Super Bowl LVI will be played at SoFi Stadium in California this Sunday between the Cincinnati Bengals and the Los Angeles Rams. The Super Bowl delivers excitement not only for football fans, but also for casual viewers looking forward to new commercials and the halftime show. The game will be the climactic culmination of months of preparation for the players and coaches. The same can be said for advertisers.

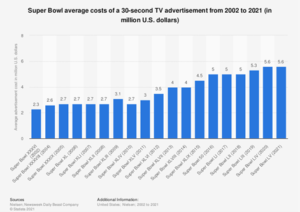

Super Bowl advertisers are shelling out a record $6.5 million for a 30-second slot during the game this year (certain prime slots are selling even higher, at $7.0mn). $6.5 million equates to almost $217,000 per second. It is also a 30% increase from NBC’s last game broadcast in 2018, and a 16% increase over the $5.6 million price tags charged by Fox in 2020 and CBS in 2021. Despite the hefty price tag, inventory has been virtually sold out since September according to Dan Lovinger, president of ad sales and partnerships for NBCUniversal. The record price tag for ads this year may come as a surprise after last year’s disappointing viewership. With only 96.4 million viewers tuning in, last year’s game was the least watched Super Bowl since 2007. Viewership has been on a steady decline since Super Bowl XLIX in 2015, which had the highest viewership in history with 114.4 million viewers.

However, marketers clearly continue to see value in the broad reach of the Super Bowl and the place it holds in popular culture. Despite the declining viewership, there aren’t many other chances to speak to an audience of 90+ million viewers. According to a study from the University of Minnesota Carlson School, advertisers should expect to see a 22% word-of-mouth increase the week after the Super Bowl and a 68% increase in online word-of-mouth on the day of the game. Additionally, with daily new cases of Covid-19 declining from the omicron variant’s peak, the timing may be right for fun and even silly Super Bowl commercials after what was a more somber tone during last year’s game.

Another factor that adds to the value (and likely the price) of Super Bowl television commercials is that popular, funny ads now air once during the broadcast, but then become “free” digital marketing when they get posted online and rack up additional impressions later. According to YouTube view counts, one Doritos commercial from last year’s game featuring Matthew McConaughey has been watched over 20 million times since its debut.

This Sunday, many of us will simply watch the game, savor the food, and be entertained without too much thought paid to the going rate for a thirty second spot. But with most of us here at Consensus being hearty Patriot fans, we’ll probably be paying more attention than usual to the commercials.

Headlines of the Week

Facebook shares plunge more than 20% on weak earnings, big forecast miss

Facebook shares tumbled more than 20% in extended trading on Wednesday after the company reported disappointing earnings, gave weak guidance and said user growth has stagnated. The company, which was recently renamed Meta, issued disappointing guidance for the first quarter in addition to coming up short on its fourth-quarter profit and user numbers. Daily Active Users (DAUs) on Facebook were slightly down in the fourth quarter compared to the previous quarter, marking its first quarterly decline in DAUs on record. Facebook said revenue in the first quarter will be $27 billion to $29 billion, while analysts were expecting sales of $30.15 billion, according to Refinitiv. That would mean 3% to 11% year-over-year growth. Facebook said it’s being hit by a combination of factors, including privacy changes to Apple’s iOS and macroeconomic challenges. It blamed the lower-than-expected growth in part on inflation and supply chain issues that are impacting advertisers’ budgets.

Amazon increases the price of Prime nearly 17% to $139 per year

Amazon is raising the price of its annual Prime membership to $139 from $119, the company announced on Thursday as part of its fourth-quarter earnings results. Amazon last hiked the price of Prime in 2018, when it increased to $119 from $99. Four years before that, it raised the subscription fee to $99 from $79. Launched in 2005, Amazon Prime gives members access to free two-day shipping, as well as access to exclusive movies and TV shows, among other perks. As of last April, the service had more than 200 million subscribers worldwide. The membership program remains one of the biggest growth levers for Amazon’s core retail business. Prime members spend considerably more on Amazon than non-Prime customers, and they also shop more often. The cost of keeping Prime members hooked on the service has also become more expensive for Amazon. The company spends billions of dollars annually to add more compelling video and music content to its streaming service. And, in recent years, Amazon has poured money into building out its logistics and fulfillment network to make one-day shipping the default nationwide.

Apparel & Footwear

A More Focused Capri Holdings Posts $322M Profit

Less might really be more — just ask John Idol. Capri Holdings Ltd., which Idol leads as chairman and chief executive officer, offered something of a tableau of fashion’s holiday season with its third-quarter results. Profits and sales bounced back strongly despite supply chain backups, and the annual outlook was raised. But supporting all the good things that happened is a new kind of focus the pandemic has brought to the merchandise assortments at Capri, which owns Versace, Michael Kors and Jimmy Choo. Idol told analysts on a conference call Wednesday that the company’s brands have been “really not trying to introduce too much” to avoid having goods that need to be cleared through the stores. “That’s one of the things that — coming through COVID-19 — really helped us to reduce the [stock keeping units] across all the companies by over 30 percent,” said the CEO, referring to the brands under the Capri umbrella.

Skechers Just Had Its Best Year Yet, Thanks to DTC Sales and a Strong Supply Chain

A global pandemic, supply chain slowdowns, and record-high inflation didn’t stop Skechers from delivering stellar results in 2021. The fast-growing comfort focused footwear brand managed to break four quarterly sales records throughout the year and set a new record for full year sales in 2021 at $6.29 billion. In the fourth quarter, Skechers unveiled sales of $1.65 billion, marking a year over year increase of 24.4%. Net earnings were $402.4 million, with diluted earnings per share of $2.56, and adjusted diluted earnings per share of $0.43. The growth was driven by 30% growth in both direct-to-consumer channels as well as the brand’s international wholesale business. The company saw 5% growth in its domestic wholesale business as well, which leaders attributed to improvements in supply chain slowdowns that helped the company get product to retailers. Skechers, which also partly relies on Vietnam and China for manufacturing, has invested in distribution centers for retail and digital channels in Peru, the UK, and Japan and is looking to expand its American distribution center.

Earth Shoes Names Former Aerosoles Chief Alison Bergen as Its New CEO

Earth has a new leader. The Norwood, Mass.-based footwear company announced that Alison Bergen has joined the company as CEO. She takes over day-to-day leadership of the firm from former president Mark Parsley, who has exited the company. She reports to Earth founder and chairman Phil Meynard. Bergen’s background includes leadership roles with Michael Kors and Louis Vuitton, and early in her fashion career she founded Meme Chose, a line of size-inclusive women’s apparel. She most recently was CEO of Aerosoles, where she orchestrated a turnaround strategy post-bankruptcy that culminated in the brand’s sale this month to American Exchange Group. During her three years at the helm, Bergen help to modernize the comfort label and shape a stronger fashion direction, while also expanding its distribution opportunities. Earth Shoes, which was acquired in August 2021 by Windsong Global LLC for an undisclosed amount, has been in the process of reconfiguring its collections to offer uniqueness to retailers and consumers — and improve its environmental impact.

Hotter Shoes owner makes debut on AIM

Hotter Shoes owner the Unbound Group has made its debut on the AIM market of the London Stock Exchange. Previously known as Electra Private Equity Group, the company said in a statement that Ian Watson and Daniel Lampard will now be appointed as directors of the company as chief executive and chief financial officer respectively. Meanwhile, Neil Johnson will continue as non-executive chairman after previously serving as executive chairman, and Gavin Manson will step down as chief financial and operating officer and will continue as a non-executive director. Watson added: “Our focus now, as well as continuing the development of Hotter Shoes, is on developing our Unbound Group partnership strategy, selling selected products in addition to Hotter Shoes footwear on the Unbound Group website, which is progressing well. Confirmation of partners in the initially targeted specialist footwear and apparel segments will be made in due course, with first revenues expected in the second quarter of 2022.”

Athletic & Sporting Goods

Sparx Hockey Acquires Minnesota-Based BladeScan

Sparx Hockey, inventors of the Sparx Skate Sharpener, announced it has acquired BladeScan, creator of the BladeScan laser-measurement machine. Based in Minnesota, BladeScan has developed customized hardware and software to measure the geometry of a skate blade and uses the information to improve and optimize skating performance. BladeScan’s patent-pending technology bolsters Sparx Hockey’s ongoing commitment to create the most advanced, accurate and easy-to-use skate sharpening products in the industry. Currently, more than 25 National Hockey League teams utilize the Sparx Sharpener and the company estimates that more than five million pairs of skates a year are sharpened globally with Sparx Hockey technology.

Pure Fishing Acquires Prominent Fishing Brands

Pure Fishing Inc., the world’s largest fishing tackle company, announced the acquisition of Svendsen Sport, a leading supplier of fishing tackle in Europe and owner of leading brands in that market including Savage Gear, Prologic, MadCat, WaterWolf and DAM. The purchase of Svendsen Sport further strengthens Pure Fishing’s position as a global powerhouse in the growing recreational fishing industry. The acquisition adds several well-known and widely distributed brands in the European market, broader sales coverage, and complementary product development and marketing capabilities that enable Pure Fishing to deliver against its global expansion goals. This strategic acquisition is the fourth for Pure Fishing in three years under the ownership of private equity firm Sycamore Partners.

Cosmetics & Pharmacy

Clean Beauty Brand Pacifica Receives Strategic Investment from Brentwood Associates

Clean beauty brand Pacifica Beauty has received a strategic investment from Brentwood Associates, a growth-oriented middle market private equity investment firm. The investment coincides with the appointment of new chief executive officer and board member, Nathalie Kristo, a longtime L’Oréal executive who previously served as Huda Beauty’s North America president, then CEO based in Dubai. In this new partnership, Pacifica founder Brook Harvey-Taylor moves to the role of company president. Together, they will leverage Brentwood’s expertise scaling disruptive consumer brands to accelerate the company’s omnichannel growth strategy and broaden awareness for the brand’s high-quality, purpose-driven products. Founded in 1996, Pacifica offers a range of products spanning skin care, hair care, cosmetics and fragrance.

‘Clean’ brand Ilia Beauty acquired by Courtin-Clarins family

Cosmetics brand Ilia Beauty has been acquired by the Courtin-Clarins family for an undisclosed sum, according to reports. By marketing itself as a ‘clean’ beauty brand, the Los Angeles-based group will give Famille C, the business’ holding company and owner of Clarins, a window into the growing category. But moving away from the ‘clean’ beauty movements’ traditional parameters, Ilia’s ethos is based on the notion that not ‘all natural ingredients are good for the skin, nor is every synthetic bad’, the brand wrote via its website. With Ilia, founder Sasha Plavsic instead attempted to bring the worlds of science and ‘clean’ together. The brand has also been a pioneer of the skin care-focused make-up category, using formulas that are powered by active levels of skin-benefitting ingredients.

Cover FX has been acquired by AS Beauty. AS Beauty also owns Julep, Laura Geller and Mally Beauty. Terms of the deal were not disclosed. Cover FX, founded in 1999 and primarily known for its complexion products, has been backed by L Catterton since 2011. The company explored a sale process shortly after makeup’s boom started to dwindle. Back then, in 2018, CoverFX was said to be projecting about $65 million in gross sales. Now industry sources said the brand’s retail sales are hovering at around $20 million. AS Beauty has acquired Cover FX with a plan to kick-start growth, said Ralph Azrak, principal at AS Beauty. He said the brand has “deep-rooted heritage” and “was never really in the spotlight.” “For Cover FX, there’s this opportunity to tell a story that no one has heard yet,” Azrak said.

Bath & Body Works Q4 sales rise 11%

Bath & Body Works Inc. ended the year on a strong note. The specialty retailer said that its net sales rose 11% to $3.027 billion for the quarter ended Jan. 29, up from $2.718 billion for the year-ago period. Analysts expected sales of $2.964 billion. (In August, Bath & Body Works, formerly known as L Brands, completed the separation of its Victoria’s Secret business and was launched as an independent standalone public company.) Bath & Body Works expects to report earnings per share of approximately $2.25, compared to its initial guidance of $2.10 to $2.25 per share, and compared to $1.96 earnings per share in 2020. Excluding a charge related to a write-off for inventory destroyed in a tornado at a factory, earnings are expected to be $2.28. The company, which will report fourth quarter earnings on Feb. 23, said it ended the fiscal year with about $2 billion in cash.

Estée Lauder Posts Best Quarter Yet

The Estée Lauder Cos. has posted its largest quarter ever, notching $4.85 billion in net sales. The maker of MAC, Clinique and Tom Ford Beauty saw sales increase 14 percent for the quarter ended Dec. 31, thanks to the recovery in Western markets and strong online sales. Lauder posted earnings of $1.09 billion, up from $870 million in the prior-year period. For the six months ended Dec. 31, Lauder posted nearly $10 billion in sales — $9.93 billion — an 18 percent increase from the prior-year period. Net earnings were $1.78 billion. Fabrizio Freda, Lauder president and chief executive officer, said Thursday that the figures are “all the more impressive” when compared to Lauder’s pre-pandemic holiday quarter in 2019, which was also a record-setter.

Discounters & Department Stores

Kohl’s slams takeover bids as inadequate, adopts ‘poison pill’

Kohl’s board of directors has adopted a shareholder rights plan, also known as a “poison pill,” designed to prevent a hostile takeover, the retailer announced on Friday. The plan is effective immediately and expires in one year, according to a company press release. Following an independent review of two recent unsolicited takeover offers, the board concluded they “do not adequately reflect the Company’s value in light of its future growth and cash flow generation,” Kohl’s said. Updates on “ongoing strategic initiatives and capital allocation plans” will be provided at its March 7 shareholders meeting. Acacia Research, owned by activist firm Starboard Value, offered $64 per share for Kohl’s, and private equity firm Sycamore Partners is rumored to be another suitor, with an undisclosed offer. On Friday, Acacia didn’t immediately respond to a request for comment, and Sycamore declined to comment.

Target introduces 40 new beauty brands to its lineup

In a continued effort to advance its beauty offerings, Target introduced 40 new beauty brands in stores and online, according to a company announcement. Half of the brands are exclusive to Target, and most items are $10 or less. Twenty of those brands are from Black-owned or founded companies, and almost all products meet the company’s clean standards for ingredient transparency. The assortment incorporates graduates from the company’s Target Takeoff accelerator program, which gives up-and-coming beauty brands the chance to learn about mass retail. Companies from the program include Frederick Benjamin, Sassy Hair and Undefined Beauty.

Walmart, Amazon lead as consumers’ online grocers of choice

Walmart stands well ahead of Amazon as consumers’ main destination for online grocery shopping, according to new research from CPG/grocery digital commerce platform Chicory. Of more than 1,000 U.S. adults polled in January, over 35% named Walmart as the retailer they use most often to buy groceries online, the third annual Chicory Online Grocery Usership Survey found. E-tail giant Amazon finished a distant second, cited by about 23% of respondents as their most-used online grocer. Third-party online grocery provider Instacart was the only other company to reach double digits, named by 10% of survey participants.

Landlords are starting to play hardball again, JLL finds

Landlords remain open to negotiation, so that rents on average are below pre-pandemic levels, and leases are still generally shorter. But pandemic-related concessions like percent-sale rent and rent relief are now harder to come by, according to the JLL City Retail 2022 report. The recovery in urban areas is split, with districts dependent on office workers and tourists slow to revive, and neighborhoods comparatively thriving, according to the report. Pandemic-era street reconfigurations to facilitate outdoor dining continue to aid the retail rebound in some neighborhoods, as cities look to make some temporary moves more permanent, JLL found.

Emerging Consumer Companies

Beverage brand Olipop raises $30 million

Olipop, an Oakland, California-based better-for-you soda brand that incorporates plant-based fiber, prebiotics and other botanical ingredients to help the body’s microbiome and promote well-being, raised $30 million. The round was led by Monogram Capital Partners, which also led the company’s 2020 Series A round, and features several celebrity investors, including the Jonas brothers, Mindy Kaling and Gwyneth Paltrow, and well-known business execs including former PepsiCo CEO Indra Nooyi, ClassPass founder Payal Kadakia and Beautycon co-founder Moj Mahdara. The current round values the three-year-old business at $200 million.

Stoggles, Los Angeles-based protective eyewear brand, raises $40 million

Stoggles, a direct-to-consumer eyewear brand that aims to create eyewear that is both protective and stylish, announced that it had raised $40 million from The Chernin Group. Stoggles eyewear is designed with antifog lenses that block UV and blue light and meet ANSI Z87 certification standards, which is required for use in professional healthcare settings in the US. The glasses sell for $39.99 each. The company has also launched Stoggles Rx, which allows consumers to order prescription Stoggles — priced at $75 to $145. The founders of Stoggles were running Roav, a direct-to-consumer sunglasses brand that launched in 2016, when the pandemic hit. They realized during the onset of the pandemic that their knowledge of eyewear design could be applicable to safety goggles worn by healthcare workers.

Digital fitness company, Future, announced a $75 million Series C

Future, a San Francisco-based digital fitness coaching app, announced its $75 million Series C funding. SC.Holdings and Trustbridge Partners led the round and were joined by Kevin Durant’s Thirty Five Ventures, Fabletics cofounder Kate Hudson, and golfer Rory McIlroy. Consumers who subscribe to the Future service for $149 a month are paired with coaches who communicate with them every day and track their workouts through an Apple Watch. The funding round comes as the fitness industry is adapting to changes, such as consumers returning to gyms after using equipment at home earlier in the pandemic. The company plans to use this funding round on advertising, hiring additional fitness trainers, and potentially expanding the company’s service into stress management and nutrition.

Food & Beverage

Nestle Health Sciences to acquire Orgain

Nestle Health Science, a business unit of Nestle SA, is acquiring a majority stake in Orgain, Irvine, Calif., a plant-based nutrition company that manufactures and markets powders, ready-to-drink beverages and nutrition bars. Terms of the acquisition were not disclosed. Andrew Abraham, Phd, founder of Orgain, and Butterfly Equity, a private equity investor with a stake in the company, will remain minority investors. The agreement includes the option for Nestle to fully acquire Orgain in 2024.

Chobiani expands dairy presence with launch of milk and coffee creamer products

Chobani is expanding its presence in dairy with milk and half and half, marking the latest product rollouts for the company as it moves aggressively to grow beyond its Greek yogurt roots. The company’s Chobani Ultra-Filtered Milk, which is made using a special filtration process to help eliminate lactose and reduce sugar by half, is said to have 2.5 times more protein than traditional milk. The offering is available in whole, reduced fat 2%, fat free and chocolate. The Chobani Half and Half, available in both plain and lactose-free options, allows the company to further grow its presence in the coffee creamer space by complementing its earlier dairy, oat and plant-based varieties. The products immediately position Chobani as a potential disruptor in categories with billions of dollars in annual sales. Ultra-filtered milk is driving growth in the $1.7 billion easy-to-digest milk segment, according to Nielsen data provided by Chobani, while dairy-based half and half is valued at $1 billion.

Grocery & Restaurants

Starbucks’ mixed Q1 results impacted by inflation and labor costs

Starbucks reported mixed results on Tuesday for the first quarter of 2022 ended on Jan. 2, with U.S. same-store sales up 18% and global same-store sales up 13%. But despite strong demand during the company’s usually busy holiday season, Starbucks’ income growth was slower than expected which may have been due to outside factors like inflation and COVID-19-related labor costs, according to CEO Kevin Johnson. “As we enter the third year of this pandemic, our stores continue to play an important role as a community gathering place that offers safe, familiar and convenient experiences for our customers,” Johnson said in a press statement accompanying the company’s earnings release. “Although demand was strong, this pandemic has not been linear, and the macro environment remains dynamic as we experienced higher-than-expected inflationary pressures, increased costs due to Omicron and a tight labor market.” U.S. same-store sales growth was driven by an increase in comparable transactions and a 6% increase in average ticket. Starbucks net revenues grew 19% year-over-year to $8.1 billion, driven by the same-store sales jump, especially as compared with COVID-19-related challenges during the first quarter of last year. The company also continues to grow its physical and digital footprint, with 4% net unit growth of 484 new stores opened globally over the past quarter, and loyalty program members up 21% year over year.

U.S. restaurant sales forecast to hit $898B in 2022, reports National Restaurant Association

The U.S. foodservice industry is expected to reach $898 billion in sales this year, returning to pre-COVID pandemic trajectory, the National Restaurant Association said in its 2022 State of the Restaurant Industry report released Tuesday. The Washington, D.C.-based association noted that foodservice sales remain, in inflation-adjusted dollars, about 11% below where they were before the COVID-19 pandemic was declared in March 2020. “What we did this year is include a deflated look at total industry sales because menu price inflation has been running at such an aggressive rate during the pandemic,” said Hudson Riehle, the association’s senior vice president of the research and knowledge group, in an interview Monday. “When you deflate it in terms of real gains, it’s still down by well over 11%. That’s still a hefty number.” Wholesale food costs were up 7.9% in 2021 and hourly labor costs in eating and drinking places was up about 8.6% for the year, he said.

Home & Road

Walmart targets Home Depot, Lowe’s with home services offering

Walmart is entering the home services market through a new partnership. The discount giant is starting to compete with offerings such as the Home Services programs at Home Depot and Lowe’s via a collaboration with online professional services platform Angi. Through Angi, consumers can search for home maintenance and renovation professionals qualified to perform specific services. Angi’s providers will soon be available in nearly 4,000 Walmart stores across all 50 states, and nationwide online. This service offering includes over 150 common home projects including flooring, painting, plumbing, electrical, TV mounting, installation, and assembly services for furniture. Prices start at $45 for furniture assembly and $79 for TV mounting. All services provided through this partnership are backed by the Angi Happiness Guarantee, which covers projects up to their full purchase price. Walmart will be Angi’s first limited-time exclusive retailer to offer these services.

Hooker Furnishings enters outdoor category by acquiring Sunset West

Hooker Furnishings has completed the acquisition of Sunset West, a leading West Coast-based manufacturer of outdoor furniture, in an all-cash transaction. According to an SEC filing, the company acquired substantially all of the assets of Sunset West in exchange for $23.5 million in cash at closing, an additional $2 million subject to an escrow arrangement and possible earn-out payments to the Sunset West members up to an aggregate of $4 million, with the closing cash consideration subject to adjustment for customary working capital estimates. The deal gives Hooker Furnishings immediate market share in the growing outdoor furniture segment of the industry. Under terms of the deal, Sunset West’s management team and all the company’s employees will continue to serve its customers from its headquarters in Vista, Calif.

Raymour & Flanigan acquires Taft Furniture

Top 100 retailer Raymour & Flanigan has acquired Taft Furniture, adding two stores to its store count. Taft Furniture’s two stores, located on Central Ave. in Albany, N.Y., and Ballston Ave. in Saratoga, N.Y., will join three existing Raymour & Flanigan showrooms in the region. “After nearly five decades in business, it has been our honor and privilege to serve the Capital Region, and it was an easy choice to choose to sell the business to Raymour & Flanigan,” said a Taft Furniture spokesperson. “Our goal has always been to loyally serve our customers through superior service, and Raymour & Flanigan has demonstrated a passion and dedication to that same goal. As we transition our business to Raymour & Flanigan, we thank our loyal customers for shopping with us, and know that they are in great hands going forward.”

Jewelry & Luxury

Scott Burger To Become Alex And Ani CEO

Scott Burger, who formerly headed Pandora’s North American jewelry division, has been named the new CEO of Alex and Ani. Lyndon Lea, founder and managing director of Lion Capital, majority owner of Alex and Ani, confirmed the news to JCK Tuesday. The story originally appeared Monday in The Boston Globe. The Providence, R.I.–based charm maker filed for Chapter 11 in June but has since been restructured. Since March 2019, Burger has served as CEO of Classic Brands, a sleepwear company, where he reportedly doubled its sales. He worked for Pandora’s North American jewelry division from 2007 to 2018, eventually becoming president of its North American division in 2011.

Ralph Lauren rides luxury boom as high-end apparel sales soar

Ralph Lauren Corp raised its annual revenue forecast on Thursday and became the latest luxury goods retailer to top market estimates for holiday-quarter revenue as demand for high-end apparel soars. Shares in the New-York based designer, which also announced a new $1.5 billion stock buyback program, rose 4% in morning trading. Global luxury groups, including Versace owner Capri Holdings, LVMH and Prada, have reported strong results as customers coming out from lockdowns splurge on luxury fashion, propelling sales to above pre-pandemic levels.

The Industry Shrank Less in 2021 Than in 2020, JBT Says

The North American jewelry industry logged 555 business discontinuances in 2021, according to the annual statistics compiled by the Jewelers Board of Trade (JBT)—an 11% drop from the 627 discontinuances the group recorded in 2020. The 2021 discontinuances include 435 retailers, 60 wholesalers, and 60 manufacturers. JBT’s definition of discontinuance includes businesses that ceased operation (437 companies fell into this category), filed for bankruptcy (4), or merged or acquired (114). All but 19 of the discontinuances were in the United States; the rest were in Canada. Last year, JBT recorded 394 new jewelry businesses in North America—a stunning 151% increase over the prior year. That number breaks down to 327 retailers, 39 wholesalers, and 28 manufacturers.

Luxury Brands are (Finally) Tapping into Resale – What Does That Mean for the Secondhand Market?

For Oscar de la Renta, the decision to tap into the secondhand space started with the customers themselves, sharing stories of discovering their mom’s little black dresses from the ’80s and the like. “Our designs are very classic — quite timeless — so having heard these stories for many years and wondering how this might be a business opportunity, we started to explore what was going in the world of resale,” says Alex Bolen, CEO of Oscar de la Renta, who explains that the brand keeps an in-house archive of designs from every collection. “We started to speak to vintage dealers around the country and looked at places like TheRealReal, Vestiaire Collective and other resale sites to source pieces for our archive, and we found that our customers were shopping there as well.”

Office & Leisure

GameStop partners with blockchain startup ImmutableX to develop NFT marketplace

GameStop will partner with Australian blockchain startup ImmutableX to set up an NFT marketplace to help game developers create their own non-fungible tokens, the company announced Thursday. GameStop said it will set up a fund with up to $100 million worth of ImmutableX’s tokens, called IMX, that it will dole out to developers who create NFTs for its marketplace that can be used in video games. As part of the deal, ImmutableX could also pay the retailer as much as $150 million in its tokens if the GameStop NFT marketplace achieves certain milestones, according to a filing. For several months, the struggling video game retailer’s leadership has talked about pursuing new lines of business in emerging technologies like Web3 and blockchain tech. As consumer demand for physical video games has declined in recent years, GameStop’s business has withered, unable to seize on new business opportunities and forcing it to close physical storefronts across the globe to save costs. In December, the GameStop website invited visitors to sign up to be creators on GameStop’s NFT marketplace. The company also recently hired around 20 employees to staff a new NFT division.

Dog Walking App Wag! to Go Public in SPAC Deal With CHW

Wag Labs Inc., the developer of dog-walking app Wag!, has agreed to go public through a merger with a blank-check company, according to people with knowledge of the matter. San Francisco-based Wag and CHW Acquisition Corp. will have a value of about $350 million as a combined company, the people said, asking not to be identified discussing private information. The company, to be named Wag! Group Co., is expected to be listed on Nasdaq, they said. The company has raised an equity placement at $10 a share from existing investors including Battery Ventures, ACME Capital, General Catalyst and Tenaya Capital, the people said. The transaction also includes $30 million in debt financing from Blue Torch Capital, the people said. Wag in 2019 repurchased a 50% stake in itself from SoftBank Vision Fund, which first invested $300 million in the company in 2018.

AMC Theatres to Raise $500 Million in Bond Sales to Refinance Debt

AMC Theatres plan to sell $500 million in bonds in order to pay down debt and other fees that will mature by 2025, the theater chain announced on Wednesday. The senior secured notes, which hold an interest rate of 10.5%, will be used to pay related fees, costs, premiums and expenses. CEO Adam Aron had previously indicated an intention to refinance some debt in 2022, so the move is not unexpected. AMC was near bankruptcy prior to the pandemic but took on debt at high interest rates throughout the pandemic in order to stay afloat. The theater chain in Q4 had its highest quarter in two years but still lost over $100 million, despite revenue soaring in Q4 2021 compared to the same time in 2020 when many theaters remained shuttered ahead of the vaccines. AMC also had some help throughout the pandemic thanks to its position as a “meme stock” from retail traders, which enabled the company to sell shares at an inflated price.

Party City gets an upgrade from Fitch as sales improve

Fitch Ratings lifted the long-term credit rating for Party City to B- from CCC+ this week, citing confidence in the company’s 2021 performance and “longer-term operating trajectory.” Analysts with the ratings agency also pointed to EBITDA that has risen “modestly” above pre-pandemic levels, $230 million in cost-cutting efforts and positive cash flow, though they noted elevated leverage levels. Fitch issued a stable outlook for the company’s rating. Party City’s struggles preceded the pandemic. For 2019, the company lost almost $77 million in sales from the previous year and posted a nearly $533 million net loss after years of profitability. Along with competitive issues, the company has been burdened with a large debt load, a legacy from a previous private equity acquisition. When the pandemic hit, few categories in retail were as intimately, existentially affected as Party City’s. Social gatherings are what party suppliers exist for, and COVID-19 carried the potential to turn any party into a super-spreader event. The retailer had to manage that reality along with temporary closures and traffic declines that most of the industry had to contend with.

SeaWorld makes takeover offer for Knott’s Berry Farm parent company

Knott’s Berry Farm could become a Busch Gardens theme park selling Shamu orca plush dolls under an unsolicited offer by SeaWorld to take over the Cedar Fair parent company of the Buena Park theme park. SeaWorld Entertainment offered to buy Cedar Fair for $3.4 billion on Tuesday, Feb. 1, according to Bloomberg. The companies are working with advisers on the merger proposal, but it remains unclear whether the ongoing deliberations will lead to a transaction, according to Bloomberg. Cedar Fair was reviewing the “unsolicited, non-binding” proposal from SeaWorld to determine the best course of action in the interest of the company and shareholders, according to a Cedar Fair statement. SeaWorld made a cash bid of approximately $60 per unit for the Ohio-based Cedar Fair, according to Bloomberg. Cedar Fair stock had been trading at about $50 per share before the SeaWorld offer and closed on Tuesday just above $56. SeaWorld stock rose as well on the news.

Technology & Internet

Facebook is the big loser of the fourth quarter’s advertising wars

Facebook, now Meta, has emerged as the fourth quarter’s biggest loser in the hotly contested advertising wars. Meta’s stock plummeted 26% Thursday after it revealed that it’s taking a big hit from Apple’s privacy changes, adding that it expects the feature to decrease the company’s 2022 revenue by about $10 billion. Facebook’s admission is the most concrete data point so far on the impact to the advertising industry of Apple’s App Tracking Transparency feature, which reduces targeting capabilities by limiting advertisers from accessing an iPhone user identifier. Meta lost more than $230 billion in value Thursday, which is the biggest one-day drop in value in the history of the U.S. stock market. Meta’s drop in value comes as the company is looking past its current businesses, such as Facebook, Instagram and WhatsApp, and toward the metaverse, a virtual world based on new technology.

Amazon’s profit engines are humming despite retail slowdown

Amazon just reported its slowest revenue growth in over four years and missed estimates. But investors found plenty of relief elsewhere. That’s because cloud computing and advertising, the areas where Amazon generates the heftiest profits, showed rapid expansion. Amazon Web Services, which provides remote computing, storage and database services, reported a revenue jump of almost 40% from a year ago to $17.8 billion, beating the $17.37 billion expected by analysts. Amazon also surprised investors by breaking out advertising as a separate business for the first time. Ad revenue jumped 32% to $9.7 billion, almost equaling Google’s ad growth rate for the quarter. Meanwhile, revenue from Amazon’s online stores dropped 1% to $66.1 billion. Its U.S. segment recorded $206 million in operating losses, while the international side lost $1.63 billion. The retail business has been battling through supply chain problems, a labor market crunch that’s persisted because of the Covid-19 omicron variant and inflationary pressures on consumers. Amazon responded by spending big on wage hikes and by increasing incentives to lure workers. It also used its balance sheet to secure space on ships at a time when the cost of procuring and moving cargo containers skyrocketed, and to pay for coronavirus-related safety measures to protect front-line workers.

Finance & Economy

Housing wealth is setting new records for both owners and sellers

The stunning jump in home values over the course of the Covid-19 pandemic has given U.S. homeowners record amounts of housing wealth. What they choose to do with it could have impacts on the broader economy. Annual home price gains averaged 15% in 2021, up from 6% in 2020, according to CoreLogic. Strong pandemic-driven demand, record low supply and record low mortgage rates conspired to create those hefty gains. The upward trend is continuing, despite winter being historically the slowest season for housing. Even homeowners who weren’t listing their properties for sale were gaining equity. About 42% of homeowners were considered equity-rich at the end of last year, meaning their mortgages were half or less than half the value of their home.

Payrolls gain 467,000 in January despite omicron surge

Payrolls rose far more than expected in January despite surging omicron cases that seemingly sent millions of workers to the sidelines, the Labor Department reported. Nonfarm payrolls surged by 467,000 for the month, while the unemployment rate edged higher to 4%, according to the Bureau of Labor Statistics. The Dow Jones estimate was for payroll growth of 150,000 and a 3.9% unemployment rate. The stunning gain came a week after the White House warned that the numbers could be low due to the pandemic. Covid cases, however, have plunged nationally in recent weeks, with the seven-day moving average down more than 50% since peaking in mid-January, according to the CDC. Most economists, while expecting January’s number to be weak, see a further rebound coming in the months ahead.

U.S. job market faces reshuffling as workers quit at near record rates

Job openings are near historically high levels as companies seek to rebuild staff or pivot in response to changes in consumer demand, and there aren’t enough workers to fill all the positions. As of December, there were nearly two openings for every unemployed person, according to the Labor Department. That mismatch means that many workers are finding themselves with more options – and taking them. With hiring still outpacing the level of quits, some economists say the trend dubbed the “Great Resignation” is really more of a great reshuffling as people take advantage of the tight labor market to move into jobs with better pay, more flexibility or to try something new.