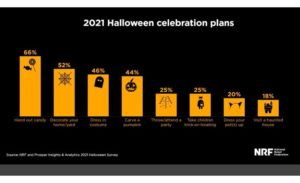

As a longtime resident of Salem, Massachusetts, I have witnessed firsthand just how popular Halloween and all things spooky are throughout the year. This year, however, seems to be unlike any other – not only in the city of Salem, but across the United States. To make up for lost time after COVID-19 forced many Americans to put a pause on celebrating the holiday last year, spending on Halloween this year doesn’t seem so scary. Whether it’s putting up spooky decorations, purchasing a costume (for yourself, your children, or your pets), or if you are simply handing out candy to trick-or-treaters, plans to celebrate are far underway, and up significantly versus last year. According to the National Retail Federation (NRF), 65 percent of Americans are expected to celebrate Halloween this weekend, which is up from 58 percent just last year.

Due to the greater participation in the holiday, the average amount spent on Halloween is also expected to rise. According to the NRF annual survey conducted by Prosper Insights & Analytics, consumers plan to spend $102.74 on costumes, candy, decorations and greeting cards, which is $10 higher than last year. Overall, Halloween spending is up over $2 billion this year and is expected to reach an all-time high of $10.14 billion compared to $8.05 billion in 2020. The biggest spike in spending compared to last year is expected to be related to in-person gatherings, according to a survey by The Harris Poll, which suggests Americans will spend 76% more on parties this year than in 2020.

While Halloween spending is on the rise, it may be hard for certain shoppers to find exactly what they are looking for on store shelves this year due to the ongoing supply chain crunch. In addition to the supply shortages, uncertainty surrounding the vaccine rollout and Delta variant likely increased complications. At least some stores likely reduced orders until there was more confidence in the degree to which people would be able to safely partake in celebrations. Additionally, logjams at ports and a shortage of trucking capacity has hindered retailers’ ability to catch up, even if confidence is recovering.

Although there are challenges with the supply chain, the NRF is expecting spending of $3 billion in candy, $3.2 billion in decorations and more than $3.3 billion in costumes, which is the highest it’s been since 2017 as consumers bounce back from a muted, uneasy Halloween last year. Of course, the biggest question about Halloween-related spending is whether it might be an early indicator of how consumers will behave during the Holiday shopping season in November-December. With strong expectations for Halloween abounding, retailers and industry observers certainly hope it will be.

Headlines of the Week

PayPal is in late-stage talks to acquire Pinterest

PayPal is in late-stage talks to buy social media company Pinterest, said a person familiar with the matter. Shares of Pinterest soared Wednesday after Bloomberg first reported that PayPal may acquire the social media company. PayPal has discussed acquiring the company for a potential price of around $70 a share, which would value Pinterest at about $39 billion, according to Bloomberg. Pinterest stock closed at $55.58 per share on Tuesday. Competitive pressure from e-commerce platform Shopify has pushed PayPal to explore the acquisition, the person told CNBC. Shopify has heavily invested in blending e-commerce and fintech. Last year, it partnered with Affirm, a buy now pay later provider, to become the exclusive provider or point-of-sale financing for Shop Pay, Shopify’s checkout service.

Spanx—Founded With $5,000—Is Now Worth $1.2 Billion in Blackstone Deal

Sara Blakely founded Spanx Inc. in 2000 with $5,000 of her personal savings earned from selling fax machines door-to-door. She just struck a deal with Blackstone Inc. that values the company at $1.2 billion. Blakely, 50, will retain a significant interest in the Atlanta-based maker of shapewear and pantyhose, according to a statement from the two firms on Wednesday. She will continue to oversee daily operations alongside Spanx’s existing senior management team and will become executive chairwoman once the deal closes. “This is a really important moment in time for female entrepreneurs,” Blakely said in the statement. “I started this company with no business experience and very little money, but I cared the most about the customer, and that gave me the courage to launch the company.” Blakely often recounts her bold marketing tactics during the company’s early days, including modeling her own undergarments in pitch meetings to convince retailers to carry the products.

Apparel & Footwear

Crocs posts blazing growth even amid supply chain struggles

Crocs beat expectations once again, with third-quarter revenue growing 73% year over year to $626 million. Digital sales were up nearly 69% and accounted for 36.8% of all revenue. Direct-to-consumer revenue grew 60.4% while wholesale revenue grew more than 88%. Operating income more than doubled to $203.1 million, according to a company release. This came even as the clogs brand faced factory closures in Vietnam and “and widespread disruption in the global supply chain.” For the quarter, the company made $75 million in capital expenditures on its supply chain to support its growth. Crocs had to overcome multiple supply chain challenges to maintain its growth through the quarter. At the top of its earnings release, the company called out supply chain disruptions, including the Vietnamese factory closures. On a conference call Thursday, Crocs CEO Andrew Reese said that factories in Vietnam that the company relies on were closed several weeks during the quarter. They began operating earlier this month, though are in “various stages” of restarting.

Justin Timberlake-founded William Rast gets bankruptcy bid

Fashion label owner Sequential Brands is fully outfitted for a bankruptcy auction scheduled for next week. The owner of brands including American actress and singer Jessica Simpson’s fashion collection and Joe’s Jeans announced a $1m bid Tuesday for William Rast, an American clothing line founded by Justin Timberlake and Trace Ayala in 2005. WRBH Brands Group, a New York-based company affiliated with Millennial Apparel Group, has offered to pay $800k at closing, plus two payments of $100k for the premium jeanswear brand. Those instalments are due on or before the first and second anniversaries of the sale. The family-owned apparel maker already holds a licence for William Rast, along with brands including Celebrity Ace, Kemistry and Pastel. WRBH will serve as the so-called stalking horse, or lead bidder, at a Zoom auction for Sequential’s brands set for 28 October.

Daniel Kulle Resigns Top Spot at Forever 21

The Daniel Kulle era at Forever 21 has come to an end. Kulle spent 25 years with H&M before being lured by the fast-fashion retailer’s new owners to become chief executive officer at Forever 21 in February 2020. But according to an email he sent Tuesday night to his contacts, Kulle said he had resigned his post two weeks ago and will be “taking some time off to find out my next move.” Simon Property Group together with Authentic Brands Group and Brookfield Property Partners bought Forever 21 out of bankruptcy for $81.1 million not including another $73 million for the goods already bought and other costs. It is part of SPARC, which owns Brooks Brothers and other brands. David Simon, CEO of the mall developer, approached Kulle about taking the top job at the Los Angeles-based fast-fashion retailer right before the pandemic. At H&M, Kulle had been serving as strategic adviser to former H&M Group ceo Karl-Johan Persson and was part of a steering group for three new digital start-ups within the H&M Group when he joined Forever 21. It was his digital experience that was most appealing to Forever 21’s new owners.

The chief financial officer and treasurer of Express, Perry Pericleous, has resigned to pursue another opportunity, according to documents filed with the Securities and Exchange Commission. As the company searches to fill the role, COO Matthew Moellering will serve as acting CFO. Moellering has been the company’s chief operating officer since September 2019. He served as the retailer’s interim president and CEO from January to June of 2019. Additionally, Moellering was the retailer’s CFO and treasurer from 2007 to 2011. Pericleous will work with Moellering “to ensure a smooth transition” until his departure on Nov. 12, according to a company press release. The apparel retailer started the year “hemorrhaging cash” as stated by analysts at Wedbush. Yet, the company has been accelerating its Expressway Forward growth strategy, which aims to generate over $100 million in operating profit by 2024.

Athletic & Sporting Goods

Youth Enrichment Brands Launches With Acquisition of i9 Sports

Youth Enrichment Brands, a new platform of leading youth activities brands, launched following the acquisition of i9 Sports. Youth Enrichment Brands is the nation’s leading youth activities company, offering camps, leagues, clinics, and other programs that annually serve more than 600,000 kids ranging from 2 to 18 years old. Backed by Atlanta-based Roark Capital, Youth Enrichment Brands encompasses US Sports Camps, the official provider of Nike Sports Camps, i9 Sports, the nation’s largest youth sports league franchisor, and U.S. Baseball Academy, the country’s largest network of youth baseball and softball camps. i9 Sports offers recreational sports leagues, camps, and clinics to kids in popular sports such as flag football, soccer, basketball, baseball, ZIP Lacrosse, and volleyball.

Korys joins Dutch bike manufacturer Santos Bikes

Korys is joining Dutch Santos Bikes. Santos is an independent bike manufacturer that builds durable and technically high-quality bikes tailored to the needs of each individual cyclist. The investment is perfectly in line with Korys’ investment philosophy, which focuses on consumers who are health conscious and think about their impact on the environment. The involvement of Santos founder Robbert Rutgrink (CEO) and investor Robert Vaneman (also current CFO) remains unchanged. After 4 years, Think2Act is passing the torch to Korys, but looks back on the cooperation with satisfaction. Korys is the investment company of the Colruyt family. Today, it has more than EUR 4.5 billion of assets under management.

Cosmetics & Pharmacy

Ulta to open 50 stores annually; promises faster delivery, invests in AI company

Ulta Beauty laid out its strategic priorities and long-term financial targets for fiscal 2022 through 2024 at its virtual analyst and investor conference on Tuesday. The beauty giant is launching same-day delivery in select markets, and introduced “Beauty to Go,” a commitment that buy online, pick-up in-store orders will be ready for pick-up in two hours or less. Ulta rival Sephora recently said it was rolling out a new, proprietary, same-day delivery service. Additionally, Ulta Beauty plans to open 50 new stores in the United States per year. The retailer will also test smaller format stores, something it had previously tested years ago. International expansion plans remain on hold. The company is also launching a new business called UBMedia, a retail media network which Ulta’s brand partners can use to place ads on the retailer’s e-commerce site and app, and outside sources such as Facebook and Instagram.

Unilever warns of more price hikes as inflation worsens

Unilever warned inflation was likely to accelerate next year and its prices would have to rise further as consumer goods companies battle to offset surging energy and other costs. The maker of Dove soap and Knorr soup beat third-quarter sales growth forecasts and kept its full-year profit margin guidance, defying some analysts’ fears of a cut. However, finance chief Graeme Pitkethly saw little let up in inflationary pressures, in a potential blow to central bankers who are hoping the current spike in prices will be transitory. “We expect inflation could be higher next year than this year,” he said on a media call, adding it was likely to peak in the first half of 2022 and moderate thereafter. Rivals Procter & Gamble and Nestle said this week they too would raise prices further.

Discounters & Department Stores

Target more than doubles Apple shop-in-shops in time for the holidays

As holiday shopping ramps up, Target announced that it is more than doubling the number of dedicated Apple shops within its locations to 36 stores. Target initially opened 17 Apple shop-in-shops in February, promising to open more by the end of fall. The in-store Apple shops build on Target’s 15-year-long partnership with the tech giant. Through the expansion, even more Target shoppers can gain access to Apple products at their local store. Buying Apple products at Target could also give consumers access to the mass merchant’s same-day fulfillment services, 5% RedCard discount and its latest holiday price match guarantee.

Belk launches apparel brand Wonderly

Belk announced that it launched a private label womenswear brand, Wonderly, according to information sent to Retail Dive. The new brand replaces the company’s New Directions private label. The line offers apparel like tops, bottoms and dresses in sizes 4 to 26 and select petite styles in sizes 4 to 16. The entire assortment will be available at over 100 Belk stores and on the retailer’s website. The Wonderly denim offering is the largest private label denim line for the retailer. The collection also features an athleisure collection, dubbed Wonderly Studio.

Kohl’s touts new brand partnerships ahead of the holidays

To entice early holiday deal seekers, Kohl’s is kicking off its five-day holiday event on Wednesday to offer discounts on products like jewelry, shoes, home goods, luggage, intimates and accessories, the retailer announced on Friday. The department store is capitalizing on its recent partnerships this year, advertising new brands including Calvin Klein, Tommy Hilfiger and Eddie Bauer, per the press release. The company is also offering customers $5 of Kohl’s Cash coupons for each $25 spent between Wednesday and Sunday. Shoppers can also take advantage of other Kohl’s Card and Kohl’s Rewards incentives, according to the announcement.

Walmart tests text-to-shop tool

Adding another channel for consumers to purchase goods, Walmart’s Global Tech and Store No. 8 teams have collaborated to test a text-to-shop tool in select areas, the company announced on Thursday. The retailer didn’t say when it will release its Walmart Text to Shop feature to everyone, but Dominique Essig, vice president of conversational commerce at Store No. 8, noted in the announcement that it plans to make the tool “more widely available in the future.” The announcement comes over a year and a half after the mass merchant discontinued Jet Black, a shop-by-text service geared toward urban customers that were out of reach of Walmart’s stores.

Walmart+ members get first dibs on Black Friday deals, which will start in early November

Walmart will not only dangle discounts on giant TVs, air fryers and Legos this holiday season. It will also push its subscription service, Walmart+. The retail giant said that the program’s members will be first in line for Black Friday deals this holiday season. Those customers can start shopping online sales four hours earlier than other shoppers throughout the month of November. By granting that special access, Walmart is betting it can boost its membership — particularly at a time when many holiday shoppers are already worried about out-of-stocks caused by global supply chain challenges.

Emerging Consumer Companies

Solo Brands, the Southlake, Texas-based company that operates Solo Stove and has acquired three premium outdoor lifestyle brands – Oru Kayak, ISLE Paddle Boards, and Chubbies – announced terms for its IPO. The company plans to raise $200 million by offering 12.9 million shares at a price range of $14 to $17. At the midpoint of the proposed range, Solo Brands would command a market value of $1.5 billion. Solo Brands was founded in 2011 and booked $254 million in sales for the 12 months ended June 30, 2021.

Camp, experiential retail concept for children, opens in former Toys R Us location

Camp, the New York City-based brand centered on experiential retail for children, opened a store in the former Toys R Us shop at Garden State Plaza mall, which is operated by Unibail-Rodamco-Westfield. It will mark Camp’s seventh location, joining ones in Manhattan, Dallas, Los Angeles, and Norwalk, Connecticut. Three more expect to open before the end of the year, and by the end of next year, it expects to double its store count. A trip to one of Camp’s stores is a unique experience in and of itself. The front of the shop looks like a traditional toy purveyor: Shelves of puzzles, Lego sets and L.O.L Surprise dolls, coupled with sweet treats. But behind another door, kids can roam around a sprawling playroom that features rotating and themed experiences, including a lava interaction and another sponsored by “Paw Patrol.”

Grocery & Restaurants

Pattison Food Group to buy Roth’s Fresh Markets

Canadian food and drug retailer/wholesaler Pattison Food Group plans to acquire Oregon grocer Roth’s Fresh Markets, its first acquisition outside of Canada. Financial terms of the deal, announced late Wednesday, weren’t disclosed. Vancouver, British Columbia-based Pattison said it expects to close the transaction on Oct. 26, pending regulatory approval. Roth’s Fresh Markets, based in Salem, Ore., operates nine stores in Oregon’s mid-Willamette Valley. Founded in 1962, Roth’s specializes in fresh and prepared foods, including custom cake centers and catering, as well as locally sourced products. Pattison said it will support the banner’s grocery model and build on its best practices in operations, marketing, purchasing and people services. Part of Canadian conglomerate Jim Pattison Group, Pattison Food Group has more than 30,000 employees and a retail network of nearly 300 food and drug stores. Its retail grocery, pharmacy and wholesale banners include Save-On-Foods, Buy-Low Foods, Quality Foods, Choices Markets, Everything Wine, Pure Integrative Pharmacy and Imperial Distributors Canada Inc., as well as other Jim Pattison Group specialty and wholesale operations. Pattison’s wholesale division serves about 2,000 independent grocers across Canada.

Portillo’s raises $405M in IPO

Portillo’s Inc. launched its initial public offering Thursday, raising more than $405.4 million and setting the stage further growth of the 67-unit fast-casual brand, says Michael Osanloo, the company’s CEO and president. The Oak Brook, Ill.-based Portillo’s set its opening price at $20 for each of its 20.3 million shares and they closed nearly 50% higher at a little more than $29 a share. The fast-casual brand currently has 67 units in nine states. Osanloo said Portillo’s team remains “maniacally focused” on execution and plans to add about 16 restaurants in the next two years. Founder Dick Portillo started the company in 1963, investing $1,100 in a trailer hot dog stand in Villa Park, Ill. The brand is known for its Chicago-style hot dogs, Italian beef sandwiches, char-grilled burgers, fresh salads and chocolate cake. The company also has the Portillo’s Home Kitchen catering business and ships food to all 50 states via its website.

Home & Road

Houzz: Strong Renovation Activity Expected Through Q4 2021

Despite continuing shortages and delays, construction, architect and design businesses expect continued business through the remainder of the year. Houzz Inc. has released its Q4 2021 Houzz Renovation Barometer. The report tracks residential renovation market expectations, project backlogs and recent activity among U.S businesses in the construction sector and the architectural and design services sector. The Houzz Barometer found that businesses anticipate strong activity through the end of the year. With steady increases in backlogs since the beginning of the pandemic, construction professionals in particular report wait times of nearly three months before new projects can begin.

Tractor Supply posts strong Q3; business ‘has never been stronger’

Tractor Supply Co. reported its sixth consecutive quarter of double-digit comparable store sales growth amid rising sales and earnings and raised its guidance for the year. The country’s largest rural retailer reported that its net income totaled $224.4 million, or $1.95 per share, in the quarter ended Sept. 25, up from $190.6 million, or $1.62 per share, in the year-ago period. Net sales increased 15.8% to $3.02 billion, topping estimates of $$2.86 billion. Comparable store sales jumped 13.1%, nearly double estimates. Tractor Supply said its comp-sales increase was broad-based and across all geographical regions, and reflected robust demand for everyday merchandise, including consumable, usable and edible products, and continued growth in summer seasonal categories. In addition, the company’s e-commerce sales experienced strong double-digit growth for the 37th consecutive quarter.

Jewelry & Luxury

Lightbox Is Now Selling Loose Lab-Grown Diamonds

Lightbox is expanding its selections again, this time capitalizing on the customization trend by making loose lab-grown diamonds available for consumers to buy. Lightbox Loose Stones are available to purchase on the brand’s website in pink, blue, and white in sizes up to 2 carats. They are priced according to the brand’s uniform $800-per-carat structure. Lightbox’s initial offering includes round brilliant and princess cuts. The company said additional cuts will be released early next year.

Former Signet CFO Joins Shinola Parent Co. Bedrock Manufacturing

Michele Santana, the former chief financial officer of Signet, has become the chief financial officer of Bedrock Manufacturing, the Detroit-based parent company of Shinola and Filson. In her new role, she will report to Bedrock’s executive chairman, Mark Light, who was CEO of Signet when Santana worked there. Santana served as Signet’s chief financial officer from 2014 to 2019. After Signet, she worked as chief financial officer for Majestic Steel USA. Prior to joining Signet, she was a senior audit manager for KPMG, according to her LinkedIn profile.

Diamond Jewelry Demand at a ‘Record High,’ Alrosa Says

Consumers’ current, and seemingly insatiable, appetite for diamond jewelry has pushed demand to record levels, Alrosa said, and continues to fuel midstream demand. Alrosa reported earlier this month that sales of rough and polished diamonds totaled $298 million in September—$289 million in rough and $9 million in polished. That is 11 percent below the $336 million it generated in rough and polished sales in September 2020—which is right around the time diamond demand began to recover—but remains ahead of September 2019 sales of $258.7 million. And Alrosa is still posting significant year-over-year gains.

Office & Leisure

Halloween Spending Could Hit A Record This Year

The nation’s top infectious disease expert, Dr. Anthony Fauci, says trick-or-treating outdoors should be safe for young children and it seems millions of families are planning to do just that. The National Retail Federation expects Halloween spending to reach more than $10 billion this year, an all-time high. “Last year, I only spent about $50. This year I’m up to $200 so far, so I’m excited,” said Angel Colamarino who was shopping at Party City. This year’s festivities will include lots of trick-or-treaters dressed as superheroes. Spiderman and Batman are both among the top five costumes for kids. And it’s not just about humans, one out of five people plan to dress up their pets. “We have over 40 different pet costume options for our pets and they are going like gangbusters,” said Julie Roehm, Party City Chief Marketing and Experience Officer. She said supply chain issues affecting retailers nationwide have created challenges for them as well.

Shawnee Peak purchase means Boyne Resorts now owns 4 ski areas across Maine, New Hampshire

Boyne Resorts announced that it has purchased Shawnee Peak ski resort located in Bridgton, Maine. Shawnee Peak is Boyne’s fourth resort in New England, joining Sugarloaf and Sunday River in Maine and Loon Mountain Resort in New Hampshire. Boyne did not reveal the terms of the transaction, saying only that the purchase was finalized, according to a news release from the company. Transition of the resort’s ownership is set to begin immediately. Boyne said all Shawnee Peak team members are being retained under its ownership.

Supply snags will not steal Mattel’s Christmas this year

Mattel on Thursday raised its 2021 sales forecast, saying it would overcome industry-wide shipping disruptions to ring in a strong holiday season steered by Barbie and Hot Wheels, driving its shares 6% higher in extended trading. The company has pulled forward production, contracted more ocean freight capacity and secured access to additional ports to keep up supply during the most crucial time of the year for toymakers, Chief Executive Officer Ynon Kreiz told Reuters. While demand for toys is at an all-time high, severe global supply chain bottlenecks have threatened to keep store shelves empty this holiday season, leaving retailers and suppliers scrambling for ways to speed up product shipments. “We’ve been working through supply chain disruptions, it’s not a normal year. But even with that, we expect to have lots of toys under trees this Christmas holiday,” Kreiz said.

Technology & Internet

Instacart acquires smart cart maker Caper

Aiming to join the in-store and online shopping experiences, Instacart has acquired “smart” shopping cart company Caper Inc. in a $350 million cash and stock deal. New York-based Caper’s artificial intelligence (AI)-powered cart enables shoppers to scan items they select off grocery store shelves and pay for them directly via the cart, eliminating the need to wait in line at the checkout area. Instacart said Tuesday that the Caper AI cart will become part of its roster of solutions for retail partners, which includes the Instacart online shopping marketplace, enterprise e-commerce services, fulfillment technology for delivery and pickup, last-mile delivery and other offerings. Caper’s team also will join Instacart’s product and technology bench, bringing hardware expertise.

Olo is acquiring software solution platform Wisely for $187 million

Technology platform Olo announced Thursday that it will be acquiring software solution company, Wisely, for $187 million. The transaction, which is expected to be finalized by the fourth quarter of 2021, will be Olo’s first acquisition since going public in March. Wisely is a customer intelligence platform that specializes in personalizing the restaurant guest experience through consumer data – a crucial tool for operators, especially in the post-pandemic era. Wisely offers several key capabilities that Olo CEO Noah Glass said will be available to Olo customers once the acquisition goes through: front of house tool, Host, which serves as a “mission control for the host stand;” marketing and CRM capabilities like email and text message-based communications; a customer sentiment feature that lets operators see guest feedback from internal and external sources like Google and Yelp; and a consumer data platform, which lets operators pull all of these elements together and create customer profiles. Olo is set to acquire Wisely in the fourth quarter of 2021, for $77 million in cash and $110 million in Olo’s Class A common stock.

Finance & Economy

Global consumer confidence has been sitting still since July

Ipsos’s Global Consumer Confidence Index is now reading at 48.5, down just 0.1 point from September. As many countries struggle to contain the spread of COVID-19 variants, global consumer sentiment is virtually unchanged for the third consecutive month. The Global Consumer Confidence Index is the average of 24 countries’ National Indices. It is based on a monthly survey of more than 17,500 adults under the age of 75 conducted on Ipsos’ Global Advisor online platform. This survey was fielded between September 24 and October 8, 2021. Of the 24 countries surveyed, only India, Japan, and South Africa see significant gains in their National Index scores from last month, each by about 2 points. Argentina (-1.7) is the only country to experience a significant drop in consumer sentiment since September.

Home builders grow more confident in spite of continued supply-chain headaches

Sentiment among home builders improved for the second consecutive month, rebounding further from the low point reached at the end of summer. The National Association of Home Builders’ monthly confidence index increased four points to a reading of 80 in October, the trade group said. The figure represents the highest point since July. “Although demand and home sales remain strong, builders continue to grapple with ongoing supply chain disruptions and labor shortages that are delaying completion times and putting upward pressure on building material and home prices,” Chuck Fowke, a custom home builder from Tampa, Fla., who currently serves as the association’s chairman, said in the report. All regions saw a monthly increase in builder confidence in October. However, over the past three months, builder sentiment was flat across the Northeast, the South and the West, only rising slightly in the Midwest.