On March 1st, I wrote in this space about a scarcity of shipping equipment and containers available for ocean freight from China to the U.S. and Europe impacting the supply chain for consumer goods and the costs companies were paying to import products. At that time, indexes tracking such container rates had surpassed $5,000 from typical levels in the low-to-mid $1,000s. Additionally, capacity limits were adding weeks to supply chain lead times causing late arrivals to miss their delivery windows – leading to chargebacks, lower sell-throughs and outright cancellations, especially for fashion and seasonal merchandise. Since that time, the situation steadily worsened week-by-week until a month ago – when availability constricted precipitously and costs rocketed even higher. The past month of extreme supply chain woe has coincided with earnings season, as publicly traded companies report on recent performance and, typically, update their outlooks for the remainder of the year. With seemingly (if not literally) every consumer company’s quarterly disclosures citing supply chain logistics and container prices as an issue, attention on this usually mundane back-of-house cost center has exploded across chat boards, trade journals, business publications and even mainstream media.

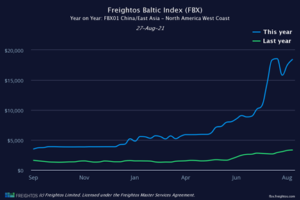

The underlying statistics leave everyone yearning for the olden days of March! The Freightos Baltic Index tracking container cost for the bellwether China/East Asia to North America West Coast route measured last week at $18,425 (not a typo). When this metric had just crossed $5,000 in early March, it was already a stunning 4X increase from a year earlier. At that time, to provide context on the extremes being required of some businesses, I shared that Consensus clients had confided paying an up to then-astronomical $9,000 per container. Similarly, we now hear clients stretching up to $23,000. In fact, Freightos reports that its composite index includes a high price of $28,101 for the week ended August 27th. The following chart reflects the Freightos Baltic Index for China/East Asia to North America West Coast container shipment prices over the past year (and compared to the preceding year).

While the costs of operating cargo ships have increased over the same period as the freight rate spike, consider that the rate for the return trip transporting containers of U.S. exports from California to China is $914.

The Delta variant driving the ongoing fourth wave of COVID-19 across the globe has exacerbated supply chain pressures. Factories have slowed or paused to allow outbreaks to subside, making transportation time even more critical to meet delivery deadlines. Ports in Asia also have closed for days or weeks to quell outbreaks; most notably, the Meishan terminal handling approximately 25 percent of volume at China’s second largest port of Ningbo-Zhoushan closed from August 11th to 25th following a positive COVID test. As this infection wave plateaus and then recedes, hopefully the mechanics of the global supply chain will begin to catch up and be more prepared for the ups and downs to come as the pandemic runs its course. Like everything these days, opinions vary widely about when and what the recovery to supply chain normalcy will look like. Even optimists see the current state-of-play sustaining into 2022 and costs remaining above historic pre-COVID levels for the foreseeable future. Many experts with the most informed views are likely just too busy addressing each day’s evolving challenges to formulate or share prognostications.

In the interim, business managers are left with few choices – none of which are good. The biggest businesses have chartered entire cargo ships for their own use. But for everyone who is not a Walmart or a Home Depot, the question is whether to pay the market rates or wait them out. I have yet to hear anyone willing or able to wait. With no way to know how costs will evolve over what timeframe, businesses can only take the plunge heading into the key holiday selling season lest they suffer the consequences of economist John Maynard Keynes’ famous aphorism: “The market can stay irrational longer than you can stay solvent.”

Headline of the Week

Warby Parker files for a direct listing on the NYSE

Warby Parker, the eyewear brand best known for selling lower-priced, fashion-forward glasses, is preparing to debut on Wall Street, having filed paperwork for a direct listing on the New York Stock Exchange. With its initial public offering, Warby Parker is expected to join a growing list of consumer-facing brands that will be trading soon on Wall Street. Jessica Alba’s Honest Co. and medical scrubs-maker Figs recently went public. Salad chain Sweetgreen filed confidentially for an IPO and shoe brand Allbirds is reportedly getting ready for one, too. Over the past three years, Warby Parker’s sales have grown — but so have its losses. Warby Parker’s net revenue in the fiscal years that ended Dec. 31 of 2018, 2019 and 2020 were $272.9 million, $370.5 million and $393.7 million, respectively, according to documents filed with the Securities and Exchange Commission.

Apparel & Footwear

Gap Inc. acquires 3D fitting room startup Drapr

Joining other companies in buying fit tech startups, Gap announced on Thursday it has acquired Drapr, an e-commerce startup that uses 3D virtual try-on technology. The company helps shoppers find clothing that suits their body type and personal style, per the announcement. Sally Gilligan, chief growth transformation officer at Gap Inc., said in a statement that the company plans to use Drapr’s technology to improve the fitting experience for shoppers and give its digital evolution an extra push. Gilligan noted that finding accurate fit remains a problem for its customers that, hopefully, Drapr’s 3D technology can solve. The company also noted that the Drapr might reduce returns if the technology could help shoppers find the right fit. Last year, amid the pandemic-induced e-commerce spike, a National Retail Federation and Appriss Retail report said online returns doubled from 2019 to 2020. For retailers, reducing returns could alleviate the cost associated with them and limit environmental damage.

Guess Inc. Logs $63 Million Quarterly Profit

Guess Inc. continues to make gains. But Wall Street keeps asking for more. The apparel, accessories and footwear retailer revealed earnings Wednesday after the market closed, improving on top and bottom lines compared with the same time last year. But an outlook predicting more downward trends to come — and quarterly revenues below pre-pandemic levels — caused company shares to nosedive more than 6 percent in after-hours trading. Still, Carlos Alberini, chief executive officer, said he was pleased with the company’s progress, which exceeded expectations. For the three-month period ending July 31, total revenues were $628 million, up from $398 million a year ago, but down from $683 million in 2019’s pre-pandemic second quarter. Alberini said the surge in revenues in the most recent quarter was thanks to fewer promotional sales and more full-priced selling.

Former Coach CEO will take over at Capri next year

Former Coach chief Joshua Schulman has returned to the fashion business. As of Tuesday he is leading Capri’s Michael Kors brand, and, in September 2022, will succeed John Idol as chief executive officer of Capri Holdings itself, the luxury conglomerate said in a press release. Before Coach, from 2012 to 2017, Schulman was president of Neiman Marcus Group’s Bergdorf Goodman business, taking on additional responsibility for NMG International with the 2014 acquisition of MyTheresa. Before that he was CEO of Jimmy Choo, which, along with Michael Kors and Versace, is now in Capri’s portfolio. Schulman has also held senior positions at other global fashion labels including Yves Saint Laurent and Gucci. He left his role at Coach last year, a few months ahead of the abrupt departure of Tapestry CEO Jide Zeitlin. When he takes over as CEO at Capri, Idol will become executive chairman.

Athletic & Sporting Goods

Why Dick’s Sporting Goods is crushing it

Dick’s Sporting Goods is riding a great deal of momentum into the all-important holiday shopping season. And there is more behind it than a second quarter that included stimulus checks to many U.S. households. Investors could boil the company’s much-better-than-expected quarter on Wednesday to several factors: 1) more outdoor-minded athletes have been formed during the pandemic; 2) Dick’s stores are becoming better places to shop amid investments in upgraded shopper experiences; and 3) the golf business remains on fire given the sport’s socially distanced nature. Dick’s said it saw double-digit percentage sales gains in all three of its product categories in the quarter — hardline, apparel and footwear. Average ticket and transactions increased, too.

CCM Hockey Acquires Base Layer License

CCM Hockey announced the acquisition of its worldwide base layer license from its licensing partner Icon-Elite Group Inc., effective September 1, 2021. This transaction will allow CCM Hockey to offer a broader collection of hockey equipment products. “This is extremely positive news for CCM Hockey, as the base layer products represent a great opportunity to grow our apparel product offering and provide our research and development expertise in the apparel category to our consumers.” said Marrouane Nabih, CEO, CCM Hockey. This base layer licensing partnership was originally created in 2015 to further strengthen the business relationships between CCM Hockey and Icon-Elite Group Inc. with its manufacturing partner Bulletin.

Swiss shoemaker On Holdings, backed by tennis star Roger Federer, has filed to go public in New York, according to a Securities and Exchange Commission filing. In its F1-filing, the Zurich-based company listed the size of its offering as $100 million. The footwear firm plans to list on the New York Stock Exchange under the ticker symbol “ONON.” On, which saw its online shoe sales jump 200% during the pandemic, could seek a public valuation of $6 billion to $8 billion, Reuters reported, citing sources. The company was reportedly valued at about $2 billion in its last funding round. US venture capital firm Stripes holds a 12.4% stake in the company, while Alex Perez’s Point Break Capital holds a 25.4% stake, according to the filing. Asian private equity firm Hillhouse holds a stake worth 6.1%.

Cosmetics & Pharmacy

Shiseido sells bareMinerals and Laura Mercier as shine comes off US push

Shiseido has agreed to sell bareMinerals and two other US cosmetics brands to private equity firm Advent for $700m, closing a bitter chapter in the Japanese company’s $2.1bn expansion into the US. The sale of bareMinerals, Buxom and Laura Mercier for an amount two-thirds below the original price tag marked a broader strategic shift for Japan’s largest cosmetics group. Under chief executive Masahiko Uotani, the company has said it would focus on higher-margin skin care products, particularly in Asia. Over the past 12 months, Shiseido has also offloaded its personal care business to CVC, the Luxembourg-based private equity firm, for $1.5bn and ended its licensing contract with the fragrance business of Dolce & Gabbana, the Italian luxury brand. The divestitures announced on Thursday came as the Covid-19 pandemic has damaged Shiseido’s sales in Japan and the US. Operating losses in North America expanded three-fold to ¥22.3bn ($202m) last year, while revenue fell 24 per cent in local currency terms. But even before the pandemic, analysts questioned the $1.9bn acquisition of Bare Escentuals, the New York-based natural make-up company behind bareMinerals and Buxom, in 2010.

StriVectin to Be Acquired by Crown Laboratories

StriVectin is being acquired after turning around its business under the guidance of chief executive officer Joan Malloy. Crown Laboratories, a Hildred Capital Management LLC-owned portfolio company, will acquire StriVectin from L Catterton, which bought the business in 2009. The deal is expected to close by mid-September, with Greenspring Associates and Montreux Growth Partners listed as additional equity sponsors in Crown. Further terms were not disclosed. StriVectin will be a wholly owned subsidiary of Crown. It will join Crown’s newly formed Premium Skincare Division, which also includes Vita Liberata. Cori Aleardi, StriVectin’s president, will be elevated to president and chief commercial officer of Crown.

Ulta Beauty revenue jumps as same-store sales exceed pandemic

Ulta Beauty’s second-quarter earnings blew past estimates amid the resurgence of the beauty category. Ulta’s net income rose to $250.9 billion, or $4.56 per share, in the quarter ended July 31, from $8.1 billion, or 14 cents per share, in the year-ago period. Analysts had expected earnings of $2.59 per share. Revenue increased to $1.97 billion from $1.2 billion a year ago, topping the $1.76 expected by analysts. Same-store skyrocketed 56.3% compared to the year-ago period when the pandemic cut into shopper spending on beauty. Same-store sales were 13.6% higher than the second quarter of 2019.

Discounters & Department Stores

Walmart to sell its delivery service to other businesses

Walmart announced Tuesday that it is offering its delivery platform to other businesses — a move that further diversifies its revenue stream and profit pools. Its new line of business, called Walmart GoLocal, gives other companies access to the retailer’s delivery capabilities, according to a press release. The white-label delivery service includes delivering products with size and other complex requirements as well as the option to meet a range of timelines, Walmart said. The retailer did not disclose the price of the service.

Kohl’s Chief Executive Michelle Gass said there is plenty of room for the retailer and for Amazon to operate brick-and-mortar stores, despite the two already working together through Kohl’s locations. “Retail is vast, and there’s a lot of market to be had,” Gass told CNBC’s Courtney Reagan Tuesday afternoon, during a CNBC Evolve livestream event. “We always have to be raising the bar.” Gass’ comments come after a report in The Wall Street Journal said that Amazon is planning to open large locations that resemble department stores, marking the e-commerce giant’s latest experiment with brick-and-mortar retail. The stores are expected to resemble the size of a TJ Maxx and hold both apparel and tech products, the paper said. When asked by CNBC at the time of the report, Amazon declined to comment.

Inventory confounds Nordstrom in subdued Q2

Nordstrom beat expectations for its second quarter, but failed to achieve the improvements over 2019 seen at other department stores. Total company net sales rose 101% year over year but fell 6% from 2019, according to a filing with the Securities and Exchange Commission. Digital sales rose 30% year over year and 24% from 2019, and were 40% of total sales. At Nordstrom, net sales rose 127% year over year and fell 5% versus 2019; at off-price Rack, net sales rose 61% year over year and fell 8% versus 2019. The company stopped reporting store comps pre-pandemic. Nordstrom swung into the black with net income of $80 million from its $255 million net loss last year.

Emerging Consumer Companies

Headspace and Ginger to merge to form Headspace Health

Meditation app Headspace announced plans to merge with on-demand mental health service Ginger to form Headspace Health. The new organization would sport a combined value of $3 billion and a headcount of more than 800. The merger comes during accelerated usage of both parties, as the pandemic has put a strain on mental health across the globe and many have turned to virtual solutions to address the growing problem. Ginger announced a $50 million Series D roughly one year ago and a $100 million Series E this March, bringing its total funding north of $220 million. Headspace last year raised a $100.7 million Series C, bringing total funding to $216 million. Headspace is one of the top global meditation apps, along with chief competitor, Calm.

Shimmy, Boston-based sanitizer brand, raises $3 million seed round

Shimmy, a Boston-based maker of hand sanitizer products for the home, raised a $3 million seed round. The investment was led by Wayfund, a network of current and former Wayfair employees created to support Wayfair alumni and the businesses they are building. The newly launched company aims to combine sanitation and hygiene with home décor with dispensers that blend into the aesthetic of the home.

Grocery & Restaurants

Tamarix and Pacific General Holdings invests in Playa Bowls

Private-equity fund Tamarix Equity Partners and investment firm Pacific General Holdings announced a strategic investment in the açai bowl and smoothie concept Playa Bowls LLC. The New Jersey-based concept with a surfing theme was founded in Belmar, N.J. and now has more than 126 locations nationwide, most of which are franchised. Playa Bowls was founded by Robert Giuliani and Abby Taylor, long-time surfers whose travels introduced them to açai or pitaya bowls. The decided to create their own version for the Jersey Shore. “We are delighted to be partnering with Tamarix and Pacific General to fuel our growth,” said Giuliani, Playa Bowls’ CEO, in a statement. “Their operating skills and financial acumen will help Playa Bowls execute our exciting growth plan and attract more franchisees over the coming years.” Tamarix is a New York-based private equity firm managed by Mark Hauser and Gary Matthews, focused on investing in lower middle market businesses. Pacific General Holdings, with offices in New York and Seoul, focuses on assisting U.S.-based businesses to expand international markets to Asia and the Middle East.

Sainsbury’s could be next in line for private equity interest

Sainsbury’s could be on the shopping list of private equity outfits as the race to buy Morrisons highlights the attractiveness of the big supermarket chains to investors. Last week the buyout firm Clayton, Dubilier & Rice won the backing of the Morrisons board for its £7bn offer to buy the UK’s fourth largest supermarket chain. That bettered the £6.7bn already on the table from rival suitor Fortress. After Morrisons, the most obvious target for a financial buyer is Sainsbury’s. The US buyout firm Apollo is taking an “exploratory” look at company, according to the Sunday Times. Apollo has been scouring the industry for targets after being outbid for Asda last year, it said. Shares in Sainsbury’s have already surged 30% this year on the back of bid speculation.

Home & Road

Williams-Sonoma Q2 revenues up 31%, net income up 83%

Williams-Sonoma closed its second quarter on Aug. 1 with revenues up nearly 31% and net income up nearly 83%. “We are proud to report another quarter of outperformance with a 30% comp, strong growth across all brands and channels, and 360 basis points of operating margin expansion,” said Laura Alber, president and CEO. Revenues for the period reached $1.95 billion, up from $1.49 billion in the 2020 period. Net income increased from $134.6 million last year to $246.1 million this year, with earnings per share at $3.21 compared with $1.70 in the year-ago period.

Ace Hardware on track to open more than 170 stores in 2021

Ace Hardware is riding the home spending wave. Ace, the largest retailer-owned hardware cooperative in the world, has opened 110 new stores so far in 2021. It is planning to open at least an additional 60 locations by the end of the year. Ace captured the top spot in the “Highest in Customer Satisfaction Among Home Improvement Retail Stores” category in the J.D. Power 2021 U.S. Home Improvement Retailer Satisfaction Study. The retailer, which has taken the top spot for 14 out of the last 15 years, ranked No. 1 in four of the five categories: staff and service; in-store experience; online experience; and merchandise. Ace operates more than 5,500 locally owned hardware stores in all 50 states and 70 countries, with global sales topping $20 billion. The company’s cooperative business model offers local entrepreneurs not only the ability to become owners of their local store operation, but they also become one of a limited number of shareholders of Ace Hardware Corp.

Jewelry & Luxury

De Beers Plans to Include Code of Origin on Its Diamonds

As part of a new plan to increase the value and visibility of its name, De Beers hopes to eventually sell most of its diamonds with a code of origin that indicates the company mined them. Executive vice president Stephen Lussier and chief brand officer David Prager announced the Code of Origin program during “The Power of Purpose-Led Brands: How Values Create Value,” which took place at the Marcello Ballroom at The Venetian Resort on Thursday at Luxury by JCK. Each code of origin diamond will have a unique table inscription that will identify it as a natural, conflict-free gem that was discovered by De Beers in Botswana, Canada, Namibia, or South Africa.

Pandora’s U.S. Sales Soar 63%, Leading To Record Quarter

Pandora posted record revenue for the second quarter of 2021, with U.S. sales soaring 63% over the same period in 2019. The company attributed its “unusually” strong U.S. performance to the stimulus checks included in the American Rescue Plan. “We do expect that there will be a natural correction once the fiscal stimulus is removed,” CEO Alexander Lacik said on an earnings call following the results’ release, according to a Seeking Alpha transcript. But, he added, “We have strong indications that Pandora has been building market share.”

Beyoncé and Jay-Z Are All “About Love” for Tiffany & Co.

Tiffany & Co. announced that power couple Beyoncé and Jay-Z will star in its latest campaign, “About Love.” “Beyoncé and Jay-Z are the epitome of the modern love story,” said Alexandre Arnault, executive vice president of product and communications at Tiffany & Co., in a statement. “As a brand that has always stood for love, strength, and self-expression, we could not think of a more iconic couple that better represents Tiffany’s values. We are honored to have the Carters as a part of the Tiffany family.” This is the first time the couple has appeared in a campaign together and do so against the backdrop of Jean-Michel Basquiat’s Equals Pi, in a partnership with the Artestar agency. This is the first time Equals Pi (1982), which is part of a private collection, has been seen in public.

Office & Leisure

Office Depot Parent ODP Names New Post-Split Execs

ODP, the parent company of Office Depot, Tuesday unveiled the names of the two companies into which it will split, and named the executives slated to run both businesses. The moves follow Office Depot’s plan to split into two companies first unveiled in May. Office Depot, which expects to complete its split sometime during the first half of 2022, said its B2B solution provider business will be known as The ODP Corp. once the split is final. The ODP Corp. will be reorganized to include ODP Business Solutions, which will include the contract sales channel of its current Business Solutions Division, and Varis, a new B2B digital platform technology business. Both will be owned by ODP but operated as separate businesses. Office Depot’s global sourcing operations and supply chain operations will remain with The ODP Corporation. Gerry Smith, current Office Depot CEO, will be CEO of The ODP Corp., the company said. Office Depot’s consumer retail and SMB products and services will be spun off and be known as Office Depot, and will be led by Kevin Moffitt. Moffit, currently executive vice president and chief retail officer of Office Depot, will be the CEO of Office Depot after the spin-off happens.

Chewy CEO Sumit Singh says online pet retailer wants to evoke same feelings as Disney World

Chewy CEO Sumit Singh said Tuesday he wants ordering dog food — and even getting a delivery of cat litter — to feel a little like going to Disney World. At a CNBC Evolve virtual event, Singh said the online pet retailer is focused on leaving an impression. “Remember the first time that you went to Disney and you had such a great experience and then you were like ‘I wish I could go back again,’ and you had a great experience again?” he told CNBC’s Courtney Reagan. “It’s about these compounding, amplifying experiences that just drives consumers back and builds loyalty over time. I think that’s what we’re really all about.” Chewy was founded about a decade ago and became one of the fastest-growing e-commerce sites, with a cult following and recurring revenue through auto-shipped orders. The start-up was acquired by brick-and-mortar retailer PetSmart for $3.35 billion in 2017. But PetSmart spun off the online business, and it went public in June 2019. Roughly nine months after Chewy made its debut, the pandemic struck and fueled a pet boom.

‘Relax we’re vaxed’: SF hotel, convention enforcing vaccine mandate

Many are learning to keep their proof of vaccination handy. As of Friday it’s a requirement in San Francisco for most indoor settings; restaurants, gyms and concerts. But hotels and conventions are also part of the mandate and some travelers are pushing back. Newlyweds Belma and Ernad were spending their wedding night at the Hotel Nikko in San Francisco, where proof of vaccination is required. “The more people who get vaccinated, it’s going to be better for everyone, so hopefully no one asks for vaccination cards when cases come down,” said groom Ernad Dzananovic. Proof of vaccination is not required to check in, but posted signs say you’ll need to show proof in hotel bars and restaurants. “So if someone is not vaccinated they can order room service but so far, it’s been great, we’ve had little to no push back,” said Hotel Nikko VP and GM Anna Marie Presutti.

Technology & Internet

Amazon partners with Affirm for first buy now, pay later option

Amazon is getting into the buy now, pay later space. The e-commerce giant is partnering with Affirm for its first-ever installment payments option on the popular e-commerce site. Affirm’s buy now, pay later checkout option will be available to certain Amazon customers in the U.S. starting Friday with a broader rollout in the coming months, the companies said in a statement. The partnership will let Amazon customers split purchases of $50 or more into smaller, monthly installments. Affirm’s stock spiked as much as 48% after-hours Friday on the news, adding more than $8 billion to its market capitalization, later settling up around 33%. So-called installment loans have been around for decades, and were historically used for big-ticket purchases such as furniture. Online payment players and fintechs have been competing to launch their own version of “pay later” products for online items in the low hundreds of dollars.

Best Buy Shares Rise on Earnings Beat; Consumers Are Investing in Work at Home

Best Buy said Tuesday fiscal second-quarter sales rose nearly 20% as consumers upgraded devices and equipment and permanently embraced habits formed over the past year — from hybrid work to streaming TV shows. The company’s shares closed Tuesday up 8.32% to $121.49. The consumer electronics retailer raised its outlook for the second half of the fiscal year. It now expects same-store sales to range from flat to down 3% versus a year ago. It previously anticipated a high single-digit decline. “Over the longer term, we are fundamentally in a stronger position than we expected just two years ago,” CEO Corie Barry said in a press release. “There has been a dramatic and structural increase in the need for technology.” Due to the coronavirus pandemic, she said the retailer now serves “a much larger install base of consumer electronics with customers who have an elevated appetite to upgrade due to constant technology innovation and needs that reflect permanent life changes.” She said the company’s sales also benefited from strong consumer spending, government stimulus, and higher wages and levels of savings.

Finance & Economy

Durable goods orders slip as supply chain disruptions persist

Orders for big-ticket items slipped last month as manufacturers continued to navigate a supply chain crunch that has resulted in higher materials costs. New orders for manufactured durable goods in July fell 0.1% to a seasonally adjusted $257.2 billion, according to the Census Bureau. Analysts surveyed by Refintiv had anticipated a 0.3% decline. Orders rose an unrevised 0.8% in June and have increased 13 of the last 15 months. Excluding transportation, new orders decreased 0.7%. Supply chain disruptions that were caused by factories shutting down in an attempt to help slow the spread of COVID-19 resulted in unfilled orders increasing for a sixth straight month, rising 0.3% to $1.225 trillion. Unfilled machinery orders, which have increased 16 straight months, rose by $2.3 billion to $109.2 billion.

Consumer prices rising in South and Midwest amid recovery, threatening low-cost appeal

Inflation is squeezing Americans across the country, but it’s pinching in some places more than others. In recent months, consumer prices have risen more sharply in the South and Midwest than in the West and Northeast, upending the normal pattern of the past several years, according to the Bureau of Labor Statistics and analyses by Oxford Economics and Moody’s Analytics. Economists cite stronger economic growth and consumer demand in the South and Midwest, largely because those regions imposed fewer business restrictions during the COVID-19 pandemic and lost fewer residents – and even gained some – as Americans fled densely populated coastal areas. “It seems the pandemic is having a larger impact on inflation in the South and Midwest,” says economist Oren Klachkin of Oxford Economics.