Last weekend, my four-year-old son and I were having lunch and he asked for some cherry tomatoes. Unfortunately, cherry tomatoes weren’t available at the local grocery store the last time we went, so we were out of luck. To explain to him why certain kinds of produce may be occasionally unavailable at the store, we broke out a globe and talked seasons, weather, and temperatures a bit. I spared him the full details of crop seasonality, but I did tell him that currently, North American farmers are focused on planting their crops for the 2023 season. They have quite a lot of planting to do. To mention just one of the important crops currently in or approaching planting season, U.S. farmers are projected to plant 91 million acres of corn this year, up 2.4 million acres from last year, which is expected to produce a 15-billion-bushel crop. The higher production is expected to bring down the average farmgate price $1.10 a bushel from last year to $5.60 a bushel. USDA said the record yield forecast is based on a “weather-adjusted trend assuming normal planting progress and summer growing season weather.”

In general, the planting season for many crops in North America begins around this time, typically in March or April, as the soil begins to warm up and the risk of frost diminishes. This is a critical time for farmers, as they must carefully prepare their fields, select the appropriate seeds, and begin planting to maximize the chances of a successful crop. The length of the planting season varies depending on the crop and the region. In some parts of North America, the planting season may last only a few weeks, while in

other areas it may stretch from early spring all the way through late summer.

There are several fruits and vegetables that are harder to get in North America during the winter months due to the colder climate. Some examples include berries, sweet corn, tomatoes, avocado, peppers and leafy greens. Of course, availability may vary depending on the specific region and the growing practices of local farmers, as well as imports from other countries.

Agriculture technology has great potential to combat climate change and seasonality and help ensure food security for the growing global population. Here are some examples of how technology is being used in agriculture to deal with these issues:

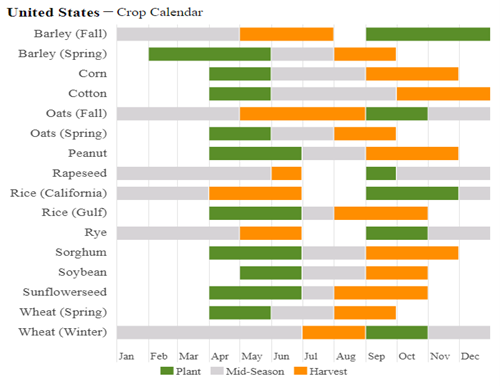

By combining innovative technologies with sustainable practices, farmers can increase efficiencies and ensure more cherry tomatoes are on more plates in the “off season.” The hard work of planting has begun, and consumers will reap the benefits later this year. Below you can see when your favorite crops will be ready to eat.

(Source: USDA)

Headline of the Week

Walmart sells Bonobos to WHP Global and Express in $75 million deal

Walmart has sold menswear brand Bonobos to brand management firm WHP Global and Express in a $75 million deal announced Thursday. It’s the second time this year Walmart has offloaded a direct to consumer brand that it bought under former e-commerce President Marc Lore after it sold Moosejaw to Dick’s Sporting Goods in February. Walmart originally purchased Bonobos in 2017 for $310 million while it was attempting to grow its online presence and compete with Amazon under Lore, who founded Jet.com. It was just one of the DTC brands the mega-retailer picked up under his tenure and later sold, including Bare Necessities, Shoes.com and ModCloth. Lore left Walmart in 2021. WHP, which took a 60% stake in Express in December, will acquire the Bonobos brand for $50 million, the company said in a news release. Express will get Bonobos’s operating assets and related liabilities for $25 million. As part of the deal, Express will enter into a licensing agreement with WHP that will allow it to run Bonobos in exchange for royalty fees. The transaction is expected to close in Express’s second fiscal quarter of 2023, which typically ends in late July.

Apparel & Footwear

Xcel Brands Signs Two Licensing Deals

Xcel Brands Inc. has signed new licensing deals with One Jeanswear Group and JTV. One Jeanswear Group (OJG) will design and produce apparel products for Xcel’s C. Wonder by Christian Siriano brand, beginning with items shipping for the fall 2023 season. The new agreement marks an expansion of Xcel’s partnership with OJG, which also manufactures Logo by Lori Goldstein apparel products under license from Xcel. Siriano is creative director of the C. Wonder by Christian Siriano brand, which launched in March 2023. He also serves as the public face and voice of the brand, including appearing on HSN’s broadcast and streaming service. Siriano has helmed his own brand since 2008. The agreement with JTV, a national jewelry retailer and broadcast network, involves putting Judith Ripka fine jewelry on JTV.com beginning in June and through the network’s live TV broadcasts beginning in August. Founded in 1993, JTV has a large assortment of jewelry, gemstones and jewelry-making products and conducts live broadcasts 24 hours a day from six high-definition studios to millions of homes. The company also conducts online business through its e-commerce site, mobile apps, streaming devices and social media platforms. JTV will also license the Judith Ripka e-commerce platform, JudithRipka.com.

Gretchen Weimer Joins Kizik as Chief Merchandising Officer

Hoka One’s dream team of Gretchen Weimer and Wendy Yang are back together — but this time, they’re putting their skills to work at Kizik, the originator of the hands-free shoe. The duo worked together for seven years in their roles as global vice president of product and president, respectively, for the fast-growing Hoka brand. Yang stepped down last May as president of performance lifestyle at Deckers Brands, where she oversaw Hoka and Teva, while Weimer quietly left Hoka in early January. At the end of last year, Yang joined Kizik’s board of directors, and now, Weimer has come on board as chief merchandising officer. At Hoka, they partnered to transform the brand from a niche cushioned running shoe to a buzzy fashion industry darling with sales of over $1 billion. Now they’re hoping to replicate that success at Kizik, which currently has sales of just over $100 million. They also worked at New Balance at the same time before they joined Hoka.

David’s Bridal Responds to Rumblings of a Possible Bankruptcy Filing

Whether David’s Bridal is considering filing for bankruptcy for the second time in five years remains a question mark. Based in Conshohocken, Pennsylvania, and founded more than 70 years ago, the chain has 300 stores primarily in the U.S. There are also outposts in Canada and the U.K. and franchised locations in Mexico. David’s Bridal specializes in affordable wedding gowns and special occasionwear, and has been the dominant player in that tier of the business. In response to a media report Saturday speculating about a potential Chapter 11 filing, a spokesperson for the nationwide chain Laura McKeever said via email, “As a company, we do not comment on speculation.” The retailer has also reportedly hired the law firm Kirkland & Ellis. David’s Bridal had a bout with bankruptcy in the fall of 2018, when the retailer reached a deal with lenders to reduce its debt by more than $400 million. In April 2021, the bridal company closed a $70 million loan provided by CPPIB Credit Investments, a subsidiary of the Canada Pension Plan. That loan matures next year and is being used to fund operations and for corporate purposes.

Women’s workwear brand Argent is back in growth mode. The company first launched in 2016, and saw a precipitous rise over its first few years — especially thanks to well-known fans of the brand like Hilary Clinton. But the pandemic changed everything — with people no longer going to work in offices and overall demand plummeting. During that time, said Argent founder and CEO Sali Christeson, “it really became about survival and hunkering down and going lean and figuring out what our strategy was going to be.” And while the company saw a loss in both 2020 and 2021, things are once again on the up and up. “We’ve never seen numbers the way that we’re seeing now,” said Christeson. Though Argent began as a digital brand, over the years it launched a few showrooms. And while many of those closed during the pandemic, Christeson said that in-store retail is a focus for this year. With that, the brand has reopened its Soho store, and hopes to open more over the next year. But owned stores aren’t the only area of growth for Argent. The brand recently began a wholesale partnership with Nordstrom.

Athletic & Sporting Goods

Tonal raises US$130m and appoints new CEO as it targets sustainable growth

Tonal, the smart home gym tech startup backed by an array of leading athletes, has raised US$130 million at a fraction of its peak valuation and appointed a new chief executive as it seeks to find sustainable growth in a challenging market. The funding round, led by existing investors including L Catterton, Cobalt, Dragoneer, Kindred Ventures and THVC, values the company at between US$550 million and US$600 million, according to the Wall Street Journal. This is a steep decline from the US$1.9 billion that Tonal was said to be worth last year. In March 2021, Tonal raised US$250 million in a funding round that valued it at US$1.6 billion and was exploring the possibility of going public.

Dan Snyder reaches agreement to sell franchise to Josh Harris group for $6 billion

The Washington Commanders have an agreement in principle in place for Josh Harris and his group to purchase the franchise for $6 billion, a source confirmed to CBS Sports. The deal will set an NFL record for the most expensive sale in league history. The previous record of $4.65 billion was set last year by the Walton-Penner group when it purchased the Denver Broncos. Harris owns the NBA’s Philadelphia 76ers and NHL’s New Jersey Devils. His group in the Commanders bid reportedly includes D.C.-area billionaire Mitchell Rales as well as Basketball Hall of Famer Magic Johnson.

Cosmetics & Pharmacy

Famille C Acquires Controlling Stake in Pai Skincare

The corporate venture capital arm of the Courtin-Clarins family office, the family behind the French luxury cosmetics company Clarins Group, has acquired a majority stake in Pai Skincare. The holding company originally purchased a minority stake in Pai back in 2021, leading its $9 million Series B investment round. Financial terms of the most recent investment were not disclosed. Founded by Sarah Brown in 2007, Pai’s philosophy is that well-grown, carefully extracted organic ingredients result in great products. Therefore, the brand is certified organic, vegan and cruelty free. Today Pai is sold in 900 doors in 30 countries, and 40 percent of its overall business is generated online. According to Prisca Courtin, chief executive officer of Famille C Participations, “It’s time for Pai to accelerate in its country of origin, which is the U.K., and to develop in Europe.”

Forma Brands exits bankruptcy, names previous Outdoor Voices exec CEO

About three months after filing for Chapter 11, beauty company Forma Brands exited bankruptcy through a completed sale to its investor group, according to a Tuesday press release. The company — which owns makeup brand Morphe — also appointed Cliff Moskowitz as its new chief executive officer. Moskowitz previously acted as interim CEO at athletics apparel brand Outdoor Voices and is an operating partner at &vest. Forma Brands’ new owners include Jefferies Finance, funds managed by Cerberus Capital Management, FB Intermediate Holdings and &vest, per the release.

Sampler Expands into Beauty With Abeo Acquisition

Sampler has acquired abeo, which will expand Sampler’s expertise in the beauty category and accelerate its expansion into Europe and the United States, where abeo currently holds its offices. As part of the transaction, Arcade Beauty will be receiving a minority stake in Sampler. In addition, as part of an ongoing relationship, both companies have entered into a commercial partnership agreement which will allow for brands to partner with both companies to design end-to-end solutions for promotional activities. The abeo team will be joining Sampler.

Discounters & Department Stores

Wall Street says 50,000 retail stores will close in 5 years

The past year has seen 2,000 retail store closures, with the likes of Bed Bath & Beyond, Foot Locker and Walmart shuttering locations as they look to save money. But that trickle is set to turn into a flood in the next five years, according to one Wall Street analysis that predicts 50,000 stores will close. If the economy falls into a prolonged recession, closures could reach 90,000, analysts at UBS said in a research note published Tuesday. Smaller operations that employ 500 or fewer people are most likely to close, they wrote. The U.S. currently has roughly 940,000 stores and the UBS prediction “simply implies that there will be 5% fewer stores by the end of 2027,” analysts said. The forecast is particularly troubling because, according to the National Retail Federation, about 70% of retail sales still come from brick-and-mortar stores, meaning retailers could suffer greater losses once they close off the places where customers physically stroll and shop.

The legacy of Family Dollar founder Leon Levine is in the spotlight after he died last week at age 85, following a career spent building up his retail empire from humble beginnings. Levine opened his first Family Dollar store in 1959 in Charlotte, overseeing the discount chain’s explosive growth before handing control to his son in 2003, and ultimately selling the company to Dollar Tree in 2014 at a $8.5 billion valuation. Today, there are more than 8,200 Family Dollar stores across the US, and the chain recorded record net sales of $12.9 billion last year, as historic inflation drove more consumers to seek bargain prices.

Emerging Consumer Companies

Casper sells Canadian operations to Sleep Country for $20.6 million

Canadian retailer Sleep Country will acquire Casper Sleep’s Canadian operations for $20.6 million, receiving a $4.5 million marketing transition fee and three-year warrants that could convert into a roughly 1% stake in Casper. Sleep Country also invested $20 million in five-year convertible notes that could convert into about 5% of Casper’s shares. Casper has six physical stores in Canada, and the move will benefit Sleep Country’s traditional retail business. Casper CEO Emilie Arel said the partnership would “accelerate our expertise and rapid growth in the retail omnichannel space.”

Indochino expands women’s custom suit offerings

Indochino is expanding its women’s custom suit offerings to all stores and its e-commerce site following a successful pilot program in select showrooms. The announcement coincides with the launch of the brand’s Spring/Summer 2023 collection, which features its first dual-gender campaign imagery. Indochino’s women’s collection comes in both premium and luxury versions, with suits starting at $449 and separates at $99. The brand reported a 40% YoY revenue increase in 2022 and sold its one millionth suit.

Food & Beverage

Plant-based sales hit $8B in 2022

Plant-based food sales reached $8 billion in 2022, an increase of 6.6% from the previous year, according to statistics from SPINS and reported by the Plant Based Foods Association and the Good Food Institute. Most categories saw sales increase. Plant-based milk, which is the largest category in the space by far, grew 8.5%, tallying $2.8 billion in sales. Three categories saw sales drop: plant-based meat, which decreased 1.2%; ice cream, which fell 4.5%; and cheese, which was down 2%. Last year was difficult for all food makers, as intense inflation and supply chain issues increased prices and impacted supplies. Many plant-based meat companies had an especially bad 2022, with layoffs, operating losses and company closures.

Chobani is taking a cautious approach about breaking into more food and beverage categories as the New York-based company prioritizes innovation in core product lines where it has a strong market presence. Recently, Chobani has focused on its $1 billion-plus yogurt business, as well as newer product launches of oat milk and creamers, by introducing more flavors, packaging formats and promoting additional usage occasions for these familiar products (yogurt as a topping for a baked potato, for example). In the last two years, Chobani has launched 160 new items. Chobani’s decision to direct more attention to innovating its existing product line is a notable change in strategy. The company had been aggressively stretching the Chobani name into other categories beyond yogurt — where it controls more than a fifth of the market — as part of a broader effort to transform the 16-year-old business into a food and beverage giant.

“A Lot of Fun is Being Had”: How Coachella Is Embracing Non-Alc

Call it a change of tune. As it kicks off this weekend, the Coachella Music Festival has for the first time partnered with a non-alcoholic retailer, The New Bar, to offer zero-proof cocktails and ready-to-drink (RTD) beverages at the two-weekend concert event in Southern California. The Venice, California-based, alcohol-free bottle shop will curate and serve a variety of zero-proof beverages to festival goers at two locations: a large bar in the general admission Indio Central Market as well as a full-service satellite bar at the 12 Peaks VIP area near the mainstage. The bars will be offering a curated selection of specialty Coachella-inspired NA cocktails, alcohol-free spirits, wine, beer and RTDs from brands like Kin, HOP WTR and Hiyo, among others. Brianda Gonzalez, who founded The New Bar in 2022, said she always dreamed of partnering with Coachella even as she was building out the bottle shop’s early business plan. “I felt that this would be a no-brainer for us as a brand and also just an incredible way to have an impact on the category,” she said. “To really show people that non-alc has a place wherever a lot of fun is being had.”

Grocery & Restaurants

Subway may lower sale price to ‘upwards of $7B,’ report says

Subway’s planned sale, originally priced at about $10 billion, may be lowered, according to a report this week in the New York Post. “Insiders are now pegging a takeout price for the fast-food giant at upwards of $7 billion — well short of the $10 billion it had been seeking when news of the auction was first reported by the Wall Street Journal on Jan. 11,” the New York Post report said. Sources told the Post that the Subway auction “has drawn lackluster interest from prospective buyers — forcing the sandwich chain to push back bidding deadlines and raising the possibility of a lower sale price.” The asking price had been about $10 billion when the Wall Street Journal first reported the possible sale in January. “After taking an initial round of bids in late February, sources said Subway has failed to set a deadline for second-round bids, which typically comes a few weeks after indications of interest are submitted,” the Post noted. “Committed offers won’t likely be due until late this month — a delay meant to give suitors more time to conduct due diligence,” said sources close to the process.

Craveworthy Brands acquires Mongolian Concepts

Craveworthy Brands, a restaurant portfolio company created earlier this year by Gregg Majewski, has announced its acquisition of Mongolian Concepts. Majewski — former Jimmy John’s CEO and Mongolian Concepts CEO – led the acquisition of the company from its previous owners, CMG Companies. With this deal, Craveworthy absorbs Genghis Grill, BD’s Mongolian Grill and Flat Top Grill into its company, which already includes Wing It On, Krafted Burger + Tap, Budlong Hot Chicken, and The Lucky Cat Poke Company. The three additional brands have more than 80 corporate-owned and franchised locations among them.

Home & Road

3 week countdown – Shareholder vote could tip Bed Bath & Beyond into bankruptcy

Burning through the cash it has raised in recent weeks, Bed Bath & Beyond this week warned that its May 9 shareholder meeting could be do or die for the company’s continued survival. Three weeks from Tuesday, shareholders will weigh in on a proposed reverse stock split designed to boost the share price of BBBY stock, making it more attractive to institutional investors and investment funds. The stock closed at a record low of 31 cents last Thursday (April 6). Here are 3 things to know about this this morning’s announcement and the shareholder proxy.

Rooms To Go-led investment group to re-launch Furniture.com site with new model

An investor group led by Rooms To Go President Jeff Seaman is set to re-launch the Furniture.com brand as a furniture market aggregation website in the coming weeks. The new Furniture.com site, slated to launch in the first week of May, will allow consumers to shop for furniture across myriad furniture retailers, much the same way they do for airlines on sites such as Travelocity or Expedia. “This is a tool for furniture shoppers to find exactly what they want in a sea of furniture,” Seaman told Furniture Today in a recent interview. “We will have hundreds of thousands of products across dozens of companies presented in a way that will help consumers find what they want, with a bent toward finding it locally.” Seaman noted that most large furniture is still purchased in physical stores. As a result, the site will be aimed at helping consumers filter through offerings from myriad retail outlets, narrow their search based on the criteria that are most important to them and then transact at the store that best fits their location and shopping preferences. The site itself will not be transactional.

Purple reaches agreement with largest shareholder over these 7 issues

Purple Innovation has established a cooperation agreement with its largest shareholder that tried to buy the company, sued the company’s board of directors and sought to replace board members with its chosen slate. Under the agreement, Purple will expand its board from seven to eight directors, and Adam Gray, managing director of Coliseum Capital Management, the shareholder that owns about 44% of Purple’s stock, will become board chairman. In addition, Purple will terminate its shareholder rights agreement it issued in September following the takeover bid from Coliseum and redeem the shares of proportional representation preferred linked stock that were distributed as a dividend on shares of the company’s common stock. In addition, the appointed special committee will be dissolved, and Coliseum will drop its lawsuit against the board and has agreed to “a customer standstill” and other terms lasting through the company’s 2024 annual shareholders meeting. Under the agreement, Coliseum has also agreed not to exceed 44.7% ownership of Purple. Details from the agreement have been filed with the U.S. Securities and Exchange Commission.

Jewelry & Luxury

LVMH ‘Extremely Optimistic’ on China as Luxury Sales Leap

Consumer desire for luxury goods in post-COVID China has meant good news for LVMH. The Louis Vuitton owner on Wednesday reported a 17% increase in sales for its first quarter, driven in part by a resumption of shopping among Chinese consumers following the lifting of that country’s strict pandemic restrictions. Speaking during an earnings call, Chief Financial Officer Jean-Jacques Guiony said the company was “extremely optimistic” about its prospects in China for 2023, adding that its first-quarter numbers “bode well for the rest of the year.” China relaxed its international travel restrictions in January following three years of COVID-related limits. As PYMNTS wrote earlier this year, the move was a welcome one for retailers of high-end products, as Chinese consumers purchased about a third of the world’s luxury goods in the pre-pandemic year 2018. And the optimism Guiony expressed this week echoed sentiments of LVMH Chairman and CEO Bernard Arnault in January.

David Yurman, Mejuri Settle Dueling Lawsuits

David Yurman and Mejuri have settled their legal battle after more than a year of back and forth. In December 2021, David Yurman filed a lawsuit in federal court in New York City accusing Mejuri, a direct-to-consumer fine jewelry brand, of copying several of its most recognizable designs. Mejuri was accused of selling imitations of products from David Yurman’s “Pure Form” and “Sculpted Cable” collections, with side-by-side photo comparisons included in the lawsuit to support David Yurman’s allegations. The lawsuit also accused Mejuri of attempting to falsely associate itself with David Yurman “through its promotional messages, advertising campaigns and artwork, and partnerships.”

Recovering Demand in China Boosts De Beers’ Sales

After a slower start to the year, De Beers Group’s rough diamond sales picked up in late March through mid-April. The company announced Wednesday that rough diamond sales in the third sales cycles of 2023 (March 27-April 11) totaled $540 million. That is down less than 5 percent when compared with the same period in 2022 ($566 million), a relatively small decline considering how strong the company’s sales were last year. Compared with the second sales cycle of 2023 ($497 million), De Beers’ rough diamond sales were up nearly 9 percent. New CEO Al Cook said third-cycle sales were in line expectations. He described diamond jewelry demand as “positive,” calling out China specifically.

Office & Leisure

World of Barbie to make U.S. debut at Santa Monica Place

America’s most iconic doll is getting her very own dedicated attraction. “World of Barbie” will make its U.S. debut at Santa Monica Place, a Macerich Property, in Santa Monica, Calif., in mid-April. The ticketed attraction will include an array of interactive and immersive experiences, along with a store where visitors can shop and build a customized Barbie set from scratch. The space will also be available for private events and corporate parties. The World of Barbie made its global debut last summer, opening a 30,000-sq.-ft. attraction at Square One in Mississauga, Ont. (Canada). Another attraction, The Dr. Seuss Experience, is scheduled to open at Macerich’s Tysons Corner Center, just outside Washington, D.C., in April. Both The Dr. Seuss Experience and World of Barbie are being brought to Macerich by Kilburn Live, a global market leader in branded live entertainment, in partnership with Fever, a leading entertainment discovery platform. IMG, a global sports, fashion and events leader is partnering with Kilburn Live on the World of Barbie experience.

Hasbro Names Tim Kilpin as President, Toy, Licensing and Entertainment

Hasbro has announced the appointment of Tim Kilpin as president, toy, licensing and entertainment, effective April 24. In addition, Gina Goetter will join the company’s executive leadership team as chief financial officer, effective May 18. With extensive experience in the consumer products industry, Kilpin will be responsible for Hasbro’s Toy business. He was previously at PlayMonster Group, most recently as executive chairman and, prior to that, chief executive officer. He also served as leader of Activision Blizzard’s consumer products business, chief commercial officer for Mattel and a stint as executive vice-president, franchise management at The Walt Disney Company, where he oversaw the creation and development of global cross-category franchise plans for Disney’s stable of content and characters. In his new role, Kilpin will oversee Hasbro’s Consumer Products Group, with a focus on optimizing the value, relevance and performance of the company’s strategic franchise brands and IP. Gina Goetter brings over 25 years of experience across finance and accounting, joining Hasbro from Harley-Davidson, where she has served as chief financial officer since 2020.

After pet adoption skyrocketed during the pandemic, cat and dog owners are setting a new tone for pet food as many opt for more expensive fare that claims to be less processed and healthier than traditional kibble. According to a new report from The New York Times, pet owners are giving up dry food, and in many cases even canned food, in favor of nourishment that more closely resembles a human diet. Companies like The Farmer’s Dog and Ollie have led the charge, marketing high-end dog food to pet owners and calling it “human-grade,” according to the Times. But in the eyes of some pet experts, the new trend is little more than a gimmick looking to disrupt an industry where pet food has been tested by decades of use and research. “Many are pushing natural or healthy, and people look at the ingredient list and assume because they recognize everything that the diet has to be healthier,” Dr. Cailin Heinze, a board-certified veterinary nutritionist, told the Times. “It’s giving these companies a health halo, even if there is no science behind it, and the other diet has 40 years of research.”

Technology & Internet

Amazon will charge customers a fee for some UPS returns

Amazon is attempting new measures to get customers to return fewer of their online orders, including charging a fee to return items to UPS stores. For decades, Amazon built its business by creating shopping that was fast, ridiculously easy and, seemingly, error-proof. You don’t like it, just return it. But not anymore: so many customers have buyers’ regret, or simply bigger feet than they thought they had, that handling returns has become an expensive problem for the company. Amazon will start charging customers a $1 fee if they return items to a UPS store when there is a Whole Foods, Amazon Fresh grocery store or Kohl’s closer to their delivery address. (Amazon owns Whole Foods and Fresh, and has a partnership deal with Kohl’s.) Amazon still offers free return options, and an Amazon spokesperson said the fee would apply to a small number of customers. The company still offers a way for these customers to return stuff for free by bringing items to Whole Foods, Amazon Fresh, and Kohl’s.

Best Buy lays off hundreds of store employees as shopping trends shift

Best Buy said Friday that it is laying off hundreds of store workers across the country as more of its shoppers buy online and sales of consumer electronics weaken. In a statement, Best Buy said it is “evolving our stores and the experiences we offer to better reflect the changes in customer shopping behavior, as well as how we organize our teams to ensure we continue to provide our expertise, products and services in the best way possible.” The retailer framed the job cuts as a shift in its priorities, saying Best Buy plans to add thousands of customer-facing employees and invest in growing areas, such as its Totaltech membership program and its health business. As of the end of January, Best Buy had more than 90,000 employees in the U.S. and Canada. That’s a drop from the nearly 125,000 workers that it had in early 2020, according to company financial filings. Best Buy is also following a period when many of its customers sprang for new laptops, kitchen appliances and home theater systems during the early years of the pandemic. Much of what it sells are big-ticket items that people don’t replace frequently.

Finance & Economy

US inflation falls to lowest level since May 2021

Prices are moving in a more palatable direction for US consumers. Annual inflation, as measured by the Consumer Price Index, dropped in March for the ninth consecutive month. And for the first time since September 2020, grocery prices fell on a monthly basis. Prices rose 5% for the 12 months ended in March, down from 6% in February, the Bureau of Labor Statistics reported. Annual CPI plunged to its lowest rate since May 2021, helped by year-over-year comparisons to a period when food and energy prices spiked amid Russia’s invasion of Ukraine.

Layoffs are up nearly fivefold so far this year with tech companies leading the way

Companies announced nearly 90,000 layoffs in March, a sharp step up from the previous month and a giant acceleration from a year ago, outplacement firm Challenger, Gray & Christmas reported. Planned layoffs totaled 89,703 for the period, an increase of 15% from February. Year to date, job cuts have soared to 270,416, an increase of 396% from the same period a year ago. The damage was especially bad in tech, which has announced 102,391 cuts so far in 2023. That’s a staggering increase of 38,487% from a year ago and good for 38% of all staff reductions. Tech already has cut 5% more than for all of 2022, according to the report, and is on pace to eclipse 2001, the worst year ever amid the dot-com bust.

US retail sales fall 1% amid high inflation, rising rates

Americans cut their spending at retail stores in March for the second straight month, a sign consumers are becoming more cautious after a burst of spending in January. Retail sales dropped 1% in March from February, a sharper decline than the 0.2% fall in the previous month. Sales jumped 3.1% in January, as unusually warm weather and a big jump in Social Security benefits likely spurred more spending. Sales fell among most retailers, including at auto dealers, gas stations, electronics stores, and home and garden stores. Gas-station sales plunged 5.5% in March, though the data isn’t adjusted for price changes, and gas prices fell last month.