Casualization has been a megatrend in apparel and footwear over the last two decades, fueled by changing norms in the workplace and the emergence of athleisure. The trend has been a boon for companies like lululemon and Allbirds, but it has been a challenge for brands and retailers catering to business and occasion dressing. When the pandemic hit in 2020, restrictions on gatherings and a surge in working from home sent casualization into hyperdrive, and it was fair to wonder whether dressy clothing and footwear could ever recover. However, while some of the changes driven by the pandemic appear to be permanent, the death of “dressy” does not appear to be one of them. Casualization is likely here to stay, but, at the moment, dressier clothing and footwear is making a comeback.

The most obvious reason for dressy’s resurgence is the return to normalcy that the country has been enjoying since the passing of the Omicron spike in January and February. Many employers around the country are encouraging (and in some cases requiring) workers to come back to the office. A Microsoft survey conducted early this year found that roughly half of all companies were already implementing plans to require workers to come back to the office full-time. Large gatherings are bouncing back as well. While some events, such as corporate conferences, are coming back more slowly, others, such as weddings, are exploding. According to the Wedding Report, a trade group in the bridal industry, 2.5 million weddings are expected to happen this year, the most in any year since 1984, as previously delayed events will finally take place. Additionally, lower covid counts are giving many consumers the confidence to return to behaviors and activities that they embraced before the pandemic, such as going to restaurants and entertainment venues that require dressier clothing.

The comeback of dressy is evident in several places. First, certain brands and retailers are seeing strong demand in dressier styles. Marc Fisher of his eponymous footwear brand told Women’s Wear Daily (WWD) last month when announcing a new men’s line, “Our dressy business is off the charts. Women want to look feminine and guys are sick of sweatpants.” Others echo Fisher’s sentiments. Also in WWD, executives from Neiman Marcus, Saks Fifth Avenue, and Macy’s were all recently quoted on the strength of dressier businesses, especially in men’s. Sam Archibald, general business manager of apparel for Macy’s said “We had been in a casual trend for a while, but now men are updating their wardrobes with refined sportswear, collections and tailored clothing.”

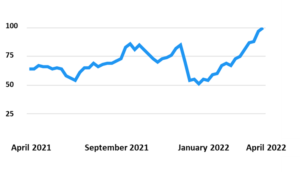

The resurgence of interest in dressing up is also clear on Google. Searches for the term “dress shoes” are up 54% versus this time last year, and up nearly 100% versus early January, according to Google Trends. Similarly, since mid-December, searches for the term “business casual” are up 115%, and searches for the term “dressy” are up nearly 80%.

Graph: Google Trends – Searches for the term “Dress Shoes”

For consumers and brands who are tired of yoga pants and flip flops, this is all another welcome sign that life is beginning to return to normal. But, of course, not everything has fully returned to normal, and the global supply chain is still operating with many disruptions. Shortages and stockouts have already been seen in bridal gowns and prom dresses. Still, the reversal of casualization likely won’t be derailed by these supply chain disruptions. From brides to bosses, the directive this spring is clear: time to button up.

Headlines of the Week

Out-of-stocks led to $175M in lost sales at Bed Bath & Beyond

In what executives blamed on ongoing supply chain challenges and inventory constraints, Bed Bath & Beyond reported fourth quarter net sales fell 22% year over year to $2.1 billion, while comparable sales fell 12%. The company suffered about $175 million in lost sales during the quarter as a result of out-of-stocks at the Bed Bath & Beyond banner, which continued into March, CEO Mark Tritton said during an analyst call Wednesday. Gross margin during the period fell 320 basis points year over year to 28.3%. The home goods retailer swung to a loss of $159 million from a profit of $9 million last year, according to a company press release. For the full year, Bed Bath & Beyond reported net sales fell nearly 15% to $7.9 billion, while net loss widened by over 270% to $559.6 million.

ADM announces $300 million investments in Alt-Protein production

Archer Daniels Midland Co (ADM) announced the company is investing approximately $300 million to expand its alternative protein production facilities in Decatur, IL, in addition to opening a new state-of-the-art Protein Innovation Center. Once completed, these and other investments are expected to grow ADM’s global alternative protein production capacity by more than 30%. ADM says increased production is needed to meet strong and growing consumer demand for quality plant proteins. The expansion of its Decatur-based complex, scheduled to be completed in Q1 of 2025, will significantly increase the company’s soy protein concentrate capacity and double its extrusion capabilities. ADM will also use the latest technology and processes to conform to its environmental sustainability standards.

Apparel & Footwear

Britain’s Ted Baker looks to sell itself after takeover interest

Ted Baker is open to selling itself at the right price after seeing a flurry of takeover interest, the British fashion retailer said last week in the wake of a robust rebound from the pandemic. Ted Baker launched a formal sale process after private equity firm Sycamore improved its takeover proposal and another third party showed interest in bidding for the company, sending its shares surging as much as 11% to 142.6 pence. “The Board has decided to conduct an orderly process to establish whether there is a bidder prepared to offer a value that the Board considers attractive relative to the standalone prospects of Ted Baker as a listed company,” it said in a statement. The company, which has 560 stores and concessions, is in the middle of a three-year turnaround plan under chief executive Rachel Osborne and has seen demand return from pandemic lows.

Karen Katz Joins Intermix’s Board

Karen Katz, former president and chief executive officer of Neiman Marcus Group, has been elected to the board of Intermix, bringing the total to six board members. As the former president and CEO of Neiman Marcus Group, Katz led the company through its digital transformation. Among her accomplishments were leveraging Neiman Marcus’ brick-and-mortar presence to launch its omnichannel strategy, integrating customers’ online and in-store experiences through technology and personalization. After eight years as CEO and 33 years with the company in various posts, she retired in 2018. Katz serves on three company boards: Under Armour, The RealReal and Humana Healthcare. She also spends time as a board member on privately held consumer company boards and is an advisor to several startups in the technology, service and product spaces. Last May, Gap Inc. agreed to sell Intermix to private equity firm Altamont Capital Partners for an undisclosed sum. Intermix, which was founded in 1993, has 29 boutiques with hyper-localized assortments and a rapidly growing e-commerce channels.

Generation Tux: George Zimmer’s Lucrative Second Chapter

When everything went south for George Zimmer in 2013 after he was unceremoniously fired from Men’s Wearhouse, the company he founded in 1973, he could have easily ridden off into the sunset licking his wounds and counting his money. Instead, the then-64-year-old set the wheels in motion for his next chapter. It’s called Generation Tux, an online tuxedo and suit rental business that launched a year after he departed Men’s Wearhouse and now has annual sales of $50 million. At the time, the idea of a direct-to-consumer tuxedo rental service seemed doomed to fail. But Zimmer again proved his entrepreneurial knack, much as he did with Men’s Wearhouse, which, at its peak, exceeded sales of $2.5 billion.

Athletic & Sporting Goods

SFIA: Fitness, Golf And Camping Categories Seize Pandemic Boom

According to SFIA’s 2022 Manufacturers Sales by Category Report, consumer exercise equipment categories saw the biggest revenue gains over the last two years during the pandemic. Golf led the gains among sports equipment categories, followed in the Top 5 by camping, snow sports, tennis, and basketball. Both athletic apparel and athletic footwear categories experienced strong recoveries in 2021 after posting declines in 2020 tied to the shutdowns and heightened restrictions seen in the early stages of the pandemic. Team sports equipment also saw a bounce-back year in 2021. The total market for sports equipment, exercise equipment, athletic footwear, sports apparel, and licensed merchandise saw a 15.8 percent increase in revenue from 2020 and a 16.4 percent increase since 2019 pre-pandemic numbers, with a majority of the tracked categories experiencing growth of over 10 percent in those two years. As a result of these record-breaking numbers, the sporting goods industry is valued at over $111 billion.

ISPO: Six Megatrends To Shape Sporting Goods’ Future

ISPO has identified six underlying “megatrends” guiding how individualization, connectivity, urbanization, sustainability, and other trends impacting sporting goods are evolving. “Megatrends are the ‘blockbusters’ of change—long-term streams of societal change in habits, behaviors and morals,” wrote Christoph Beaufils, brand strategist at ISPO, in an article that first appeared in “Niederbayerische Wirtschaft” of the Chamber of Industry and Commerce of Lower Bavaria. The Future Institute, founded by Horx, currently sees 12 megatrends—Individualization, Gender Shift, Silver Society, Knowledge Culture, New Work, Health, Neo-Ecology, Connectivity, Globalization, Urbanization, Mobility, and Security.

Cosmetics & Pharmacy

Rite Aid reports Q4, full-year results

Growth in the retail pharmacy segment drove a 2.5% and 2.2% hike in Rite Aid’s revenues for the quarter and year, respectively. Despite the persistent headwinds of the pandemic, Rite Aid saw increased revenue in Q4 and its fiscal year, which ended Feb. 26, 2022. The retailer saw revenues increase 2.5% and 2.2% for the quarter and full-year, respectively. The increase was driven by growth in the retail pharmacy segment. This was partially offset by a decline in the pharmacy services segment, the company said. Revenue for the full-year increased from $525 million to $24.6 billion. For the fourth quarter, the company reported net loss from continuing operations of $389.1 million, or $7.18 loss per share, adjusted net loss from continuing operations of $88.6 million, or $1.63 loss per share, and adjusted EBITDA from continuing operations of $106.1 million, or 1.8% of revenues.

Millennial Brands Secures $35 Million Capital Commitment

Middle East-based consumer brand portfolio Millennial Brands has secured a $35 million capital commitment from New York-based Global Emerging Markets Group (GEM). Millennial Brands is an emerging consumer specialist firm focusing on building and scaling the greatest digital and social brands operating in the Middle East. The firm, headquartered in Dubai, was established in 2018 with a mission to invest, partner, and develop brands targeting the millennial consumer and currently operates various brands across various channels including e-commerce, direct sales, branded stores, and a distribution center. A team of 100 employees currently manages 12 brands across consumer and personal care categories, including body care, men grooming, haircare, baby care, and fragrances.

Discounters & Department Stores

Chasing digital growth, Walmart poaches PayPal CFO

PayPal Chief Financial Officer John Rainey will join Walmart as CFO on June 6, the retail giant said late Tuesday. He will replace Brett Biggs, who is leaving for “opportunities in both the for-profit and nonprofit sectors,” according to a company blog post. Biggs will remain CFO until Rainey’s first day, then continue as an adviser until he leaves Walmart on Jan. 31. In addition to his CFO job, Rainey serves as PayPal’s executive vice president of global customer operations. Before PayPal he was CFO at United Airlines, and spent a combined 18 years working for both United and Continental Airlines.

Target is selling used clothing in partnership with ThredUp

Target is testing a secondhand apparel marketplace, leveraging ThredUp’s “resale as a service” platform, the retailer said by email. The offer includes about 400,000 women’s and kids items from Target’s owned brands as well as national and premium brands curated from ThredUp’s own assortment, the retailer said. This is Target’s second foray into the space, having previously partnered with ThredUp in 2015.

UBS expects 50,000 store closures in the U.S. over the next 5 years after pandemic pause

A pandemic shakeup in 2020 led to a surge in store closures, coupled with dozens of retailers filing for bankruptcy, which emptied out shopping malls and left vacancies scattered along the streets major markets including New York City. The aftermath, though, was a temporary relief from closures, as companies took the chance in 2020 to quickly slim down their store counts when consumers were holed up at home. In fact, in 2021, retailers reported net store openings, marking a sudden reversal from years of net declines. Companies seized the opportunity to take advantage of cheap rents and an eagerness among Americans to get out and shop again. While analysts at UBS see more pain ahead, it’s not as many closures as the investment bank had initially projected about a year ago.

Emerging Consumer Companies

Genies raises $150 million for metaverse avatars

Metaverse avatar company Genies has raised $150 million at a valuation above $1 billion. The company’s Series C round was led by Silver Lake and includes participation from existing investors BOND, NEA, and Tamarack Global. Founded in 2017, the Los Angeles-based company makes customizable virtual avatars and also provides celebrities with avatars that can be used as stand-ins at online events. Since its last funding round in May 2021, Genies has landed partnerships with Universal Music Group and Warner Music Group, and also started to roll out its mass consumer avatar creator tools, allowing users at every level of technical ability to create their own web 3-native avatars and avatar fashion collections, and eventually, avatar homes and social experiences.

Branch Furniture announces $10 million Series A

Headquartered in New York and launched in 2019, Branch is an online seller of office furniture to individuals and businesses. In a press release this week, CEO and co-founder, Greg Hayes, said, “many of us spend more time interacting with office furniture than any other product except our mattress…but most premium office furniture is expensive, especially for businesses purchasing through traditional dealers, and over the past two years of remote work, consumers have realized that ‘fast furniture’ doesn’t cut it.” This week, Branch announced its $10 million Series A led by Springdale Ventures. While the company has spent the last two years outfitting its 50,000+ customers’ work-from-home digs with its core products, the company will use proceeds from the round to launch some new products, including some for those returning to the office.

Men’s grooming company, Scotch Porter, raises $11 million

Scotch Porter, the six-year-old company that sells better-for-you grooming products for men, announced its $11 million Series B round last week. The round was led by Pendulum, an investment and advisory platform focused on brands founded by diverse entrepreneurs. Pendulum Managing Director Ron Mackey noted, “with its differentiated product offering and broad distribution, Scotch Porter is well-positioned for continued expansion in the men’s personal care market.” Inspired by his experience opening a barbershop in Newark, the brand’s CEO, Calvin Quallis, is on a mission to create solutions for men with textured hair. While the brand currently offers premium hair products for beard, hair, skin, fragrance, and, most recently, dietary supplements, proceeds from the round will go toward further expanding the product offering and scaling operations.

Food & Beverage

Energy drink brand A SHOC raised $29 million Series B round

Performance energy drink brand A SHOC announced it has closed a $29 million Series B funding round backed by existing investors and a roster of celebrity athletes. Founded in 2019 by serial entrepreneur Lance Collins and former Monster Energy VP Scot De Lorme, California-based A SHOC produces a line of better-for-you, functional performance energy drinks. Through a distribution partnership with Keurig Dr Pepper (KDP), the brand is available in over 112,000 retail doors nationwide. The round includes participation from existing investors, including Collins and KDP, as well as a group of individuals including professional athletes. The round will help support the brand’s continued growth in the U.S. and comes ahead of additional innovation and marketing campaign launches expected this spring.

Supply chain issues and Ukraine war drive food-at-home prices up 10%

The consumer price index for food at home increased 10% over the past 12 months — the biggest 12-month increase since March 1981, according to the U.S. Bureau of Labor Statistics’ Consumer Price Index data released this week. Flour, meats, milk, and fats and oils saw some of the biggest year-over-year price increases. On a monthly basis, food at home prices rose 1.5%. Butter saw the highest monthly price increase among grocery items, rising 6% in March, nearly double the pace of the previous month’s increase. Over the past 12 months, the price index for butter grew 12.5%. Prices for butter have been trending sharply upward since the beginning of the year, due to a variety of factors like declining dairy cow herds, labor shortages at manufacturing facilities and higher packaging costs. The war in Ukraine, meanwhile, has pressured food commodities such as grains and oils.

Grocery & Restaurants

Albertsons upholds ‘top tier’ performance in strong 2021 finish

Albertsons Cos. topped Wall Street’s earnings forecast for its 2021 fourth quarter and fiscal year as the grocery retailer saw net sales climb in both periods atop prior-year gains. Also on Tuesday, President and Chief Financial Officer Sharon McCollam commented on Albertsons’ planned strategic review, announced in late February, telling analysts that the company thinks it’s undervalued versus competitors. Full-year 2021 net sales and other revenue edged up 3.2% to $71.89 billion from $69.69 billion in fiscal 2020, when Albertsons posted an 11.6% increase. Identical sales for 2022 came in virtually flat, dipping 0.1% year over year but up 16.8% excluding fuel on a two-year basis.

Fat Brands bets on quick-service with major expansion plans

Fat Brands announced Wednesday 20 new store development deals for its newly acquired quick-service restaurant brands, including Round Table Pizza, Great American Cookies, Marble Slab Creamery, Hot Dog on a Stick and Pretzelmaker. The deals will total more than 50 new store units, with 30 locations set to open their doors by the end of the year. Over the past two years, Fat Brands has garnered attention for its robust portfolio growth, but has largely slowed its acquisition spree in 2022, focusing instead on development. The company’s quick-service category was created after the acquisition of the above Global Franchise Group brands from Serruya Private Equity, Inc. and Lion Capital LLP last summer. Most of the brands are known as snack or food court brands and have traditionally done well in mall spaces. With this new development deal in place, Fat Brands will focus on building up the Great American Cookies and Marble Slab Creamery co-branded restaurant model in the Southeast, mainly in the Nashville, Houston and Louisiana markets, with more cobranding opportunities to come in the future.

Home & Road

RH details multiple 2022 initiatives; CEO cites ‘chaotic’ challenges in retail

RH is moving full-speed ahead in a number of areas from new store (“galleries” in RH speak) and restaurant openings here and abroad to Gulfstream charter jet rentals. In his quarterly letter, Gary Friedman, CEO and chairman of the luxury home furnishings retailer, formerly known as Restoration Hardware, noted that while many of the brand’s plans for the past two years were disrupted by the pandemic, they were not disrupted by it. “We used these past two years to reimagine and reinvent ourselves once again, and believe 2022 will mark the beginning of the next chapter of growth and innovation for the RH brand,” he said. Friedman said RH’s plans for the year include…

Supply issues impact Hooker Furnishings’ Q4 sales

Hooker Furnishings today reported $134.8 million in fourth quarter sales, a 13.2% loss over the same period last year. For the year, Hooker reported net sales of $593.6 million, a $53.5 million or 9.9% increase over 2021. The company said it did well in all segments for the first half of the year, but when supply chain issues began to hit later in the year, so did revenue and sales. The company’s HMI division was particularly affected. Jeremy Hoff, CEO, said major economic hurdles faced the company in 2022, including soaring ocean freight costs and shipping bottlenecks throughout the year, material and component parts inflation, and staffing and foam shortages.

Luxury DTC bed and bath brand Brooklinen to grow store fleet

Brooklinen is growing its brand on a number of fronts. The digitally native, direct-to-consumer luxury bed and bath retailer announced several growth initiatives for 2022, including expanding its fledgling store presence outside of its New York home base. Brooklinen, which currently has stores in Brooklyn and Manhattan, plans to open locations in Los Angeles, Philadelphia, Portland and San Francisco by June of this year. Looking further out, the company plans to double its retail presence next year and the year following, with the goal of having anywhere from 25 to 30 stores by the end of 2024.

Jewelry & Luxury

Rebag, Moda Operandi showcase used luxury items in virtual trunk show

Rebag, the luxury bag and accessories reseller, partnered with Moda Operandi, the fashion curation platform, to launch a digital trunk show featuring more than 115 styles, the company announced on Tuesday. The two companies created visual and editorial content to distribute across both their social media and digital channels. Moda Operandi hosted the trunk show on April 12 and allowed shoppers to browse the available items for a limited time, according to the announcement. Rebag curated the assortment in the show from more than 30,000 items in its inventory. Among the brands featured were Hermès, Chanel, Louis Vuitton and Christian Dior.

Jewelry Sales Stayed Strong In March, Mastercard Says

With the post-COVID-19 “reopening” of the economy, some have predicted that the U.S. jewelry market will shrink in 2022. But it doesn’t look like we’re at that point yet. In its regular monthly sales tally, Mastercard SpendingPulse said that jewelry sales in March 2022 rose 11.9% over sales for March 2021—an impressive jump that is, nevertheless, smaller than recent gains. For instance, in February 2022, jewelry sales rose 22.4% over the prior year, SpendingPulse said. Still, the overall jewelry market has grown substantially: March’s jewelry sales were up 78.8% over the pre-pandemic month of March 2019, the data service said.

Cartier CEO Sees Luxury Demand Withstanding Rising Prices

Cartier plans to raise prices in the next several weeks, making it the latest luxury brand to bet its customers are willing to spend more for their high-end watches, jewelry and accessories. The “mild” price increase will partially offset the rise of the U.S. and Chinese currencies against the euro, according to Chief Executive Officer Cyrille Vigneron. It will also help to cover higher costs for key materials, such as the diamonds, platinum and gold used in the company’s jewelry, including $275,000 bracelets and $104,000 earrings. “We’re in a long-term business, and we have to be careful not to adjust our pricing too quickly,” Vigneron said in an interview. He previously said any potential price increases by Cartier would likely be between 3% and 5%. Some other European luxury houses have been more active — Chanel, for instance, has raised the prices on some its handbags by more than 50%.

Louis Vuitton, Dior sales jump, defying war and Shanghai lockdown

LVMH SE posted strong revenue growth as the world’s largest seller of luxury goods defied disruptions from the war in Ukraine and the resurgence of Covid-19 in China, a potential harbinger for the rest of the industry. First-quarter sales advanced 23% on an organic basis to 18 billion euros ($19.5 billion), led by LVMH’s biggest unit, fashion and leather goods, the Paris-based company said late Tuesday. Analysts had expected a gain of 17%. Led by billionaire founder Bernard Arnault, LVMH is the first European luxury-goods maker to publish revenue for the period. The owner of Louis Vuitton and Dior was buoyed by resilient demand in the U.S. and Europe. ”The stellar 1Q highlights their geographical and business reach and lack of reliance on any one group, considering the disruption to current trading in China,” wrote Swetha Ramachandran, who manages GAM’s Luxury Brand Equity Fund, in response to a Bloomberg query.

Office & Leisure

Hasbro to Acquire D&D Beyond from Fandom

Hasbro has announced it is acquiring D&D Beyond, digital toolset and game companion for the company’s groundbreaking fantasy franchise, DUNGEONS & DRAGONS, from Fandom. Fandom, one of the world’s largest fan platform, has owned and operated D&D Beyond since 2019 and has grown the direct-to-consumer business to be the leading role-playing game (RPG) digital toolset on the market with close to 10 million registered users. The strategic acquisition, for $146.3 million in cash, will strengthen Hasbro’s capabilities in the fast-growing digital tabletop category while also adding veteran talent to the Wizards of the Coast team and accelerating efforts to deliver exceptional experiences for fans across all platforms. Over the last three years, the royalty paid to Hasbro by D&D Beyond has represented a significant contribution to the fastest-growing source of revenue for the game. The strategic acquisition of D&D Beyond will deliver a direct relationship with fans, providing valuable data-driven insights to unlock opportunities for growth in new product development, live services and tools and regional expansions.

How Barnes & Noble Went From Villain to Hero

After years on the decline, Barnes & Noble’s sales are up, its costs are down — and the same people who for decades saw the superchain as a supervillain are celebrating its success. In the past, the book-selling empire, with 600 outposts across all 50 states, was seen by many readers, writers and book lovers as strong-arming publishers and gobbling up independent stores in its quest for market share. Today, virtually the entire publishing industry is rooting for Barnes & Noble — including most independent booksellers. Its unique role in the book ecosystem, where it helps readers discover new titles and publishers stay invested in physical stores, makes it an essential anchor in a world upended by online sales and a much larger player: Amazon. “It would be a disaster if they went out of business,” said Jane Dystel, a literary agent with clients including Colleen Hoover, who has four books on this week’s New York Times best-seller list. “There’s a real fear that without this book chain, the print business would be way off.”

Lovepop on the Rise; Opens 7 Card Stores Since 2020

Lovepop, a designer of specialty pop-up cards and gifts has opened a new store in the iconic Grand Central Terminal in New York City. As the company continues to grow, this new storefront is Lovepop’s seventh store opening since the beginning of 2020, adding to its now seven brick-and-mortar stores and 12 locations in major markets across the U.S. The nearly 600-square-foot space, located at Grand Central Terminal at 89 East 42nd Street in the main concourse off the Graybar Passage, will offer Lovepop’s full assortment of products on its iconic tiered displays. It will also feature a dedicated Lovepop Flower Shop, highlighting the entire assortment of Lovepop’s handcrafted flower bouquets and flower products. As the company continues to invest in expanding its physical retail presence in 2022, this new store opening accelerates Lovepop’s plans to open additional stores this year with an emphasis on strengthening its New York and West Coast portfolios. The company is planning to open an additional store later this year in Times Square, New York City.

Piano maker Steinway plans to launch IPO

It might just be music to investors’ ears. Steinway, the famed 169-year-old piano maker, plans to go public. The Astoria, Queens-based musical instrument manufacturer on Thursday submitted documents to the Securities and Exchange Commission indicating that it was planning to sell shares in an initial public offering on the New York Stock Exchange. Paulson & Co., the investment firm founded by billionaire John Paulson, acquired the company in 2013. In 2018, China’s government-owned conglomerate China Poly Group Corp. offered $1 billion for the firm, according to Bloomberg News, though the offer wasn’t accepted. Once the company is listed, half of the voting power will be controlled by Paulson, according to the filing documents. Steinway is profitable. Net income rose 14.4% to about $59.3 million for the year ended Dec. 31 from $51.8 million in 2020. Sales jumped about 30% to $538.4 million in 2021, the prospectus said.

Technology & Internet

Amazon slaps U.S. sellers with 5% fuel and inflation surcharge

Amazon said Wednesday it plans to add a fuel and inflation surcharge of roughly 5% to existing fees it collects from U.S. third-party sellers who use the company’s fulfillment services. The fee will go into effect in about two weeks, and is “subject to change,” the company said in a notice to sellers that was viewed by CNBC. “The surcharge will apply to all product types, such as non-apparel, apparel, dangerous goods, and Small and Light items,” the notice stated. “The surcharge will apply to all units shipped from fulfillment centers starting April 28.” With inflation soaring, the e-commerce giant is trying to offset some of its own costs by passing fees along to sellers. Amazon already collects fees from sellers who use Fulfillment by Amazon, or FBA. Merchants pay to have their inventory stored in Amazon’s warehouses and to make use of the company’s supply chain and shipping operations. “In 2022, we expected a return to normalcy as Covid-19 restrictions around the world eased, but fuel and inflation have presented further challenges,” an Amazon spokesperson said in an email to CNBC. “It is still unclear if these inflationary costs will go up or down, or for how long they will persist, so rather than a permanent fee change, we will be employing a fuel and inflation surcharge for the first time — a mechanism broadly used across supply chain providers.”

Etsy sellers start a week-long strike over increased fees and other conditions

Thousands of Etsy sellers — artists who make money from selling their handmade goods on the website — are closing their (online) shops for the week and going on strike. Earlier this year, Etsy’s CEO Josh Silverman announced that starting April 11 the company would increase the 5% transaction fee for sellers to 6.5%. This was done to fund improvements in marketing, and seller tools, among other changes, Silverman said. The sellers are fed up with new transaction fees and other Etsy-imposed costs. Many sellers feel like Etsy is intent on squeezing the platform’s independent artists with these new policies. In response, Etsy sellers banded together and launched a campaign, urging other artisans and their customers to abandon the site for one week in protest.

Why Farfetch invested $200 million in Neiman Marcus

Farfetch will invest up to $200 million in Neiman Marcus Group (NMG), which owns Neiman Marcus and Bergdorf Goodman, in a strategic partnership that bridges the next generation of luxury retail with a long-standing industry institution. Neiman Marcus will use the investment to expand its innovation and digital capabilities, according to the companies. NMG will use Farfetch Platform Solutions to re-platform Bergdorf Goodman’s website and mobile app; and both Bergdorf Goodman and Neiman Marcus will join the Farfetch Marketplace as partners, expanding the marketplace’s brand offerings in key locations. Growing the e-commerce business is “not a defensive move — it’s an offensive one,” Neiman Marcus Group CEO Geoffroy van Raemdonck tells Vogue Business. Online accounts for one-third of Neiman Marcus Group’s total sales, though this figure does not include in-store digital sales by sales associates. Partnering with Farfetch allows the company to improve the customer experience and expand global reach. “Being on the platform allows us to move even further in how we brand the experience on [Bergdorf Goodman’s e-commerce site] and how we show the product assortment. Their architecture is the best class,” he says. Farfetch founder, chairman and CEO José Neves is betting that digital will play a key role in defining the US luxury retail winners.

Finance & Economy

As inflation bites and America’s mood darkens, higher-income consumers are cutting back, too

With as much as 60% of U.S. consumers living paycheck to paycheck, it’s not a surprise to see that the spending cutbacks have started. Even with a strong job market and wage gains, as well as Covid stimulus savings, pricing spikes in core spending categories including food, gas and shelter are leading more Americans to mind their pocketbooks closely. A new survey from CNBC and Momentive finds rising concerns about inflation and the risk of recession, and Americans are saying that not only have they started buying less but they will be buying less across more categories if inflation persists. But these financial stress points are not limited to lower-income consumers. The survey finds Americans with incomes of at least $100,000 saying they’ve cut back on spending, or may soon do so, in numbers that are not far off the decisions being made by lower-income groups.

High inflation has homebuyers relocating to more affordable areas in record numbers

A record number of homebuyers are seeking to move to more affordable areas as inflation continues to soar and squeeze already cash-strapped consumers, according to a new report. According to Redfin, record-low mortgage rates in 2021 coupled with remote work allowed many consumers to relocate. As a result, pricey coastal cities such as San Francisco, Los Angeles, Seattle and Boston are “seeing early signs of a housing-market slowdown,” according to the brokerage.

Consumer Sentiment Rebounds in Early April 2022

The University of Michigan Consumer Sentiment Index (MCSI) opened April 2022 at 65.7, up by 10.6% from late March, according to preliminary results released on April 14, 2022. Key drivers were a leap of 29.4% in the year-ahead outlook for the economy and a 17.2% jump in personal financial expectations. A strong labor market contributed to optimistic wage expectations among respondents under age 45. Anticipated wage growth of 5.3% was the largest expected gain in more than three decades, since April 1990. Consumers still expect that the national unemployment rate will move downward, acting to improve consumers’ outlook for the national economy.

Mortgage rates hit 5% for the first time in over a decade

Mortgage rates rose again this week, reaching 5% for the first time in over a decade. The 30-year fixed-rate mortgage averaged 5% in the week ending April 14, up from 4.72% the week before, according to Freddie Mac. That’s the highest since 2010. Rapidly rising rates, along with sky-high home prices and rapid inflation continue to push homeownership out of reach for many Americans, according to Sam Khater, Freddie Mac’s chief economist. Rising inflation and record-high rents are also weighing on prospective homebuyers, he said.