette says the retailer is in the last stages of closing underperforming locations. “When you think about the Macy’s portfolio of stores, up until two and a half years ago we were only on-mall, and we had been closing underproductive units. Since 2016 we dropped 170 stores,” Gennette said on Sunday to an audience at the National Retail Federation’s Big Show conference in New York City. “We are in the final stretch of that.” Closing full-line stores across the country has been part of Macy’s turnaround strategy. The retailer is also diversifying its store fleet with off-mall locations.

Neiman Marcus Group hires new brand, retail chiefs

Creating two new roles at the company, luxury retailer Neiman Marcus Group announced that it appointed Nabil Aliffi as chief brand officer and promoted Stefanie Tsen Ward to chief retail officer, according to a company press release. Both will report to Neiman Marcus Brand President Ryan Ross, who joined the company in August. Aliffi’s role will be focused on creating omnichannel experiences for the company and its more than 2,000 brand partners. Additionally, he will drive innovation and expand on customer touchpoints. Meanwhile, Tsen Ward is responsible for the company’s integrated retail strategy and customer experience offered by associates, working closely with Aliffi on bringing experiences to stores. The appointments are part of Neiman Marcus’ “Revolutionize Luxury Experiences” growth strategy, with the company saying it’s made investments in technology and supply chain operations over the past few years. It has committed to making a $200 million strategic investment in stores over three years, per the release.

Restraining order sought against Dollar General over Ohio price discrepancies

Ohio Attorney General Dave Yost asked a state court to issue a temporary restraining order against one of America’s largest discount retailers. The request seeks to force Dollar General to stop advertising one price on shelves but repeatedly charging another – usually a higher price – at the register when customers check out. Dollar General did not immediately respond to Retail Dive’s request for comment Friday. Under Ohio law, stores may have a 2% error rate on overcharges, according to a release from the attorney general’s office in November. But inspectors in Butler County in October found pricing error rates ranging from 16.7% to 88.2% in 20 Dollar General stores.

Nordstrom enlists company stylists for new fashion ambassador program

Nordstrom has launched a “Stylist Ambassador” program, enlisting store stylists from each of its top 20 markets, which include cities in the U.S. and Canada. The stylists will work as influencers, helping to “bring the Nordstrom experience to life in a variety of ways including social media, events,” media opportunities and other channels, according to a company blog post. Nordstrom’s top 20 markets are Los Angeles; New York; Chicago; Dallas; San Francisco; Boston; Philadelphia; Seattle; Toronto; Washington, D.C. (including Baltimore); Atlanta; Austin, Texas; Denver; Detroit; Houston; Miami; Minneapolis; Portland, Oregon; San Diego and West Palm Beach, Florida.

Emerging Consumer Companies

The Edit LDN, London-based sneaker resale marketplace, raises $4.8 million

The Edit Ldn, the fast-growing sneaker resale platform founded by Moses Rashid, has received $4.8 million in seed round funding to help scale its business in the Middle East and North Africa region, as well as in the U.S. The investment is led by the New York-based Regah Ventures, with participation from sports celebrities including NBA player PJ Tucker, Premier League star Jesse Lingard, and New York Giants captain Xavier McKinney, who was appointed a brand ambassador last October. The international market represents around 50% of its business and the U.S. alone is responsible for generating 20% of the company’s revenue.

Makeup By Mario Receives Growth Equity Investment from Provenance and Silas Capital

Makeup by Mario has taken its first outside capital, valuing the brand at over $200m. The new funding round will fuel accelerating momentum at Sephora, product development and further expansion of the brand’s nascent e-commerce channel. Launched in October 2020, Makeup by Mario was founded by Mario Dedivanovic, a world-renowned makeup artist who is sought after for his pioneering makeup techniques.

Food & Beverage

No Meat Factory raises $42M to expand plant-based protein manufacturing

Plant-based meat manufacturing company No Meat Factory raised $42 million in a Series B round. The round was led by Tengelmann Growth Partners and Emil Capital Partners, who invested when the company was formed in 2019. These funds will help No Meat Factory expand its manufacturing footprint in North America, as well as increase its R&D. Its current manufacturing facility is in British Columbia, Canada, and a second facility is scheduled to go into operation this year. While the plant-based meat sector is poised to continue to grow, a lack of manufacturing facilities can be an obstacle. According to a study last year from the Good Food Institute, $27 billion worth of manufacturing infrastructure is needed to meet plant-based protein demand by 2030.

Kerry Sells Sweet Ingredients, Focused On Nutrition Wellness

Irish ingredient maker Kerry Group announced last week that it was in exclusive negotiations to sell its sweet ingredients portfolio in order to further focus on nutritional, functional ingredients and innovative biotechnology in food. Kerry announced that Italian specialty ingredient company IRCA is expected to purchase the portfolio for over $540 million. The portfolio includes a range of products spanning sweet particulates, chocolate confections, baked inclusions, variegates and fruit purées used in bakery, cereal, confectionery, dairy and ice cream brands throughout Europe and the U.S. Kerry’s sweet ingredients have an operational footprint of four manufacturing facilities in the U.S. (in Illinois, Kansas, Missouri, and California), and six facilities across the U.K, the Netherlands, Germany and France. More details of the deal will be available when it is finalized in the first half of 2023. IRCA was acquired by global private equity company Advent International from investment firm Carlyle in April 2022 for an undisclosed sum. The proposed sale of Kerry’s sweet ingredients portfolio is expected to strengthen IRCA’s position in the U.S. and generate over $1 billion in revenue. It will be IRCA’s third acquisition since Advent took control of the specialty ingredient company.

Nestlé invests $43M in Wisconsin factory expansion

Nestlé Health Science will invest $43 million in an expansion to its Eau Claire, Wisconsin factory. The company said it will add two production lines in order to increase capacity to meet growing demand for its Boost and Carnation Breakfast Essentials ready-to-drink products. The investment will add 60 jobs to the plant’s workforce. The CPG giant emphasized sustainability is a key element of the new facility. Along with being zero waste-to-landfill, the plant will manufacture its beverage products in recyclable TetraPak cartons. The company first launched sustainable packaging for Carnation Breakfast Essentials in early 2022, when it also decreased the added sugar content in the beverage by 25%. Nestlé previously set a goal to make 100% of its packaging recyclable or reusable by 2025.

Grocery & Restaurants

Wendy’s investor Trian says it won’t pursue takeover

The largest investor in The Wendy’s Co., Trian Fund Management L.P., said Friday it would not pursue a takeover of the burger brand as the company pre-released earnings for the Jan. 1-ended fourth quarter and fiscal year. Trian, which with affiliates holds more than 19% of Wendy’s shares, last May said it had discussed strategic options with the Dublin, Ohio-based company’s board. Wendy’s on Friday released preliminary results for the fiscal 2022 year, saying same-store sales for the fourth quarter rose 5.9% domestically and 9.9% internationally. Profit in the fourth quarter increased to $84 million from $76.9 million in the same period last year, and total revenues rose to $536.5 million from $473.2 million in the prior-year quarter. The company said it increased its quarterly dividend to 25 cents a share, and the board authorized a $500 million share repurchase. Wendy’s, along with its preliminary results, released a statement from Nelson Peltz, CEO and founding partner of the Trian Fund as well as Wendy’s non-executive chair. Peltz, whose Trian has been invested in Wendy’s International Inc. (the predecessor of The Wendy’s Co.) since late 2005, in his statement said: “Trian believes strongly in the future of Wendy’s, is confident in the company’s growth plans and is strongly supportive of the capital allocation strategy announced today.”

Wendy’s embarks on restructuring organization

The Wendy’s Co. has launched a reorganization that will focus more on the burger brand as a global company, executives said last week. “We intend to embark on a broader redesign of our organizational structure as we see an opportunity to operate as a fully global brand with a unified voice approach and operating model,” said Todd Penegor, CEO and president of the Dublin, Ohio-based company, on a call with analysts. On Jan. 12, in connection with the redesign of the organizational structure, Wendy’s announced the role of U.S. president and chief commercial officer was being eliminated. Kurt A. Kane, who had held the position since 2019, will depart the company, Wendy’s said in Securities and Exchange Commission filings. The company also said Leigh Burnside, the company’s senior vice president, chief accounting officer and chief financial officer U.S., would be resigning to become CFO at another restaurant company. She will remain through Jan. 20, and Suzanne Thuerk would be promoted to chief accounting officer. Penegor said Wendy’s was streamlining its operational structure as it continues to expand internationally and with traditional units. Penegor added that the reorganization was intended to maximize efficiency and streamline decision-making.

Home & Road

Rejected Purple suitor returns with plan to shake up company board

In response to Purple Innovation’s rejection of its buyout offer last week, investment firm Coliseum Capital Management has returned amending its filing with request to expand and recreate the company’s board. In response, the digitally native bedding brand has issued a statement that expresses “disappointment” in the investor’s tactics. In its latest filing with the Securities and Exchange Commission, Connecticut-based Coliseum, which owns nearly 45% of Purple’s stock, seeks to expand the company’s board from seven to nine, keeping CEO Robert DeMartini in place along with Adam Gray, Coliseum’s managing director and current board member, and two current independent board members the two entities agree on. The other five members would include two additional Coliseum-affiliated people, two directors selected by Coliseum that are not affiliated with the agency and one mutually agreed-upon director. Coliseum says it will nominate a slate of directors at Purple’s 2023 annual shareholders meeting, and the slate will constitute a majority of the board. If the Purple agrees to the new board structure, Coliseum said it will withdraw its buyout proposal, and the company would terminate its stockholder rights agreement – the poison pill – that the company issued in September.

Wayfair axes 1,750 jobs in next phase of cost restructuring

Wayfair is cutting an additional 1,750 jobs — 10% of its global workforce — as the multi-format home goods retailer moves forward with its $1.4 billion cost-restructuring plan started last summer. About 18% of those jobs, representing about 1,200 employees, are from Wayfair’s corporate staff. According to the company, the changes reflect efforts to eliminate layers of management and make the business more agile. Along with its prior restructuring in August, the jobs cuts represent about $750 million in annualized cost savings. Wayfair will incur between $68 million and $78 million in costs, primarily for severance and benefits, related to the layoffs, most of which will impact the first quarter of 2023. “Although difficult, these are important decisions to get back to our 20-year roots as a focused, lean company premised on high ambitions and great execution,” said Niraj Shah, CEO, co-founder and co-chairman. “The changes announced today strengthen our future without reducing our total addressable market, our strategic objectives or our ability to deliver them over time. “In hindsight,” he said, “similar to our technology peers, we scaled our spend too quickly over the past few years. The good news for Wayfair is that we have operated in a highly productive and efficient way for the vast majority of our 20-year history, and we are now simply returning to that.”

Two companies reportedly kicking the tires in possible Bed Bath & Beyond sell-offs

Bath Bath & Beyond is said to be moving on many fronts to keep itself going. According to CNBC, Bed Bath & Beyond is considering selling off its core chain as well as the Buybuy Baby business. Potential acquirers include Sycamore Partners and Authentic Brands. Sycamore, which acquired the Belk department store company in 2015, made an unsuccessful play for JCPenney when the company was on the block in 2020. The private equity firm is primarily interested in Bed Bath’s Buybuy Baby chain, according to the New York Times. Authentic Brands Group, which is led by Leonard Green & Partners, has scooped up the intellectual property of a number of struggling retail brands, including Brooks Brothers, Barneys and Forever 21. Bed Bath & Beyond is also working to secure additional financing of at least $100 million ahead of a bankruptcy filing, CBNC was told. Two weeks ago, the company announced it had “substantial doubt” about its ability to continue operations. The company said it was exploring a number of strategic alternatives, including bankruptcy, restructuring or refinancing its debt and selling assets.

Jewelry & Luxury

De Beers’ New CEO Will Start In February

De Beers’ CEO transition—which was scheduled to occur early this year—has been given a date: Feb. 20. On that day, energy executive Al Cook, an industry newcomer, will take over from Bruce Cleaver. Cleaver has served as De Beers’ CEO since 2016. Upon stepping down as CEO, he will become De Beers’ cochair, serving alongside Duncan Wanblad, CEO of Anglo American, which owns 85% of De Beers. Cleaver has said he plans his chairmanship to be “more than part-time…I will stay in touch with the trade.” Prior to coming to De Beers, Cook served as executive vice president of international exploration and production for Equinor, Norway’s state-owned energy company, where he ran operations in 12 countries across Africa, North America, South America, and Europe.

Signet Names New Jared President as Executive Shuffle Continues

Signet Jewelers has announced another executive change following a recent restructuring of its leadership team. The jewelry giant named luxury retail veteran Claudia Cividino as the new president of Jared, effective immediately. The banner’s former president, Bill Brace, has been promoted to president of Kay Jewelers, one of a nearly a dozen personnel changes the retailer recently announced. Cividino has two decades of experience in luxury retail, previously serving as the CEO of North America at LVMH-owned fashion brand Loro Piano. Prior to that, she was the North America CEO of Bally of Switzerland and held senior executive positions at Prada and Saint Laurent. She will report directly to Signet CEO Gina Drosos.

Richemont’s Jewelry Sales Up Double Digits in Q3

Richemont posted a strong third quarter, with sales in its jewelry division up double digits. The luxury conglomerate, which owns high-end brands like Cartier and Van Cleef & Arpels, posted sales growth in all regions except Asia Pacific as COVID restrictions hampered the mainland China market. For the third quarter ending Dec. 31, Richemont posted sales of €5.4 billion ($5.9 billion), a 5 percent year-over-year increase at actual exchange rates. The quarter was up against a tough comparable, with last year’s Q3 sales up 32 percent. Growth was led by retail and its online channels, said Richemont, with sales up 6 percent year-over-year in each category.

Gen Z is driving luxury sales as wealthy shoppers get younger

Luxury shoppers are getting wealthier and younger, with purchases by some of the newest consumers expected to grow three times faster than older generations over the next decade, according to a new report. Generation Y, also known as millennials, and Generation Z accounted for all of the luxury market’s growth last year, according to a report from Bain & Co. Spending by Gen Z and the even younger Generation Alpha, or those under 13, is expected to make up a third of the luxury market through 2030, reflecting “a more precocious attitude toward luxury” among the younger ranks than older generations, the report said. Gen Z consumers are starting to buy luxury goods — everything from designer handbags and shoes, to watches, jewelry, apparel and beauty products — at age 15, three to five years earlier than millennials did, the report said. “By 2030, younger generations (Generations Y, Z, and Alpha) will become the biggest buyers of luxury by far, representing 80% of global purchases,” it said.

Office & Leisure

Israeli Gambling Giant Offers to Buy Rovio

Israeli gambling giant Playtika made a lucrative all-cash acquisition offer for Rovio Entertainment, the Tel Aviv-based company has announced. The proposal was put forward following a fairly uneventful year for the Finnish developer during which it launched only two games, Angry Birds Journey and a rerelease of the original Angry Birds. Playtika is one of the world’s largest casual and casino games publishers whose latest full-year financials reveal it hit 35 million monthly players in 2021, which places it in Rovio’s ballpark, user-wise. However, the nature of the gambling niche means Playtika is significantly better at monetizing its player base than the Angry Birds maker is. Playtika has now made an offer to buy Rovio at the equivalent of $9.79 per share. The all-cash proposal is valued at $812.8 million, 55% over Rovio’s January 18 market capitalization. Playtika, which is a publicly traded company since early 2021, said it believes combining Rovio’s IP with its refined monetization and logistical capabilities would generate “tremendous” shareholder value, as per CEO Robert Antokol. The Israeli publisher revealed it already made a 6% lower offer for Rovio in November, confirming that the Finnish firm’s board of directors has been mulling a sale for some time now.

Petco’s vision of a one-stop shop for pet owners

Petco CEO Ron Coughlin’s keynote session at NRF 2023: Retail’s Big Show began with an unexpected guest — a puppy named Reese’s joined Coughlin and NRF President and CEO Matthew Shay on stage for a few minutes. “I thought I’d bring a little friend along,” Coughlin said, introducing the dog as available for adoption from New York-based Muddy Paws Rescue. Coughlin joined Petco as CEO in 2018. For the four years prior to this appointment, he served as president of HP’s Personal Systems division, and before that he held various sales and marketing positions at HP. Before that, he spent 13 years at PepsiCo. “You’ve been in consumer-facing businesses before,” Shay said. “You were in technology. And you came to Petco and have re-engineered and transformed the business with a vision of setting up a one-stop shop where people can get everything they need for their pet. Can you talk about that journey?” The first thing Coughlin did with the company was get it out of its own way. “There were 20 different metrics being tracked, so the first order of the day was corporate integrity. We simplified down to five metrics. We pushed data down to the store managers, making them general managers — the data was all being held at company headquarters — and held them accountable,” he said.

Technology & Internet

Amazon drone unit hit with layoffs as long-awaited program launches

In 2013, Amazon founder Jeff Bezos appeared on CBS’ “60 Minutes” to reveal a futuristic plan his company had been secretly pursuing to deliver packages by drone in 30 minutes. A pre-recorded demo showed an Amazon-branded “octocopter” carrying a small package off a conveyor belt and into the skies to a customer’s home, landing smoothly in the backyard, dropping off the item and then whizzing away. Bezos predicted a fleet of Amazon drones could take to the skies within five years and said, “it’s going to be a lot of fun.” A decade later, Amazon is finally starting to launch drone deliveries in two small markets through a program called Prime Air. But just as it’s finally getting off the ground, the drone program is running squarely into a sputtering economy and CEO Andy Jassy’s widespread cost-cutting efforts. CNBC has learned that, as part of Amazon’s plan to slash 18,000 jobs, its biggest headcount reduction in history, Prime Air is losing a significant number of employees. Amazon’s drone test site in Pendleton, Oregon, was hit particularly hard, with half of the team being let go, one Prime Air employee wrote in a LinkedIn post, which he subsequently deleted. Jassy has resorted to trimming Amazon’s headcount, which grew massively during the Covid-19 pandemic, as he looks for ways to curtail expenses across the company.

Apple set to challenge Amazon and Google with big move into smart-home gadget market

Apple is working on a slate of devices aimed at challenging Amazon.com and Google in the smart-home market, including new displays and a faster TV set-top box, after relaunching its larger HomePod speaker. The push into smart displays will start with a tablet product — essentially a low-end iPad — that can control things like thermostats and lights, show video and handle FaceTime chats, people with knowledge of the plans said. The product could be mounted on walls or elsewhere using magnetic fasteners, positioning it as more of a home gadget than a regular iPad. Apple has also discussed the idea of building larger smart-home displays, according to the people, who asked not to be identified because the deliberations are private. While the iPad already has smart-home features, standalone smart-home devices — often designed as countertop or wall-mounted appliances — have grown increasingly popular. Amazon sells a line of Echo Show products with displays, while Google offers its Nest Hub. And the latter company — part of Alphabet — is readying a Pixel Tablet with an optional stand.

Finance & Economy

U.S. retail sales post biggest drop in a year; inflation retreating

U.S. retail sales fell by the most in a year in December, pulled down by declines in purchases of motor vehicles and a range of other goods, putting consumer spending and the overall economy on a weaker growth path heading into 2023. The second straight monthly decrease in retail sales, which are mostly goods, is undercutting production at factories. Manufacturing output recorded its biggest drop in nearly two years in December, while monthly producer prices also tumbled, other data showed. The widespread signs of weakening demand and subsiding inflation are likely to encourage the Federal Reserve to further scale back the pace of its rate increases next month, but not pause its monetary policy tightening anytime soon as the labor market remains tight. The U.S. central bank is engaged in its fastest rate hiking cycle since the 1980s.

U.S. hits debt limit, prompting “extraordinary measures” to avoid default

Treasury Secretary Janet Yellen told congressional leaders that the U.S. has hit the limit on the amount of debt it can issue to fulfill its obligations, initiating “extraordinary measures” that will allow the country to avoid a catastrophic default for at least the next few months. The “extraordinary measures” put a hold on contributions and investment redemptions for government workers’ retirement and health care funds, giving the government enough financial space to handle its day-to-day expenses until roughly June. The expected move comes amid friction between President Biden and House Republicans that has raised alarms about whether the U.S. can sidestep a potential economic crisis.