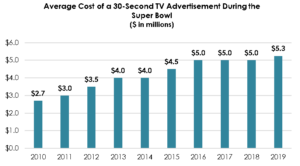

Super Bowl Sunday. Every year, football fans look forward to it, families and friends gather to watch it, and advertisers bank on it. This year’s game, which will be played this weekend, will air in more than 170 countries and will again be one of the most-watched annual sporting events in the world. With the large size of the audience comes the high cost of advertising during the game; a 30-second ad on Fox can run as much as $5.6 million this year. Business Insider reports that for this year’s game, all 77 commercial slots sold out early for the first time in more than five years, and all ads sold for more than $5 million.

Rising prices and the speed with which spots sold out this year suggest strong demand for airtime during the game. So does the roster of advertising companies, which boasts a number of the most recognizable consumer brands and companies in North America (if not the world). Many of these companies repeatedly fill the game’s commercial breaks virtually every year, including Volkswagen, Anheuser-Busch InBev, Coca-Cola, Hyundai, Proctor & Gamble, Verizon, and Pepsi (including Frito-Lay), to name a few.

But what about newer, up-and-coming brands? There is one obvious barrier for many younger companies to advertise at the Super Bowl: the aforementioned sky-high cost of the whole thing. For a younger company, $5 million could represent an entire year’s marketing budget. It’s no wonder that most Super Bowl advertisers are huge companies.

However, there are at least two arguments why we might see younger companies advertise during the Super Bowl or at least move toward television in general in the future. First: the cost of advertising online continues to rise very quickly. Prices for targeted Facebook and Google ads and impressions have risen so much that many growing consumer companies no longer find digital marketing as economically viable as it was only two years ago. Obviously, a $5 million Super Bowl ad is as far away as you can get from “targeted,” but the relative value proposition of digital marketing versus television is likely different today than it was a couple of years ago, and it may continue to move in favor of television. One can imagine that for certain large, growing, and nearly-household-name consumer companies (like Peloton, Dollar Shave Club, Stitch Fix, etc.), targeted digital ads may be of less value than the brand-building potential offered by television. While itself not a young, scaling company, PepsiCo seems to recognize this brand-building potential of Super Bowl spots and is investing this year for the first time in commercials for two of its younger brands, Sabra Hummus and Soda Stream.

Another kicker that adds to the relative value of television ads (particularly those that air during the Super Bowl) versus digital marketing is that popular, funny commercials now air once on television, but then become free digital marketing when they are posted online and rack up subsequent impressions. A quick look at YouTube shows that one Pepsi spot last year featuring Cardi B was reposted in several different clips and collectively garnered over 10 million additional views.

Perhaps the greatest endorsement of Super Bowl ads and their unique value relative to digital marketing comes from a company that will advertise during the big game for the first time this year – Facebook. If you can’t beat them, join them?

VF Corp explores sale of 9 brands

VF Corp. earlier this week said it has begun exploring strategic alternatives for the occupational brands in its workwear business, notably Red Kap, VF Solutions, Bulwark, Workrite, Walls, Terra, Kodiak, Work Authority and Horace Small. Those brands represented some $865 million of VF’s fiscal 2019 revenue and about 50% of its work segment revenue, according to a company press release. The business is primarily based in the U.S., with customers that include U.S. government agencies and Fortune 100 companies. The review reflects the company’s “continued focus on transforming VF into a more consumer-minded and retail-centric enterprise, with a portfolio of growth-oriented active, outdoor and work brands.” The announcement of these plans arrived as VF Corp. reported an uncharacteristically weak quarter that had the company downgrading its fiscal year guidance. Selling off the occupational brands could give the company an operating lift. And it could bring in about a billion dollars.

Califia Farms receives $225 million in financing

Plant-based beverage maker Califia Farms has completed a series D round of financing that has generated $225 million. The investment group was led by the Qatar Investment Authority and included other investors from Temasek, Claridge, Green Monday Ventures and a Latin American family with interests in coffee and consumer products. The new investor group will take a minority stake in Califia Farms, with representatives from the Qatar Investment Authority, Temasek, and Claridge joining the board of Califia, alongside founder and chief executive officer Greg Steltenpohl and existing investors Sun Pacific, Stripes and Ambrosia. The latest funding round will help Califia Farms build on the success of its oat platform and launch other lines, according to the company. Proceeds also will allow management to further invest in increased production capacity, substantial R.&D., deeper U.S. penetration, and continued global expansion.

Apparel & Footwear

Brand Velocity Partners Acquires Iconic Footwear Company

Brand Velocity Partners (BVP), a private equity firm focused on acquiring lower-middle market consumer businesses in search of marketing muscle, announced it has purchased Original Footwear Inc. Original Footwear, with its Altama and Original S.W.A.T. brands, is globally known for its military and law enforcement footwear and an expanded line of consumer active and fashion footwear. This is the first deal consummated by BVP, a firm founded in 2019 and run by partners with deep experience in both PE and brand marketing. Steve Lebowitz, managing partner of BVP and former co-founder and managing partner of Topspin Partners, said, “There is a yawning gap in the marketplace for a PE firm to do more than financial engineering – great consumer companies are not built through spreadsheets, but rather through excellent products and superior marketing.”

Express trimming stores in new turnaround move

Express Inc. launched a new corporate strategy that involves closing stores and cost reductions. The apparel retailer said it plans to close approximately 100 stores by 2022, with the total including nine locations that closed in 2019. Another 31 stores will shutter by the end of January 2020, and an additional 35 by the end of January 2021. Currently, Express operates approximately 600 stores. The company said the planned closures would reduce revenue by $90 million by 2022, which will be offset by the elimination of costs and by leveraging the remaining stores and online infrastructure for additional sales. As part of the new strategy, Express also expects to realize $80 million in cost reductions during the next three years. A previously announced workforce restructuring will be responsible for $55 million of the savings, with another $25 million to be driven by process improvements, inventory optimization and systems implementations.

The American owner of premium retailer Reiss is considering selling off its stake in the business. Private equity firm Warburg Pincus, which bought a majority stake in the retailer in 2016, has appointed investment bank Rothschild to review potential options, including a sale. “At some point you would expect a financial investor to consider ways in which to realise its investment, but the rumours of Warburg Pincus selling have been rumbling on for a year or so.” The news comes after a period of strong trading for the retailer. In its most recent results, Reiss reported 8.3% growth in sales to £186.3m for the year to 2 February 2019, and a 21.3% rise in EBITDA to £19.3m. Rumours emerged of a potential sale in May 2019, but at the time were denied by Reiss.

Athletic & Sporting Goods

Crescent Moon Snowshoes Acquired By Dunn-Rite Products

Snowshoe maker Crescent Moon Snowshoes has been acquired by family-owned Dunn-Rite Products. As part of the deal, Crescent Moon will transition production from Colorado to Dunn-Rite’s home in Elwood, IN. A third-generation, family-owned business specializing in summer water-recreation products, Dunn-Rite is expanding their manufacturing facilities into cold-weather water-based fun.

Under Armour Quietly Shelves its Consumer mHealth Wearables Platform

One of the early participants in the mHealth wearables movement is quietly pulling out. Under Armour, which had competed alongside the likes of Apple, Fitbit, Garmin and Withings with a connected health platform that included an app, mHealth wearables and a smart scale, recently removed its UA Record app from both Apple’s App Store and Google Play. The company has urged users to migrate data to the MyFitnessPal App, which it had acquired in 2015, but that platform doesn’t collect data on sleep, steps, weight or resting heart rate – only calories burned during exercise.

Cosmetics & Pharmacy

Colgate-Palmolive to acquire Hello Products

Colgate-Palmolive is expanding its oral care offerings. The company announced that it has entered an agreement to acquire Hello Products, which is expected to close no later than February. Hello will continue to be led by its founder Craig Dubitsky and chief executive officer Lauri Kien Kotcher. “We are excited to welcome Hello to the Colgate family and are especially pleased that Craig and Lauri will continue in their leadership roles. We have great respect for the Hello team and their impressive product line, and value the strong connection they have made with younger consumers,” Noel Wallace, Colgate’s president and CEO said. Products featured in Hello’s offerings include adult and children’s toothpaste, mouth rinse, toothbrushes and floss that are sold in primarily food, drug and mass retailers, as well as e-commerce.

CVS Health expands health-focused store format

CVS Health continues the expansion of its HealthHub concept as part of its strategy to roll out the program nationally. The company unveiled HealthHubs in nine CVS Pharmacy locations in Greater Tampa. Currently, CVS has 53 HealthHub locations in five states, including Florida, Georgia, New Jersey, Pennsylvania and Texas. It plans to expand the format to a total of 17 states in the first part of 2020 as part of its national expansion, with up to 1,500 locations operating nationwide by the end of 2021. “We are delivering real change to the health care system,” said Alan Lotvin, M.D., chief transformation officer for CVS Health. “The HealthHub products and services are designed specifically with the consumer’s health needs, challenges, and goals in mind, so that they can easily receive coordinated, personalized care in a familiar, neighborhood location.” The HealthHub store format, which CVS introduced at the end of 2018, was developed to help people manage chronic conditions more conveniently and affordably by improving the overall patient experience and featuring a wide array of health and wellness products, clinical services and expertise.

Clean Deodorant Type:A Secures Seed Funding

Clean deodorant brand Type:A raised $2.4 million in seed funding led by Marigay McKee and William Detwiler’s Fernbrook Capital Management, and is launching in 1,500 Target doors. Type:A founder and CEO Allison Moss identified white space between nebulous natural deodorants and regulated antiperspirants. The brand’s nontoxic deodorant is aluminum-, paraben- and propylene glycol-free. The product has been sold on its own website as well as through Amazon and Credo. “It means that we get to reach many more people,” Moss told Beauty Independent of Type:A’s arrival at Target. “We expect it’s going to be a lift for the entire business. Deodorant as a category is an omnichannel category. People certainly shop for deodorant online, but they still largely shop the category based on convenience and force of habit, and that tends to be at retail and more mass retail.”

Luxury Brand Partners Plans for Growth Through Bookend Partnership

As a result of a financial partnership with Bookend Capital Partners, Luxury Brand Partners (LBP), the company behind brands including R+Co, IGK, Becca and Oribe Hair Care, has announced plans for expansion and new brand launches. Bookend Capital Partners is an investment fund helmed by Alexander Panos, CEO and founder, and he will join LBP’s board of directors as part of the partnership. The $50 million minority investment is part of LBP’s plan for exponential growth in the new decade, including several soon-to-be-announced cutting-edge brands in addition to continuing innovations in the beauty and retail sectors.

Discounters & Department Stores

J.C. Penney’s poison pill is about to expire

J.C. Penney’s poison pill, put in place in 2014 to protect a $2.1 billion tax benefit, is about to expire. The Plano-based department retailer extended the shareholders rights plan once before, in 2017. That extension expires Saturday. Spokeswoman Brooke Buchanan declined to comment Wednesday about what Penney plans to do. Penney has said in its annual filings that it considers the net operation loss, often referred to as NOL carryforwards, as an asset that can offset future taxable income and reduce federal income tax liability.

Kohl’s, WW Roll Out Wellness Pop-Up Shops

As part of Kohl’s commitment to health and wellness this year, the department store is continuing to collaborate with wellness company WW (formally Weight Watchers International). Kohl’s and WW are launching WW pop-ups in select stores this January to support customers on their wellness journeys.

Target Grows Its Delivery Business by Partnering with a Rival

When Target spent $550 million to buy same-day shipping platform Shipt in December 2017, the common belief was that the retailer did so to jump-start its own ability to deliver quickly. The purchase allowed the retail chain to quickly add same-day delivery, which gave it an edge over rivals that had yet to do that, and it helped put Target on an even footing with Amazon. It was largely expected that Shipt would become a Target-centric service. That’s not entirely what has happened. The shipping company also has same-day delivery offers from CVS (a Target partner), and grocery rivals HEB and Meijer.

Emerging Consumer Companies

Peloton expands into apparel, partners with Athleta

Acclaimed fitness brand Peloton – known for its stationary bikes, treadmills, and workout classes – is making a bet on apparel. The company has released a collection of men’s and women’s apparel in partnership with Hill City and Athleta, subsidiaries of Gap.

Acquisition of Harry’s of by Edgewell yet to close, questions remain

The acquisition of Harry’s by Edgewell Personal Care has yet to close, and questions from lawyers with the Federal Trade Commission reportedly persist. It’s unclear what elements of the review remain, and whether it will impact the timing of the transaction.

GV buys out WeWork’s stake in The Wing

The Wing, the women’s focused coworking space and community, announced that GV (formerly Google Ventures) has bought out the majority of WeWork’s stake in the company. In brighter days, WeWork had invested in The Wing, but has since been selling off investments such as the Wing.

Grocery & Restaurants

Chopt Creative Salad Co. to buy Dos Toros Taqueria in deal financed by L Catterton

Chopt Creative Salad Co. is buying Dos Toros Taqueria and forming a new holding company to oversee both of them, and possibly purchase other concepts, Chopt CEO Nick Marsh said Thursday. The new company, Founders Table Restaurant Group, is being financed by private equity firm L Catterton, which is already an investor in Chopt. Marsh will be the new company’s CEO. A release announcing the formation of Founders Table said the holding company would “focus on creating, acquiring and growing innovative, founder-led, line-out-the-door restaurant companies,” leaving the founders in charge while the parent company works to build digital and other operational platforms to expand the business.

Fairway Market files for Chapter 11, plans to sell all stores

A day after refuting reports of an impending liquidation, Fairway Market said it has filed for Chapter 11 bankruptcy protection and aims to sell all of its 14 stores. Fairway announced early Thursday that, as part of the Jan. 23 filing with the U.S. Bankruptcy Court for the Southern District of New York, the company has entered into a stalking horse asset-purchase deal to sell up to five New York City stores and its distribution center to ShopRite owner-operator Village Super Market for about $70 million. New York-based Fairway said it will continue talks to divest the rest of its stores under a court-supervised sale.

General Mills invests in plant-based seafood maker

Gathered Foods Corp., maker of Good Catch Foods plant-based seafood products, secured more than $32 million in a Series B funding round including 301 INC, the venture arm of General Mills, Inc., and Greenleaf Foods, S.P.C., a plant-based company of Maple Leaf Foods Inc. that includes the Field Roast Grain Meat Co. and Lightlife Foods brands. The funding round was led by Stray Dog Capital and Rocana Ventures. Gathered Foods plans to use the proceeds to expand distribution across North America, Europe and into Asia, the company said. Funds also will go toward opening a new manufacturing facility and new food service channel launches. Good Catch offers faux fish dishes designed to look and taste like the real thing.

Krystal burger restaurant chain files for Chapter 11 bankruptcy

Dunwoody, Ga.-based quick-service burger brand The Krystal Company filed for Chapter 11 bankruptcy protection, citing debts of between $50 million and $100 million. The company had announced a management shakeup in mid-November. Just a month before, the Krystal had announced plans to refranchise between 100 and 150 of its company-owned restaurants. In the most recent Nation’s Restaurant News Top 200 census, Krystal ranked No. 112 among brands in U.S. systemwide sales, with an estimated $401 million in the fiscal year ended in December 2018.

Home & Road

Our House Designs under new ownership

High-end upholstery manufacturer Our House Designs has been acquired by a private investment group. Terms of the transaction were not disclosed. Parker Maricich, who is among the investors, will serve as president, leveraging many years in the industry in sales and marketing in both retail and manufacturing, with roles at Robb & Stuckey, Century Furniture, Lexington Furniture, Gloster and JLA Furniture. Purchased in 2001 by industry veteran Carrie Craymer, Our House Designs has established itself as a custom manufacturer of high-end leather motion and stationary furniture. The company provides specialty retail and custom design groups a wide selection of offerings in the recliner, sofa, sectional and chair categories, all built in North Carolina by skilled local artisans.

Kirkland’s looks to ‘right size’ store base; makes exec changes

Kirkland’s is closing some stores as part of a larger streamlining effort to transform its business to a more profitable model. The home décor retailer said it has further reduced expenses at its corporate office and is planning to close 27 stores in early 2020, with the potential for further closings later in the year as part of its goal to “right size” its store base. Kirkland’s currently operates 432 stores in 37 states. The home décor retailer also announced it has “mutually parted ways” with president and COO Michael Cairnes. Kirkland’s CEO, Woody Woodward, will add the role of president and will oversee operations in addition to his ongoing responsibilities across merchandising and marketing. Also, the company has promoted John Stacy, currently VP of supply chain, to senior VP of supply chain, and Jeff Martin, currently VP of transformation, to senior VP of omnichannel retail.

Jewelry & Luxury

Chow Tai Fook Jewelry to Close Hong Kong Stores, Citing Political Unrest

Hong Kong–based jewelry conglomerate and retailer Chow Tai Fook Jewelry announced this week that it will shutter roughly 15 of its 91 Hong Kong stores after their leases expire this year. The company said in an emailed statement Jan. 14 that it won’t renew the leases starting this April and cited “macro headwinds”—including the roiling protests that have crippled movement in Hong Kong’s business districts in recent months—as the reason. Chow Tai Fook’s same-store sales have fallen for three consecutive quarters in Hong Kong and Macau. The retailer will open several new stores in mainland China this year.

HRD Antwerp Appoints New Chief Executive

Ellen Joncheere, the former general manager of Fremach, has taken over as the new chief executive officer at HRD Antwerp, which runs the HRD grading lab. The current interim CEO, Michel Janssens, will retire this summer. Joncheere has worked in a wide range of other sectors, including the automotive industry and environmental services. Her previous company, Fremach, supplies plastic components to automotive companies.

Office & Leisure

Papyrus, seller of ‘curated greeting cards,’ to liquidate chain and close all stores

The Papyrus chain of stores selling art-inspired gift cards and fancy paper products will shut down after failing to find a buyer to rescue the company and its sister stores, American Greetings and Carlton Cards. Owner SFP Franchise filed for bankruptcy with plans to hire liquidators to run going-out-of-business sales at its 254 stores, which includes the Paper Destiny brand. The company employs about 1,100 people and has assets worth $39.4 million and debts of $54.9 million, according to court papers filed Thursday. SFP traced its bankruptcy to a 2009 deal, saying it saddled the chain with the high costs of closing stores and an increase in the price of products. In 2009, as SFP was struggling, it traded the Papyrus name and its wholesale business to American Greetings for that company’s retail operations. The deal left Papyrus as a store operator with 500 locations in the United States and Canada. And Papyrus became dependent on American Greetings to supply much of the cards and other items sold in those stores.

Spin Master has entered into strategic agreements with three international licensing agents in order to build out consumer product campaigns across its portfolio of brands, including Hatchimals, Bakugan, Toca Life, Zo Zo Zombie, Etch A Sketch, and Tech Deck. The global toy company has tapped WildBrain CPLG for EMEA, Tycoon for Latin America, and Haven for Australia and New Zealand. These international licensing agents will work with Spin Master to initiate and drive licensee activity across apparel, accessories, back-to-school, food and beverage, gift and novelty, health and beauty, home décor, party goods, publishing, seasonal, sporting goods and promotional partnerships. Global licensing efforts are already underway for Bakugan, Spin Master’s ninth television series, complete with an innovative toy line, card game and mobile app.

Sources: Historic Harrah’s Reno to Be Sold and Converted into a Non-Gaming Entity

Harrah’s Reno, one of the Nevada gaming industry’s historic landmarks, will be sold by real estate investment trust VICI Properties and converted into a business entity that will not include a casino, ending the presence of the Harrah’s name in the Northern Nevada city after 83 years. The transaction is expected to be announced this week, sources told The Nevada Independent. The buyer, Reno City Center LLC, plans to close the 940-room hotel-casino on North Center Street and Virginia Street within six months. Caesars is merging with Reno-based Eldorado Resorts in a $17.3 billion transaction. Eldorado operates three casinos in downtown Reno – Eldorado, Silver Legacy and Circus Circus, which are collectively referred to as “The Row.” Gaming analysts said Eldorado management, which would have acquired the Harrah’s Reno lease through the Caesars purchase, wasn’t interested in operating a fourth casino in the Reno market. In addition, there might have been federal antitrust concerns with one company owning that many gaming properties the area.

Sunrise Records owner to buy U.S. retailer For Your Entertainment for US$10M

Canadian retail chain Sunrise Records is branching out into the United States with the acquisition of For Your Entertainment, a music, film and pop culture outlet that operates across much of the country. Doug Putman, president of the Sunrise, said the deal is valued at roughly US$10 million and comes with more than 200 locations that he plans to continue operating under the U.S. brand name. For Your Entertainment, also called FYE, sells an array of vinyl records, DVDs, Blu-ray discs, toys and other items that cover a wide spectrum of popular franchises. It also operates both an FYE web store and Second Spin, another online retailer that specializes in used music and movies. The acquisition requires approval from FYE stockholders and is expected to be finalized before the end of March.

Technology & Internet

Amazon hits $200 billion mark beating Google and Apple to become world’s most valuable brand

Amazon has beaten Google, Apple and Microsoft MSFT to become the world’s most valuable brand, according to a global report. The value of the e-commerce giant’s brand has soared 17.5% to a record $220.8 billion – the first brand to top $200 billion – the Brand Finance Global 500 index found. Google, which comes second, also climbed in value, while third-placed Apple and fourth-placed Microsoft saw their brand values dip. “The disrupter of the entire retail ecosystem, the brand that boasts the highest brand value ever, Amazon continues to impress across imperishable consumer truths: value, convenience and choice,” Brand Finance chief executive David Haigh said.

Best Buy investigates misconduct by CEO Corie Barry

Best Buy Co. said it’s investigating CEO Corie Barry’s personal conduct, a potential blow to the electronics retailer that comes eight years after a former CEO resigned amid a similar probe. The board received an anonymous letter with the allegations against Barry, according to a statement. Best Buy hired the law firm Sidley Austin LLP to conduct an independent review and encouraged “the letter’s author to come forward and be part of that confidential process,” the company said.

Finance & Economy

US weekly jobless claims increase less than expected

The number of Americans filing for unemployment benefits increased less than expected last week, suggesting the labor market continues to tighten even as job growth is slowing. Claims had declined for five straight weeks, resulting in the unwinding of the surge seen in early December, which was blamed on a later-than-normal Thanksgiving Day.

Millennials’ share of the U.S. housing market: small and shrinking

Today’s young adults are starting their lives on drastically different financial footing than their parents did decades ago. Necessities cost far more and wages have flattened; as a result, many young families have to dig through mountains of debt before they can even think about growing their wealth. A data point from the Federal Reserve, highlighted recently in a special report on housing by the Economist, underscores the differences between millennials’ financial trajectory and those of earlier generations: In 1990, baby boomers, whose median age was 35, owned nearly one-third of American real estate by value. In 2019, the millennial generation, with a median age of 31, owned just 4 percent.

New FICO credit scoring system could make it harder to get a loan

Fair Isaac Corp. is coming out with a new version of its ubiquitous FICO credit score, one that likely will lower many people’s scores and make it harder for them to get a loan. Under the new scoring system, consumers who skip or make late payments are more likely to see a drop in their score. The new model also will hurt consumers whose utilization ratio remains high. The utilization rate measures how close borrowers are to maxing out on their credit limits. FICO said lenders who use the new scoring model could reduce the number of defaults in their portfolio by as much as 10% among newly originated credit cards, 9% among new auto loans and 17% on new home mortgages.