In less than a week, millions of people will gather around their televisions to watch two teams battle for the Vince Lombardi Trophy at Super Bowl LV. As the COVID-19 pandemic continues to grip the nation, and most people continue to wait for vaccination, the biggest sporting event of the year will be a notably different experience from what people are used to. While the game being played will be the same, many things surrounding the game will be different.

First, how people watch the game will be different. In a normal year, many friends and family gather in large parties to watch the game, but this year it isn’t safe to do so. Virtual watch parties may be a solution for watching the game with friends, as in-person gatherings with members of other households is discouraged by the CDC. While watching the game at home might be a bit quieter, in-person attendance will also look a lot different. The capacity at the Raymond James Stadium in Tampa will be limited to 22,000 fans, including 14,500 ticket buyers and about 7,500 vaccinated healthcare workers who will be invited as guests. All audience members will be required to wear KN95 masks that will be given out at the entrances to the stadium, and everyone will be spaced in socially distanced seating pods.

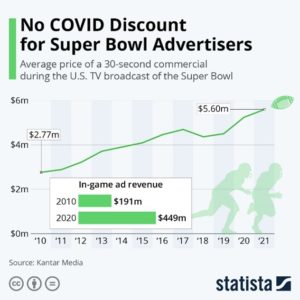

While watching the game from home or in-person will be unusual, another changing factor this year is the commercials. The Super Bowl is the most watched television broadcast in the United States each year, and because of that large viewership, advertising during the game is notoriously expensive. Since 2010, the average rate for a 30-second commercial during the Super Bowl has risen from $2.77 million to $5.60 million, according to Statista. Because of that cost and other pandemic-specific reasons, this year, a startling number of famous brands are choosing to sit on the sidelines.

Some of the most iconic Super Bowl commercials come each year from giant consumer brands like Budweiser, Coke, and Pepsi, all of which have decided to not purchase ads this year. Budweiser parent company AB InBev announced it will be donating the money that would have been spent on Budweiser’s spot to coronavirus vaccine awareness efforts and will still run ads for Bud Light. Pepsi meanwhile decided to double down on its sponsored halftime show instead of buying any 30-second spots for its namesake brand – it will, however advertise Mountain Dew and Frito-Lay products. Other brands that have decided to wait this year out are Hyundai, Audi, Olay, Little Caesars, Avocados from Mexico and Ford.

Uncertainty abounds this year, but ViacomCBS reported that it had “virtually” sold out of ad spots as of January 27, according to Ad Age. Still, this compares to 2019, when Fox sold out of its commercial inventory by Thanksgiving, underscoring the trepidation with which certain companies are approaching this year’s broadcast. Nevertheless, as some large traditional advertisers have pulled back this year, it has opened the door for other brands that have never bought a Super Bowl spot, such as Huggies, DoorDash, Fiverr, Mercari, and Vroom. While there may be more newcomers and fewer advertising stalwarts this year, plenty of the brands that advertise seemingly every year will return, such as Toyota, M&M’s, Pringles, E-Trade, and TurboTax.

While this year’s game and its broadcast will be different, many viewers will likely look to take comfort in what is the same as usual. The pageantry, the game, the ads, the reaction to the ads, and the halftime show are all components of the Big Game that come every year, and will happen again. But this year still won’t be the same. Perhaps the best metaphor for this same-but-different-dynamic is one of the players playing in the game. Tom Brady. Playing in the Super Bowl. Again. But playing for the Buccaneers? A weird time to be alive indeed.

Headlines of the Week

GameStop’s rally cools as U.S. regulators eye wild trading

The U.S. Securities and Exchange Commission waded into the battle between small investors and Wall Street hedge funds, warning brokerages and the pack of social-media traders that it was watching for potential wrongdoing. GameStop shares jumped, awarding retail investors the advantage in the latest round of their week-long slugfest against major financial institutions that had shorted the video game retailer. The so-called “Reddit rally” has inflated stock prices for GameStop and other previously beaten-down companies that individual investors championed on social media forums including Reddit. GameStop surged 51% on Friday after brokers including Robinhood eased some restrictions on trading. On Thursday, GameStop shares had fallen following the curbs imposed by Robinhood and other trading apps, which drew outrage from politicians and calls for action from regulators. Robinhood said on its blog late on Friday opening new positions is currently allowed but limited in 23 securities, including GameStop.

AMC Raises $917MM of Fresh Investment Capital Since Mid-December of 2020

AMC Entertainment Holdings, the largest movie theatre company in the United States and globally, announced that since December 14, 2020, it has successfully raised or signed commitment letters to receive $917 million of new equity and debt capital. This increased liquidity should allow the company to make it through this dark coronavirus-impacted winter. Of this $917 million in much-welcomed monies, AMC has raised $506 million of equity, from the issuance of 164.7 million new common shares, along with the previously announced securing of $100 million of additional first-lien debt and the concurrent issuance of 22 million new common shares to convert $100 million of second-lien debt into equity. In addition, the Company has executed commitment letters for $411 million of incremental debt capital in place through mid-2023, through the upsizing and refinancing of its European revolving credit facility. Based on a variety of assumptions, including future attendance levels, the Company estimates that its financial runway has been extended deep into 2021.

Apparel & Footwear

Cole Haan walks back IPO plans

Private equity-owned footwear brand Cole Haan on Friday withdrew its registration to go public, according to a filing with the Securities and Exchange Commission. Nearly a year ago the company, which was acquired by U.K.-based Apax Partners in 2013, gave the SEC a placeholder target of $100 million to be raised through an initial public offering, according to original and amended documents from February 2020. The footwear retailer initiated the IPO process in 2019. Through its Generation ZERØGRAND label launched in 2019, Cole Haan was already grappling with consumers’ mounting desire for more casual footwear, a trend the pandemic has only strengthened. But the company remains most closely associated with dress shoes for workplaces and special events — occasions that these days increasingly allow sneakers and other shoes that are more comfortable and fun.

Rocky boots acquires footwear company

Rocky Brands announced it has entered into a definitive agreement to acquire competitor Honeywell International. Rocky agreed to buy Honeywell International, which sells The Original Muck Boot Company and XTRATUF footwear brands, for a purchase price of $230 million. “We’re acquiring a well-run business with a corporate culture and a customer base similar to ours, which provides meaningful growth opportunities within our existing categories as well as an entrée into new market segments,” Jason Brooks, Rocky president and CEO, said. “Its innovative and authentic product collections complement our existing offering with minimal overlap, which will allow us to strengthen our wholesale relationships and serve a wider consumer audience,” Brooks said. Rocky Brands, headquartered in Nelsonville, is a manufacturer and marketer of footwear and apparel marketed under a portfolio of brand names including Rocky, Georgia Boot, Durango and Lehigh.

Levi’s holiday-quarter sales fall 12%, despite online gains

Levi Strauss & Co. reported Wednesday its total holiday-quarter sales dropped 12%, marking an improvement from a more than 20% decline in the prior period, as weak shopper traffic at its stores was partially offset by double-digit growth online. Chief Executive Chip Bergh told CNBC that the results for the latest quarter topped the denim maker’s internal expectations, nearly meeting the “best-case scenario” that Levi laid out back when the Covid pandemic first started to hit the United States and disrupt many businesses. “We pivoted very hard to [direct to consumer] and especially to e-commerce,” Bergh said in a phone interview. “Our e-commerce business was profitable in the fourth quarter, and profitable for the full year.” Levi’s global digital sales, which include the online sales of its merchandise at wholesale partners, made up 23% of fourth-quarter sales, up from 15% in the prior-year period. Levi said revenue from its wholesale partners dropped 15% during the quarter, while its direct-to-consumer revenue was down 5%, due to lower visits to its stores. As the coronavirus pandemic continues to disrupt normal business operations, the company said that currently roughly 40% of its stores in Europe, and 17% globally including franchisee-operated locations, are closed.

L Catterton Partners with JOTT to Support Expansion in France and Internationally

Just Over The Top (“JOTT”), one of the most successful French casual outerwear brands, today announced that L Catterton, the largest global consumer-focused private equity firm, has acquired a controlling interest in JOTT. The Gourdikian family, which founded and manage JOTT, will continue to hold a significant equity interest in the business. Founded in Marseille in 2010, JOTT is a leading French urban casualwear brand offering functional, comfortable, and versatile clothes, most notably its distinct line of light down jackets. With significant brand awareness and visibility in France, JOTT currently distributes its comprehensive collections of casual outerwear and accessory products through a network of concept stores as well as wholesale clients. L Catterton has significant experience investing in apparel brands globally. Current and past apparel investments include GANT, SMCP (Sandro Maje Claudie Pierlot), ba&sh, Sweaty Betty, GANNI, Charles & Keith, and Rhone, among others.

Athletic & Sporting Goods

Jack Wolfskin Opens First North American Showroom in Park City

Jack Wolfskin announced the opening of the brand’s first North American showroom located in downtown Park City, UT. With 549 retail locations in over 40 countries worldwide, Jack Wolfskin is looking to expanding its footprint with North American customers. The brand, founded in 1981, is celebrating 40 years in global business this year and has new product releases in the pipeline.

Golf Rounds Played Surge In December

Golf rounds played jumped 37.3 percent for the month of December and grew 13.9 percent in total for 2020, according to Golf Datatech. By region, for December, the highest growth was seen in New England, ahead 101.1 percent followed by West North Central, 84.6 percent; Mid-Atlantic, 66.6 percent; Pacific, 53.9 percent; South Central, 33.5 percent; Mountain, 30.2 percent; South Atlantic, 26.9 percent; and East North Central, up 16.8 percent. Golf rounds played have recovered strongly following the reopening of golf courses across the country starting in May. According to Golf Datatech, golf rounds played grew 6.2 percent in May; 13.9 percent in June; 19.7 percent in July; 20.6 percent in August; 25.5 percent in September; 32.2 percent in October; and 56.6 percent in November.

Lectric eBikes Secures Investment

Bertram Capital announced that it has made an investment in Phoenix, AZ-based Lectric eBikes, a designer and direct-to-consumer retailer of electric bicycles and accessories. Lectric represents the third investment in Bertram’s fourth fund. Terms of the transaction were not disclosed. “Lectric has become one of the largest and fastest-growing e-bike brands in the United States in just two short years. From the beginning, the company has aimed to deliver high quality, fully-featured bicycles at market leading prices. The team at Lectric accomplished this through a novel approach to design, marketing, distribution, and customer support, which has earned it thousands of highly satisfied, loyal customers,” said Ryan Craig, Partner at Bertram Capital. Lectric represents Bertram’s 26th investment in the eCommerce sector.

JD Sports expands U.S. footprint with $495 mln DTLR Villa purchase

JD Sports Fashion JD.L said on it would buy Baltimore-based DTLR Villa LLC for $495 million as Britain’s biggest sportswear retailer further expands its presence in the United States market, sending its shares about 7% higher. The acquisition of DTLR, an athletic footwear and apparel streetwear retailer, is JD’s second U.S. purchase in less than two months after it bought West Coast-focused Shoe Palace in December. DTLR, which was established in 1982, is majority owned by BRS & Co and Goode Capital and operates from 247 stores across 19 states, mostly in the north and east U.S. JD, which also owns Footpatrol and Cloggs, entered the U.S. market in 2018 with the acquisition of Finish Line.

Cosmetics & Pharmacy

San Francisco Equity Partners Acquires Natural Beauty Manufacturing Business

Natural beauty product manufacturer Smith & Vandiver Corp. has been acquired by San Francisco Equity Partners. Santa Cruz, Calif.-based SV Labs specializes in making effervescent products like shower tablets and bath bombs. The company, which has been around since the ’70s, also makes bath salts, skin-care, body-care and topical CBD products for big and indie brands, as well as retailers. Terms of the deal were not disclosed. “We see great potential for nimble and innovative manufacturers like SV Labs to serve the…needs of high-growth natural beauty and personal-care brands,” said San Francisco Equity Partners’ Scott Potter in a statement. “SV Labs has a long and rich heritage and is well positioned to continue to scale.” Beyond manufacturing, SV Labs provides concept creation, formulation, packaging and other services to beauty companies. San Francisco Equity Partners invests in consumer companies, and also backs Yes To and Jane Iredale in the beauty space. The firm is one of many that have demonstrated interest in beauty manufacturing investments.

Beauty retailer L’Occitane files Chapter 11

The U.S. arm of beauty and wellness brand L’Occitane filed for Chapter 11 bankruptcy Tuesday in hopes of reducing its physical footprint. The company has immediate plans to close 23 stores as it looks to shed unprofitable and declining locations after the toll COVID-19 took on its business, according to court papers. L’Occitane currently runs 166 boutiques in the U.S., largely based in regional malls. L’Occitane said in a press release that “its business continues to be impacted by disproportionately high store rent obligations that are no longer tenable,” making Chapter 11 necessary to speed store closures. In court papers, Yann Tanini, managing director of L’Occitane North America, said that the retailer’s lease obligations amount to $30.3 million annually. It currently has $15.1 million that is in arrears, and landlords are withholding more than half a million dollars in security deposits.

LVMH, L’Oréal Ventures Invest in Replika Social Commerce Platform

LVMH Luxury Ventures and L’Oréal BOLD Ventures have financed a Series A round of funding for Replika Software, a social commerce platform. The investment is expected to help the company expand its global footprint of brands and industries. Social commerce involves using social media to tap into communities and promote and sell products and services. It is a trend already popular in Asia. There, e-commerce platforms such as Taobao and Little Red Book have been integrating user-generated content to great success, for instance. “The Series A financing builds on an exceptional year for Replika. We were able to rapidly grow a roster of clients across several verticals, introducing important programming and feature upgrades while solidifying our management team with key executive appointments,” said Corey Gottlieb, cofounder of Replika Gottlieb, in a statement.

Discounters & Department Stores

Target partners with Levi’s for lifestyle collection

In its latest move to build momentum during the pandemic, Target, in collaboration with Levi Strauss & Co., will release an exclusive collection that includes over 100 home, pet, accessories and apparel products, the company announced in a press release Tuesday. The new collection, called Levi’s for Target, stems from the big-box retailer’s decade-long partnership with Levi’s. It began in 2011 when Target introduced Levi’s value brand Denizen and grew in 2019 through Levi’s Red Tab at Target.

Belk to file for bankruptcy after 130 years

Sycamore Partners on Tuesday announced that Belk will restructure under Chapter 11 bankruptcy. The department store has entered into a restructuring support agreement with Sycamore (its majority owner), the holders of more than 75% of its first lien term loan debt and the holders of all of its second lien term loan debt. The deal will recapitalize the business, reduce debt by about $450 million and extend maturities on all term loans to July 2025, according to a Sycamore press release. Sycamore, global investment firms KKR and Blackstone Credit, and some of the existing first lien term lenders have committed $225 million in new capital. At the end of the process, expected to be complete by the end of February, several lenders will end up with a minority stake in the retailer and Sycamore will retain its majority stake.

Walmart announces overhaul of ad business

Walmart rebranded its media network from Walmart Media Group to Walmart Connect, part of a larger overhaul the retailer is enacting as it looks to scale the offering into a top-10 advertising platform, according to a company announcement. Walmart Connect will focus on three areas: leveraging owned properties like Walmart.com, Walmart+ and the Walmart app to create holistic campaigns for advertisers; building out in-store experiences through assets like TV walls and self-checkout screens; and applying first-party data to improve media performance for sellers operating outside of Walmart’s proprietary sites.

Neiman’s chief digital officer out amid e-commerce revamp

Neiman Marcus Group is doubling down on digital with a series of C-suite changes and an $85 million supply chain investment, following its emergence from bankruptcy last year, saying Wednesday that it’s “grouping technology, digital products, and advanced analytics under one leader and distorting capital to these areas.” Amid the shakeup, Chief Digital Officer Katie Mullen is leaving in the summer, Neiman Marcus said in an emailed statement Thursday. Apple and eBay alum Bob Kupbens will be chief product and technology officer beginning Monday, reporting to CEO Geoffroy van Raemdonck, according to a company press release.

Emerging Consumer Companies

Kate Farms raises $9 million in Series B extension

Kate Farms, the Santa Barbara-based brand focused on plant-based nutrition, raised $9 million in a Series B extension from Main Street Advisors. The investment follows the $51 million Series B led by Goldman Sachs and Kaiser Permanente Ventures. Kate Farms produces plant-based shakes and formulas that function as meal replacements or snacks. It also produces lines for children ages 1-13, and for those with illnesses that require tube feeding. Made without major allergens, the product portfolio is USDA Organic-certified, vegan, gluten-free and kosher.

Imperfect Foods raises $95 million from Insight Partners

Imperfect Foods, the San Francisco-based online grocery business specializing in selling surplus and cosmetically “imperfect” foods, announced a $95 million Series D round of funding at a $700 million post-money valuation. The round was led by Insight Partners and brings Imperfect’s total amount of funding to $214.1 million. Previously known as Imperfect Produce, the company aims to reduce waste in the food system by rescuing so-called ugly foods, such as misshapen carrots or potatoes, and selling them directly to consumers at discounted prices. Without this, such food would go straight to the landfill, further contributing to the world’s multibillion food waste problem.

Away CEO departs a year after arrival

Stuart Haselden, the CEO of travel brand Away, is departing in February. Haselden joined Away from lululemon in January, 2020, and served as Co-CEO with co-founder Steph Korey until October, 2020, when he became the sole CEO. A company press release stated that Haselden is leaving to pursue another opportunity. Haselden will maintain his board seat, and co-founder Jen Rubio will take over as interim CEO while the brand looks for a replacement.

Grocery & Restaurants

Southeastern Grocers shelves IPO

Southeastern Grocers has postponed an initial public offering just a week after its launch. Jacksonville, Fla.-based Southeastern Grocers, the parent company of Winn-Dixie, announced the move Thursday evening but didn’t give a reason for putting off the IPO. Under the IPO announced Jan. 21, Southeastern Grocers’ selling stockholders planned to offer 8.9 million common stock shares at $14 to $16 per share and grant the underwriters a 30-day option to buy up to another 1.335 million common shares, with the potential to raise up to $163.76 million. The IPO marks the second time in seven years that Southeastern Grocers has explored going public — and then held its offering.

Hippeas raises $50 million, taps new CFO

Hippeas, a maker of organic chickpea snacks, raised $50 million from San Francisco-based investment house The Craftory Ltd. The financing consisted of direct investment and secondary purchases of shares from existing Hippeas shareholders, including CAVU Venture Partners. Funds will be used to expand production, increase distribution and boost innovation, the company said. Those efforts will be guided by Greg Buscher, newly appointed chief financial officer at Hippeas. He brings 25 years of c-suite leadership experience and a background in manufacturing and distribution to the company. Prior to joining Hippeas, Mr. Buscher was CFO at Skinny Dipped Almonds, Essentia Water and Nuerobrands LLC.

Home & Road

Ethan Allen fiscal Q2 sales tick up 2.4%

Vertically integrated furniture manufacturer and retailer Ethan Allen reported a 2.4% increase in net sales to $178.8 million for its fiscal 2021 second quarter ended Dec. 31. That increase didn’t reflect the pace of business. Like most of the industry, Ethan Allen is struggling to turn written orders into sales even as the company ramps up production to meet new demand and catch up with its existing backlog after last year’s temporary plant closures. Given the production cycle from written order to delivery, that low single-digit second-quarter sales uptick compared with 44.9% growth in retail written orders and 28.1% growth in wholesale written orders. Ethan Allen more than doubled its bottom-line performance, with fiscal 2021 second-quarter net income of $16.9 million compared with $7.1 million for the same prior-year period. Ethan Allen’s second-quarter e-commerce business grew 115% year over year, as online traffic continues to increase.

La-Z-Boy gives fiscal Q3 update

Record backlogs headline an update from La-Z-Boy on business trends, with the company’s enterprise-wide wholesale backlog up more than 20% in its fiscal 2021 third quarter compared with the same period last year. Driving that backlog is a 19% fiscal year-to-date increase in written same-store sales across the La-Z-Boy Furniture Galleries network through December vs. the prior year’s first nine months, and those continued on a positive trend in January. Fiscal third-quarter written sales for the Joybird e-commerce division alone increased by more than 75% compared with the same period a year ago.

Compared with a record third quarter in fiscal 2020 and factoring in greater-than-anticipated COVID-19-related impacts experienced in this year’s third quarter, La-Z-Boy expects consolidated sales for its fiscal 2021 third quarter to be down 1% to 2% compared with the prior-year period.

Jewelry & Luxury

Rolex, Patek Philippe to Exhibit in Revamped Watches and Wonders

Rolex and Patek Philippe top the list of the 40 watch brands that have agreed to participate in the upcoming Watches and Wonders Geneva. The show will take place virtually from April 7 to 13, and will be followed by a physical event at the West Bund Art Center in Shanghai, the dates of which have not yet been announced. The 2020 version of Watches and Wonders Geneva—formerly known as SIHH—was conceived as a different spin on the traditional watch fair, an event-driven celebration of the industry that would be open to the public. However, that version only took place virtually, because of the COVID-19 pandemic.

Only the Best Luxury Brands Can Hike Prices

One way to tell which luxury-goods brands are in fashion is whether they managed to raise prices in the middle of a pandemic. LVMH Moët Hennessy Louis Vuitton reported resilient results Tuesday, after the Paris market closed. While overall revenue fell 16% at constant exchange rates in 2020, the luxury conglomerate’s closely watched fashion and leather goods division did better. Sales only slipped 5%, and operating margins were higher than in 2019. The unit is crucial as top brands such as Louis Vuitton and Christian Dior generate two-thirds of the company’s total operating profit most years.

What History Says About the Current Diamond Battle

When Dan Scott, the founder and brand architect of Luxe Licensing, hears natural and lab-grown diamond sellers take shots at each other, it pains him. Because he has seen this movie before. In a webinar this week for CGL Canadian Gemlab, Scott, the former chief marketing officer for designer Scott Kay, recounted two past intratrade battles he was involved in: platinum vs. palladium, and cobalt vs. tungsten carbide. He tells JCK that while both sides enjoyed momentary victories, everyone ended up losing.

Office & Leisure

Toys sales surged in 2020 amid the pandemic; most popular brands were…

Sales of toys got a big boost in 2020 as families stuck at home shifted their spending from other types of entertainment to toys. Retail sales of toys in the U.S. hit $25.1 billion in 2020, up 16% over the previous year, according to The NPD Group. Toy sales through mid-March 2020 were flat vs. 2019, but the widespread lockdown measures led to an abrupt increase in sales. The increase was amplified by stimulus checks that were sent out beginning in April, resulting in the strongest month of growth for the year in May (+38%). One major theme in 2020 was the growth of online shopping. Some retail closures and consumer hesitancy towards shopping in stores led to a surge in online toy sales. In the first three quarters of 2020, the online channel gained 10 share points from the 23% share in 2019, leading to 75% growth in overall online toy sales year over year.

1000 jobs saved as Paperchase rescued in pre-pack deal

Paperchase’s future on the high street has been secured after reports that it is about to be bought in a pre-pack administration deal. According to Sky News and Retail Week, the stationery retailer will be sold to Permira Debt Managers. The deal will reportedly see the majority of the stores in Paperchase’s portfolio saved – approximately 90 out of 125 – meaning 1000 jobs will also be saved. An exact number of job losses as a result of the store closures is not yet clear, although at the start of the year reports suggested it had a total of around 1500 staff – meaning 500 could potentially be made redundant. PwC is reportedly standing by as administrators-in-waiting for the pre-pack deal. Earlier this month it was revealed that Paperchase was the brink of collapsing into administration after sales were hammered by lockdown and tiered restrictions in November and December – the period when trading usually accounts for 40 per cent of Paperchase’s annual sales.

Technology & Internet

How DTC brands will approach physical retail in 2021

The unique circumstances of the pandemic have caused online sales to balloon, seemingly overnight. As retailers were forced last spring to temporarily shutter their stores, either by choice or by government mandate, consumers shifted their spending online. E-commerce sales in March jumped to $70.1 billion from $61.7 billion in February, and were up 18.2% from the prior year, according to the Department of Commerce. As a result, retailers across the industry adjusted their strategies to meet the increased demand to their digital channels. Several ramped up fulfillment options, like curbside and in-store pickup. On the other hand, direct-to-consumer brands, which by and large operate nearly entirely online, were already well-positioned to gain as consumers spent more time, and money, online. But physical stores, something some DTCs vowed against in their early days, remain a valuable asset for digital brands.

Finance & Economy

US consumer spending fell 0.2% in December in face of virus

U.S. consumers slowed their spending by 0.2% in December, cutting back for a second straight month in a worrisome sign for an economy struggling under the weight of a still out-of-control pandemic. The decline reported by the Commerce Department followed a seasonally adjusted 0.7% drop in November. It was the latest sign that consumers, whose spending is the primary driver of the U.S. economy, are hunkered down and avoiding traveling, shopping and dining out. Since making a brief bounce-back from the viral pandemic last spring, consumer spending has barely grown. Sales at retailers have declined for three straight months. The report from the government also showed that personal incomes, which provide the fuel for spending, rose a modest 0.6% after two months of declines. Yet Americans who have been fortunate enough to keep their jobs have been largely stockpiling savings rather than spending.

Weekly mortgage demand falls, but size of average homebuyer loan hits record

Sharp gains in home prices and a slight rise in interest rates combined to weaken demand for mortgages last week. Total mortgage application volume fell 4.1% from the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Homebuyers are seeing prices rise at the fastest rate in over six years, as highly emotional, pandemic-induced demand for housing butts up against a record low supply of homes for sale, resulting in bidding wars. Mortgage applications to purchase a home fell 4% for the week, but were 16% higher than a year ago. The average loan amount for homebuyers hit another record high — $395,200.